Key Notes

- BNB price close below the $1,100 neckline support could validate the bearish pattern, potentially pushing BNB toward $835, a roughly 30% drop from current levels.

- Technical indicators suggest waning bullish momentum, with the daily RSI entering a correction phase and the MACD showing a bearish crossover.

- Binance has seen record outflows, totaling $21.75 billion in a week, including $4.1 billion in a single day.

Binance Coin BNB $1 182 24h volatility: 3.1% Market cap: $164.82 B Vol. 24h: $5.42 B , the native cryptocurrency of the Binance Chain, could soon face an end to its rally, with experts seeing a potential drop under $1,000 coming ahead.

Following rejections at $1,320, BNB price is facing strong selling pressure after a double-top pattern. On-chain data shows signs of potential profit-booking ahead.

BNB Price Sees Strong Selling Pressure After Rejection at $1,350

The daily chart of BNB price shows a potential double-top pattern forming near the $1,350-$1,375 range, signaling possible trend exhaustion after its 95% year-to-date rally.

This comes as the crypto market faced its largest liquidations in history last Friday, at a staggering $19 billion.

The two failed breakout attempts, labeled as Top 1 and Top 2, highlight weakening bullish momentum, with the neckline support positioned near $1,100. A confirmed close below this level could validate the bearish formation.

If the pattern plays out, BNB price could drop toward $835. This implies a 30% downside from current prices by late October or early November.

BNB price sees double top pattern formation. | Source: TradingView

Momentum indicators are signaling caution for BNB. The daily Relative Strength Index (RSI) has entered a correction phase after retreating from its overbought zone above 70. This indicates that the bullish momentum is waning.

The Moving Average Convergence Divergence (MACD) has triggered a bearish crossover, showing weak buying momentum. Analysts warn that a drop below the $1,100 support level could accelerate the downtrend in the coming sessions.

On-Chain Indicators Hint Caution for Binance Coin

Binance recorded a staggering $21.75 billion in user withdrawals over the past week, marking the highest outflows from a centralized exchange in that period. Notably, $4.1 billion of this total was withdrawn in a single day, according to data from CoinGlass .

Over the past few days, centralized exchanges have seen significant asset outflows, with #Binance experiencing the largest outflow — $21.75 billion over the past seven days.

— CoinGlass (@coinglass_com) October 15, 2025

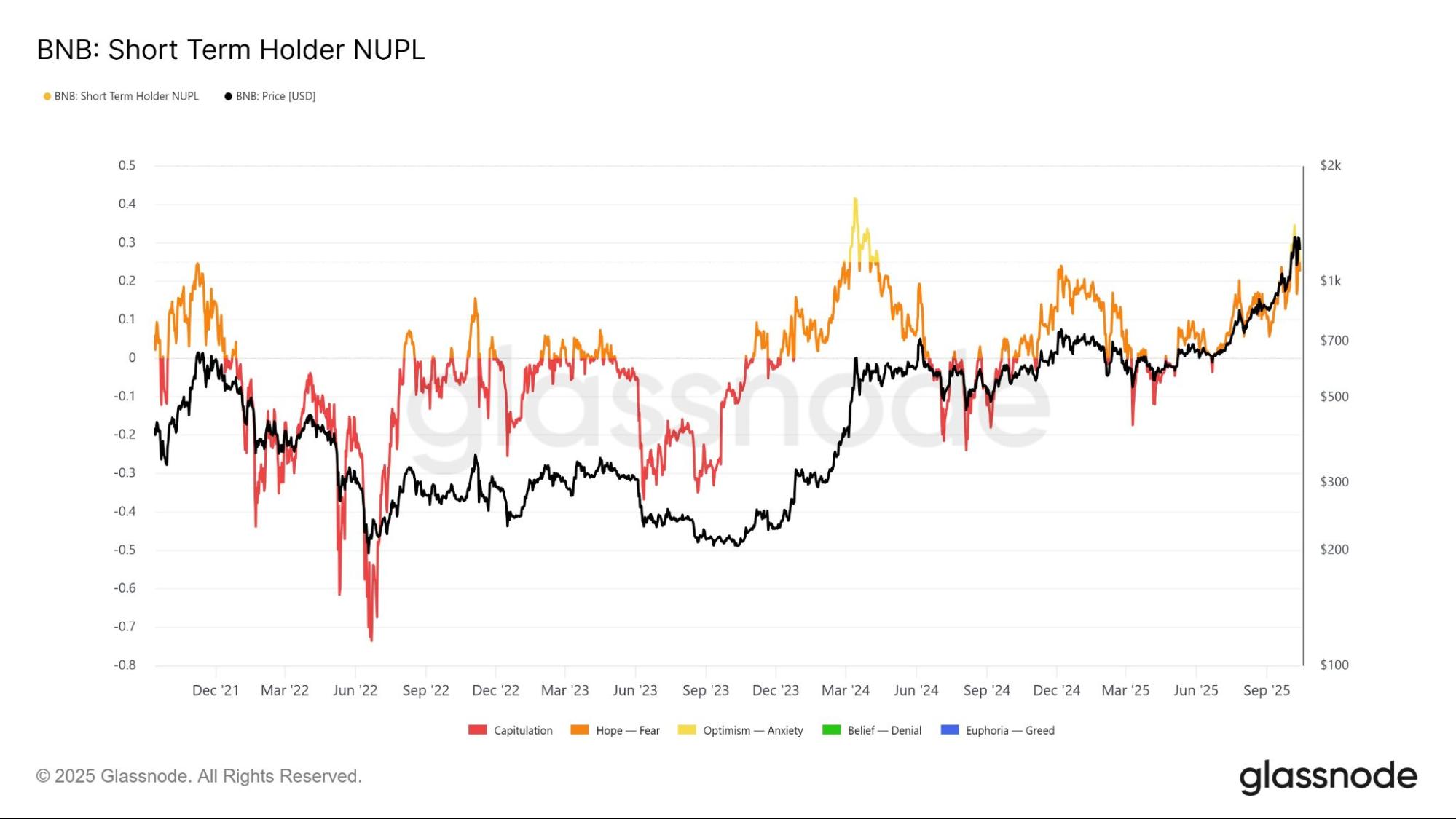

BNB’s short-term holder Net Unrealized Profit/Loss (STH NUPL) has recently surged above the 0.25 threshold, a level historically seen as a warning signal.

Crossing this mark often indicates that short-term investors have accumulated significant profits, which can trigger selling pressure and potential price reversals.

Current NUPL readings suggest that many short-term holders are sitting on sizable gains, raising the likelihood of near-term sell-offs.

BNB NUPL indicator shows profit-booking. | Source: Glassnode

Snorter Bot平台进展

Snorter Bot是一款基于Telegram的交易助手,该平台正在稳定发展。它结合了meme币的传播性与先进交易工具,使用户能在Telegram内轻松管理各种代币。

初始版本聚焦Solana生态,充分利用了该公链的快速交易与低费用特性。后续更新还计划支持以太坊、BNB Chain及其他EVM兼容区块链。

Snorter Bot简要信息

- Token Price: $0.1079

- Funds Raised: $4.7 million

- Ticker: $SNORT

- Network: Solana

平台的SNORT代币为其高级功能提供支持。Snorter Bot通过500百万枚的固定总量,致力于让高速DeFi交易触达更多用户。