With the Federal Reserve turning dovish, is Cardano (ADA) about to rebound?

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Cardano price hovers around $0.70 after a sharp correction wiped out nearly a month’s worth of gains. The bigger question is whether Jerome Powell’s hints at more rate cuts can inject new momentum into risk assets like ADA, or if this is just another dead cat bounce followed by a fresh round of declines.

Cardano Price Prediction: How is the Market Interpreting Jerome Powell’s Comments?

Jerome Powell’s recent remarks indicate that the Federal Reserve may be inclined to cut rates again to support a weakening job market. With inflation still hovering near manageable levels and a government shutdown limiting access to new data, the Fed may rely on private indicators and previous momentum to guide policy.

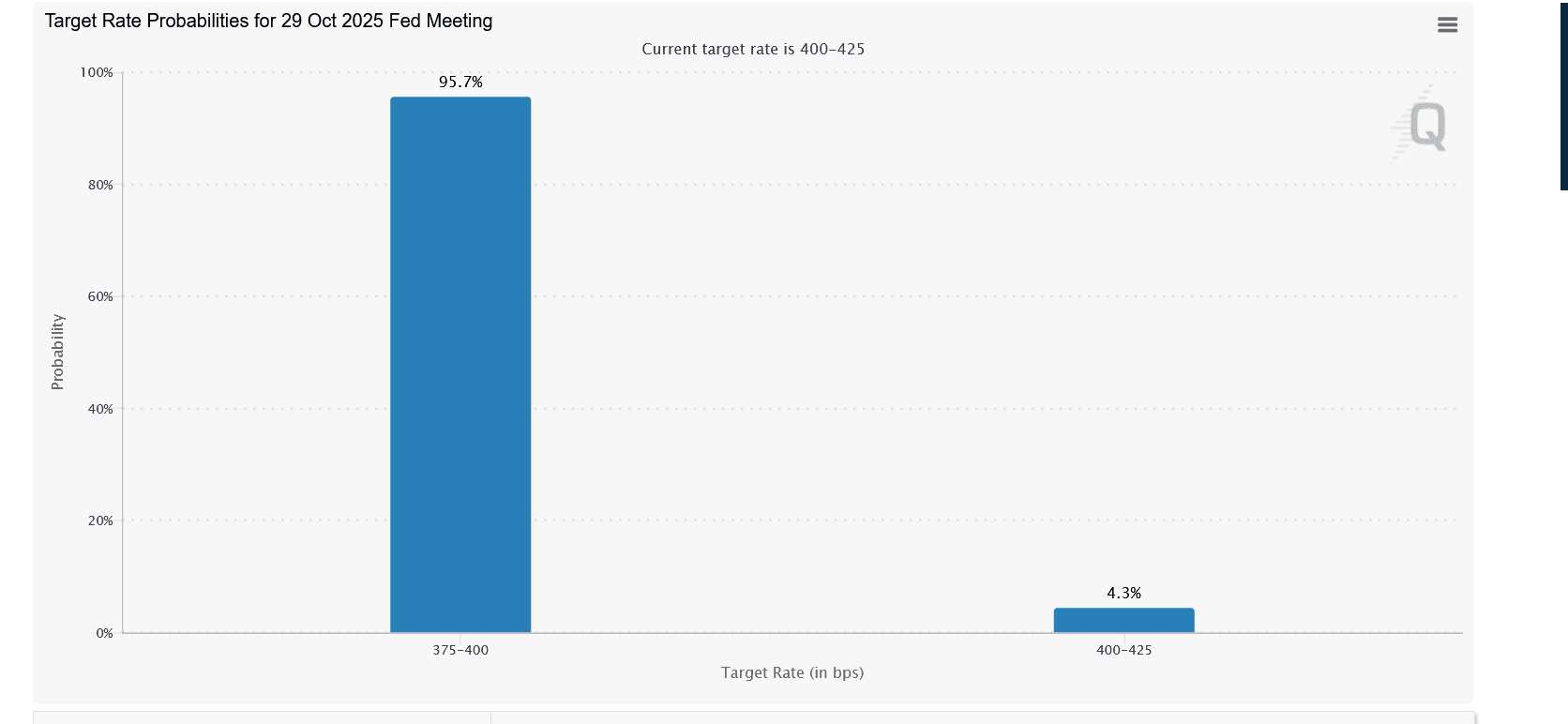

This is highly significant for crypto investors. Rate cuts typically weaken the dollar and increase liquidity—conditions that usually favor risk assets like ADA. If the CME FedWatch tool shows a 97% probability of a rate cut in October coming true, capital may start flowing back into cryptocurrencies and high-beta tokens like Cardano.

But the issue is: Powell also emphasized caution. If inflation rises again due to tariffs, the Fed may abruptly pause rate cuts, trapping latecomers in a volatile market. This uncertainty will impact ADA ahead of the next CPI release on October 24.

Cardano Price Prediction: What Does the ADA Price Chart Actually Show?

ADA/USD Daily Chart- TradingView

ADA/USD Daily Chart- TradingView The daily Heikin Ashi chart shows Cardano price consolidating below the 20-day moving average ($0.78), with price fluctuating around $0.70. The Bollinger Bands remain wide, reflecting high volatility after the early October plunge.

Key support sits at $0.63, while resistance is near $0.78—where the Bollinger Band midline aligns with the short-term moving average. The candlesticks from the past few trading days show small-bodied indecision bars, indicating buyers are cautiously returning but not yet fully confident.

If ADA price can break above $0.75 with volume confirmation, it could move toward $0.85. But if it fails to break out and falls below $0.68, the next downside target is around $0.60—an area that previously acted as a liquidity pocket during sell-offs.

How Will Fed Rate Cuts Affect ADA’s Next Move?

A rate cut confirmed later this month could push ADA above its immediate resistance. Historically, dovish monetary policy has triggered rallies in Layer-1 assets as investors seek returns and long-term value outside traditional finance.

On the other hand, if the Fed surprises the market with a smaller-than-expected rate cut or delays action due to inflation concerns, the dollar may strengthen again, pushing ADA back below its short-term support range. In this scenario, the next line of defense for ADA near $0.63 becomes crucial.

What Should Traders Watch Next?

- October 24 CPI Report – Mild inflation data will validate Powell’s dovish stance and could trigger an ADA breakout.

- Fed Rate Decision (October 29-30) – Any signals of multiple rate cuts will spark optimism for altcoins.

- Volume and Bollinger Band Contraction – A tightening band pattern suggests volatility is about to spike again, potentially setting the stage for ADA’s next major move.

Is ADA Price Ready to Rally?

$Cardano is at a crossroads where macro sentiment and technical structure are starting to align. Jerome Powell’s dovish hints have reopened the door for a liquidity-driven rally, but the charts still need confirmation.

If $ADA holds above $0.70 this week and strengthens near $0.75, the path toward $0.85–$0.90 before month-end becomes realistic. However, failure to hold current levels could mean a deeper retest near $0.60.

In short: ADA’s next big move will depend less on its blockchain news and more on how quickly the Fed decides to inject new liquidity into the system.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Vitalik: What improvements can be made to Ethereum PoS, and what are the possible approaches?

This article will focus on the Ethereum "Merge" issue: What areas in the technical design of Proof of Stake can still be improved, and what are the possible ways to achieve these improvements?

Forward Industries disclosed that the total SOL holdings have exceeded 6.87 million

Powell sees signs of crisis

Powell's primary motivation for halting quantitative tightening is to prevent a liquidity crisis in the financial markets.