'Ship has sailed': Ripple CEO Brad Garlinghouse says US won’t return to hostile crypto climate under Gensler

Quick Take The sector won’t be going back to a time when former Securities and Exchange Commission Chair Gary Gensler led that agency, Ripple CEO Brad Garlinghouse said on Wednesday. Garlinghouse also criticized traditional finance, calling it “hypocritical” as crypto firms try to gain access to a Federal Reserve master account.

The cryptocurrency industry won't find itself being thrown back into the throes of a hostile regulatory environment, even if there is an eventual shift in the White House, said Ripple CEO Brad Garlinghouse.

The sector won't be going back to a time when former U.S. Securities and Exchange Commission Chair Gary Gensler led that agency, Garlinghouse said, where he brought a more critical eye to crypto while also bringing charges against many in the space.

"Frankly, I think the ship has sailed," Garlinghouse said Wednesday at DC Fintech Week. "You can't put the genie back in the bottle in the United States."

When campaigning, now-President Donald Trump vowed to make the U.S. the "crypto capital of the planet. Trump also has strong ties to digital assets, including his and his family's involvement in DeFi and stablecoin project World Liberty Financial and the launch of memecoins early on in his presidency.

During the Biden administration, Gensler led the SEC. Under his authority, the agency took a cautious approach to crypto and brought several cases against large crypto firms, saying that most cryptocurrencies were securities. Gensler had also been criticized for his regulation-by-enforcement approach.

Though not brought during Gensler's time at the SEC, the agency's case against Ripple continued on during his leadership. In 2020, the SEC accused Ripple of raising $1.3 billion through the sale of XRP, which it said was an unregistered security. New York Judge Torres then ruled that some of Ripple’s sales, called programmatic, did not violate securities laws because of a blind bid process in place for them. She did, however, rule that other direct sales of the token to institutional investors were securities.

That case officially wrapped up this past year.

TradeFi v. crypto

Garlinghouse also criticized traditional finance on Wednesday, calling it "hypocritical" as crypto firms try to gain access to a Federal Reserve master account. A master account allows institutions direct access to the Fed's payment systems and provides the most direct access to the U.S. money supply available to financial institutions. Those without master accounts are often forced to rely on partner banks with master accounts to provide services.

The crypto industry should be held to the same standards as traditional finance in terms of anti-money laundering and know-your-customer, Garlinghouse said.

"And we should have the same access to infrastructure, like a Fed master account," Garlinghouse said. "You can't say one and then combat the other like that. That's disingenuine."

On the Hill

Garlinghouse also offered insight given his close ties to where legislation to regulate the digital asset industry may go next. Notably, Garlinghouse has engaged with the Trump administration on crypto, including a dinner with President Trump earlier this year, ahead of his inauguration.

The House passed its version of the bill over the summer, 294-134, with several Democrats in support. Republicans in the Senate Banking Committee have a bill on the table that would allocate jurisdiction between the Securities and Exchange Commission and the Commodity Futures Trading Commission, as well as create a new term for "ancillary assets" to clarify which cryptocurrencies are not securities.

Prospects of the bill being passed any time soon have been dashed. Last week, a proposal from Senate Democrats revealed their stance to prevent illicit activity through decentralized finance, which caught the ire of Senate Republicans and the crypto industry at large over concerns that it wasn't workable.

Garlinghouse said he is still optimistic.

"The industry needs what Ripple has already achieved, which is clarity," Garlinghouse said. "We had to get clarity through a $150 million lawsuit and a federal judge, but we think the whole industry should have that same clarity, so we have been fighting for that and we will continue to do so."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

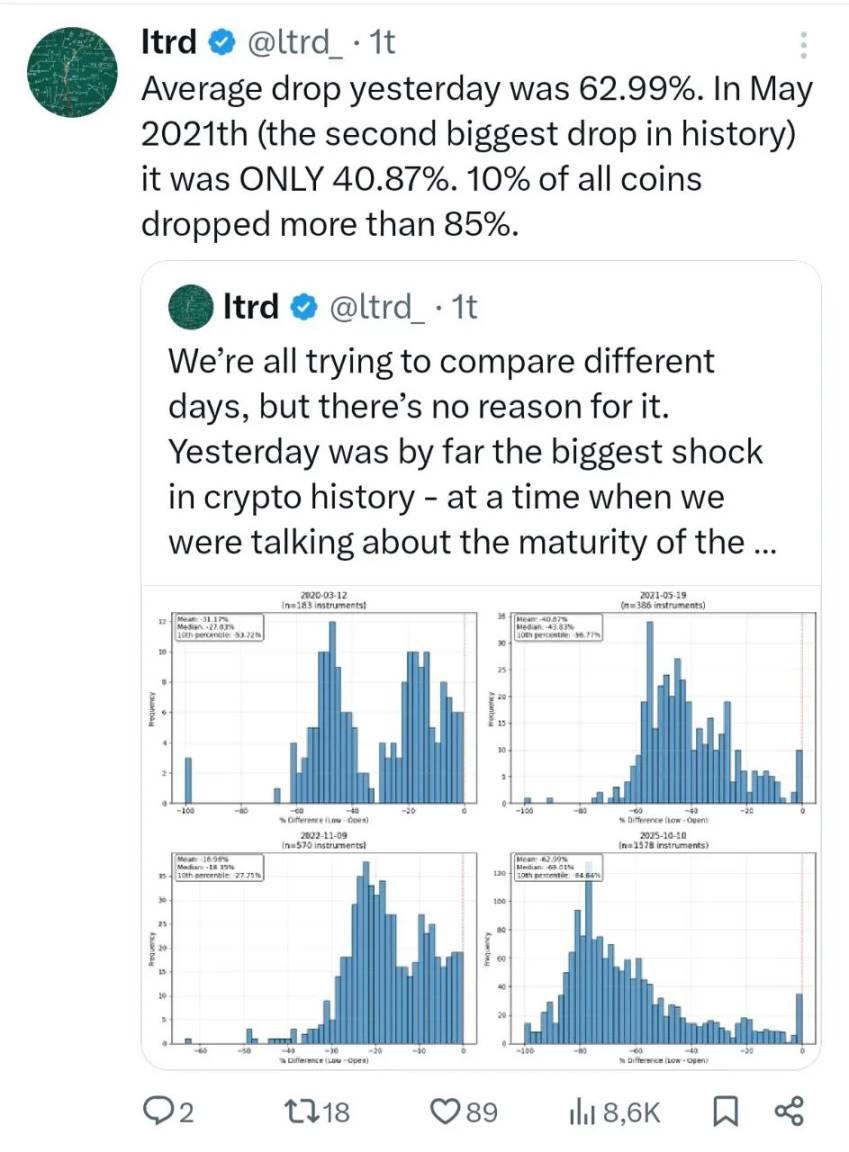

"10.11" Review and Survival Guide for the Survivors

In the post-crash era, where should cryptocurrency investment go from here?

From JPEG to AI Infrastructure, How Does AINFT Achieve a New Ecological Reconstruction?

AINFT aims to build a decentralized AI application aggregation ecosystem, allowing users to freely explore and utilize various AI Agent digital assistants just like using an "App Store."

$1.5 billion worth of Bitcoin seized: The collapse of the Southeast Asian "pig-butchering" empire

This article reports on the largest operation to date by US and UK law enforcement targeting the Cambodian Prince Group transnational crime organization and its leader, Chen Zhi. The US Department of Justice (DOJ) seized nearly 130,000 bitcoins (worth approximately $15 billion at the time), marking the largest asset seizure in US history. The operation aims to crack down on "pig-butchering" scam networks and modern slavery scam compounds spread across Southeast Asia.