What is Hydrex, the Base ecosystem project that is rising against the market trend?

On October 11, while the overall market experienced a sharp decline, the DeFi project Hydrex's token HYDX on the Base chain surged more than 40% against the trend.

On October 11, while the overall market saw a sharp decline, the DeFi project Hydrex’s token HYDX on the Base chain bucked the trend and surged by over 40%.

Written by: Nicky, Foresight News

On October 11, 2025, the cryptocurrency market experienced a significant downturn. However, the Base ecosystem project Hydrex’s token HYDX defied the trend, posting a daily increase of over 40%.

Hydrex positions itself as the MetaDEX and liquidity infrastructure of the Base ecosystem, aiming to guide liquidity incentives and protocol revenue distribution through community governance. According to protocol data, Hydrex currently has a total value locked (TVL) of $13 million, supports over 250 assets, has accumulated a trading volume of $178 million, and has nearly 2,000 user accounts.

Project Positioning and Core Features

Hydrex’s core positioning is as a “liquidity coordination system,” aiming to drive token allocation and protocol revenue through community governance, directing liquidity and trading volume to the most productive pools.

Its design integrates a vote-escrow (ve) mechanism and strategy optimization. Users can participate in governance by locking tokens, influencing the direction of liquidity incentives, forming a positive cycle of “locking - voting - attracting liquidity - generating fees - redistribution” (the “Hydrex flywheel”). At the same time, the protocol distributes 100% of trading fee revenue to staked liquidity providers, with cumulative trading fee income exceeding $1.18 million.

In terms of specific functions, Hydrex offers three types of accounts to meet different user needs: Liquid Accounts (flexible) support instant yield and asset lending; Flex Accounts (long-term) require a 2-year lock-up and offer a 30% yield boost (early withdrawal is penalized); Protocol Accounts (perpetual) provide indefinite lock-up and stable returns by converting oHYDX tokens.

The protocol has set up a strategic reserve mechanism, requiring that each circulating HYDX token must be backed by at least 0.01 USDC. This design is intended to ensure that token issuance has real capital support and to avoid unlimited inflation. Users obtain liquid HYDX by converting option tokens oHYDX, which requires depositing the corresponding amount of USDC.

Additionally, Hydrex emphasizes a “liquidity-neutral” strategy, not limited to its own liquidity pools but integrating external DEXs on the Base chain (such as Uniswap V4, Algebra, etc.) through routing technology to secure the best trading prices for users.

Team Background

The Hydrex team has chosen to remain anonymous, without disclosing the specific identities of core members. This approach is relatively common in Web3 projects, usually to avoid regulatory risks or for personal privacy reasons. According to Twitter user @larrettgee, the team recently added a new BD lead and a growth advisor (Base OG).

Publicly available advisor information shows that Coinbase Senior Software Engineer Colin Johnson has joined the Hydrex advisory board.

In terms of funding, Hydrex emphasizes that it has not conducted traditional venture capital rounds, nor has it held presales or KOL marketing campaigns. The project mainly obtains funding through ecosystem partnerships, including $10,000 in seed funding from Peapods Finance and a Builder Grant from the Coinbase developer platform for embedded wallet integration and DeFi entry optimization.

Tokenomics

The initial supply of HYDX tokens is 500 million, but about 90% of the tokens will be permanently burned through the creation of protocol accounts (i.e., perpetual locked positions, formerly known as veHYDX), with the current total token supply at about 34.38 million. In the initial allocation, 50% is used for community and partner growth activities, 25% is allocated to the treasury, 20% to core contributors, 3% to protocol-owned liquidity, and 2% to advisors and early supporters.

Its issuance and economic model revolve around “reserve constraints” and “long-term alignment.” Key mechanisms include:

- Strategic Protocol Reserve: For every 1 HYDX issued, at least 0.01 USDC must be deposited into the reserve to ensure real capital backing for token issuance. Users must pay USDC or burn oHYDX to exchange for liquid HYDX, which can be obtained directly from the market or through governance rewards.

- Account Types and Yield Distribution: All users staking HYDX in liquidity pools have their fees distributed back to account holders on a weekly basis. The duration and size of the lock-up directly affect voting weight and earning potential, encouraging long-term participation.

- Anti-dilution and Rebalancing: veHYDX holders initially receive 26% of emissions, which decreases over time to balance new token issuance and the interests of existing users. The penalty mechanism for early withdrawal from Flex accounts (burning a portion of HYDX) provides deflationary pressure.

The protocol adopts an anti-dilution mechanism, with veHYDX holders’ base share of emissions starting at 26% and decreasing by 0.5% weekly during the first year. This design aims to gradually reduce inflationary pressure as the ecosystem matures and to promote long-term participation.

Ecosystem Integration

Hydrex is deeply adapted to the characteristics of the Base ecosystem, supporting features such as Base App, smart wallets, Farcaster platform DeFi entry, and Flashblocks fast trading. It is officially referred to as the “liquidity hub of the Base ecosystem.”

Hydrex is deeply integrated with Farcaster, launching a mini-app that allows users to stake more than 30 Base ecosystem assets without leaving the social platform. This social DeFi experience, combined with Base ecosystem features such as smart wallets, free transactions, and EIP-7702, aims to provide new users with a smooth on-chain entry.

Community Performance

Recently, Hydrex launched the Anchor Club program to encourage users to participate in protocol governance over the long term. By automating liquidity accounts or registering flexible accounts, users can accumulate Anchor Club points, which can be exchanged for governance rights and additional community benefits.

In community discussions, its “no VC, no presale, no KOL marketing” label is frequently mentioned, and the mechanism of distributing 100% of revenue to holders has also attracted attention. When the market plummeted on October 11, 2025, HYDX’s counter-trend surge reflected some investors’ confidence in its liquidity coordination capabilities and Base ecosystem synergy.

How to Participate

Different users can set up Liquid Accounts (flexible), Flex Accounts (long-term), or Protocol Accounts (perpetual) on Hydrex to earn yields according to their needs.

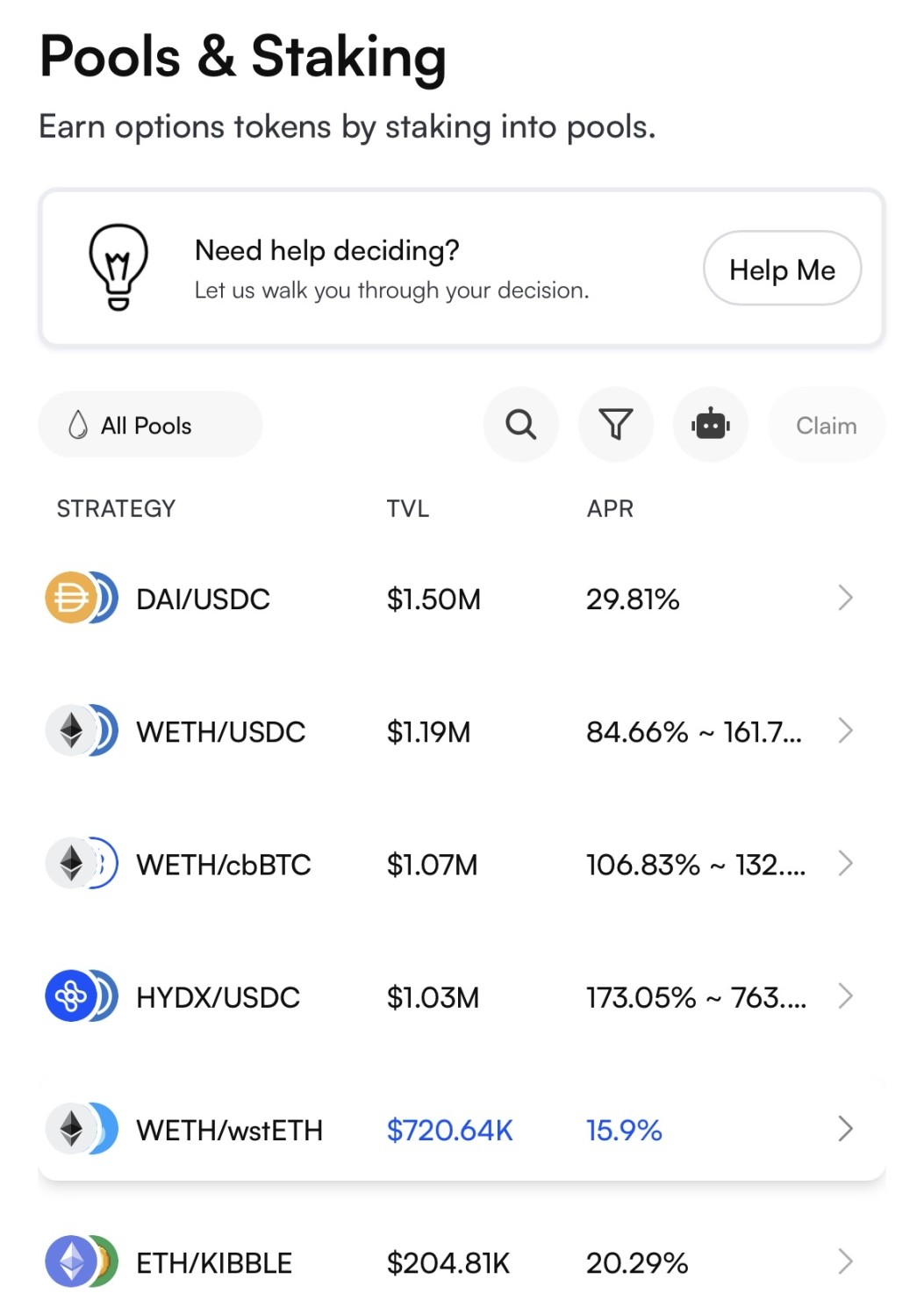

Users can also stake in liquidity pools via Base App or wallets to earn annualized yields. For example, the stablecoin strategy TVL for DAI/USDC is $1.5 million, with an annualized yield of 29.81%. The TVL for USDC/HYDX exceeds $1 million, with annualized yields reaching up to 774%.

Risk Warning

With growing expectations for token issuance on the Base network, native protocols like Hydrex may attract more attention. However, investors should remain aware of the potential risks posed by anonymous teams and complex mechanisms. In the future, as core features are further implemented and ecosystem collaborations deepen, whether Hydrex can achieve its stated goal of becoming a “sustainable liquidity hub” remains to be seen.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Price predictions 12/10: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BCH, LINK, HYPE

Ether vs. Bitcoin: ETH price poised for 80% rally in 2026

Prediction markets bet Bitcoin won’t reach $100K before year’s end

Bitcoin rallies fail at $94K despite Fed policy shift: Here’s why