Kadena and Brickken launch testnet for compliant RWAs

Kadena and Brickken have launched a testnet RWA chain that combines compliance with scalability.

- Kadena and Brickken have launched a testnet RWA chain.

- The first phase will involve tokenizing $10 million in real-world assets

- The mainnet launch is planned for 2026

Tokenized real-world assets have long been touted as the missing link between traditional finance and crypto. On Wednesday, October 15, Kadena, the proof-of-work Layer-1, teamed up with Brickken to launch a testnet infrastructure for compliant RWAs.

The testnet is the first phase of a broader rollout that includes the tokenization of $10 million in real assets, with mainnet deployment planned for 2026. In essence, the rollout brings together Kadena’s (KDA) scalable RWA blockchain with Brickken’s tokenization platform.

“Brickken enhances Kadena’s RWA strategy by providing an end-to-end tokenization platform for issuers to create, manage, and distribute real-world assets on-chain,” said Annelise Osborne, Chief Business Officer at Kadena. “Integrating Brickken’s robust tokenization infrastructure with Kadena’s scalable, energy-efficient Proof-of-Work blockchain delivers a secure and compliant foundation for bringing real-world value into the digital economy.”

Kadena and Brickken hope to bring institutions on-chain

As part of the partnership, Kadena will handle the technical aspects of the chain. At the same time, Brickken will handle compliant asset issuance, KYC verification, and automation and transparency features. Thanks to these features, the two firms hope to build the infrastructure that institutions need to go on-chain.

“Partnering with Kadena reinforces Brickken’s commitment to advancing institutional-grade blockchain solutions. Together, we’re bridging traditional finance and Web3 and delivering the infrastructure required for compliant and secure Real-World Asset tokenization at scale. It is a new benchmark for the future of institutional adoption,” said Edwin Mata, CEO of Brickken.

RWAs are becoming an increasingly dominant narrative in the crypto space. According to Skynet Report, the RWA market could reach $16 trillion by 2030, with tokenized treasuries likely driving adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana’s Uptake Among Institutions and Recent Market Fluctuations: Reasons to Trust in Its Long-Term Potential

- Solana secures institutional validation via JPMorgan's $50M Solana-based commercial paper and Bhutan's gold-backed TER token, signaling cross-sector adoption. - Technical upgrades like Firedancer and consensus algorithm enhancements boost scalability, outpacing Ethereum while maintaining cost efficiency and sustainability. - Q2 2025 revenue ($271M) and $7.14B trading volume post-Bhutan deal highlight Solana's market dominance despite $130–$145 short-term volatility amid macroeconomic uncertainty. - JPMor

BrightView’s Approach to Growth in the Changing Landscaping Industry: Harnessing Infrastructure and Sustainable Practices

- BrightView leverages infrastructure and sustainability to lead the evolving landscaping sector. - Its 2025 initiatives include smart irrigation (30% water savings) and 17% electric fleet expansion, aligning with UN SDGs and SASB standards. - IoT/AI tools boost efficiency, while 2025 EBITDA rose 8.5% to $352. 3M , supporting $300M fleet upgrades and $150M share buybacks. - Client diversification (83% retention) and niche markets (e.g., solar-powered senior living) strengthen market reach and client loyalt

Retirement Preparation and Portfolio Longevity for Wealthy Individuals: Harmonizing Emotional Preparedness with Financial Stability

- High-net-worth individuals (HNWIs) face a critical gap between financial preparedness (92% with advisors) and emotional readiness (11% deemed ready by advisors) for retirement. - Studies reveal 74% of HNWIs work with advisors, yet 49% admit their financial planning needs improvement, highlighting misaligned confidence and actual preparedness. - Portfolio sustainability strategies like diversified alternative assets (10% CAGR) and tax-efficient tools (Roth conversions, annuities) address inflation risks w

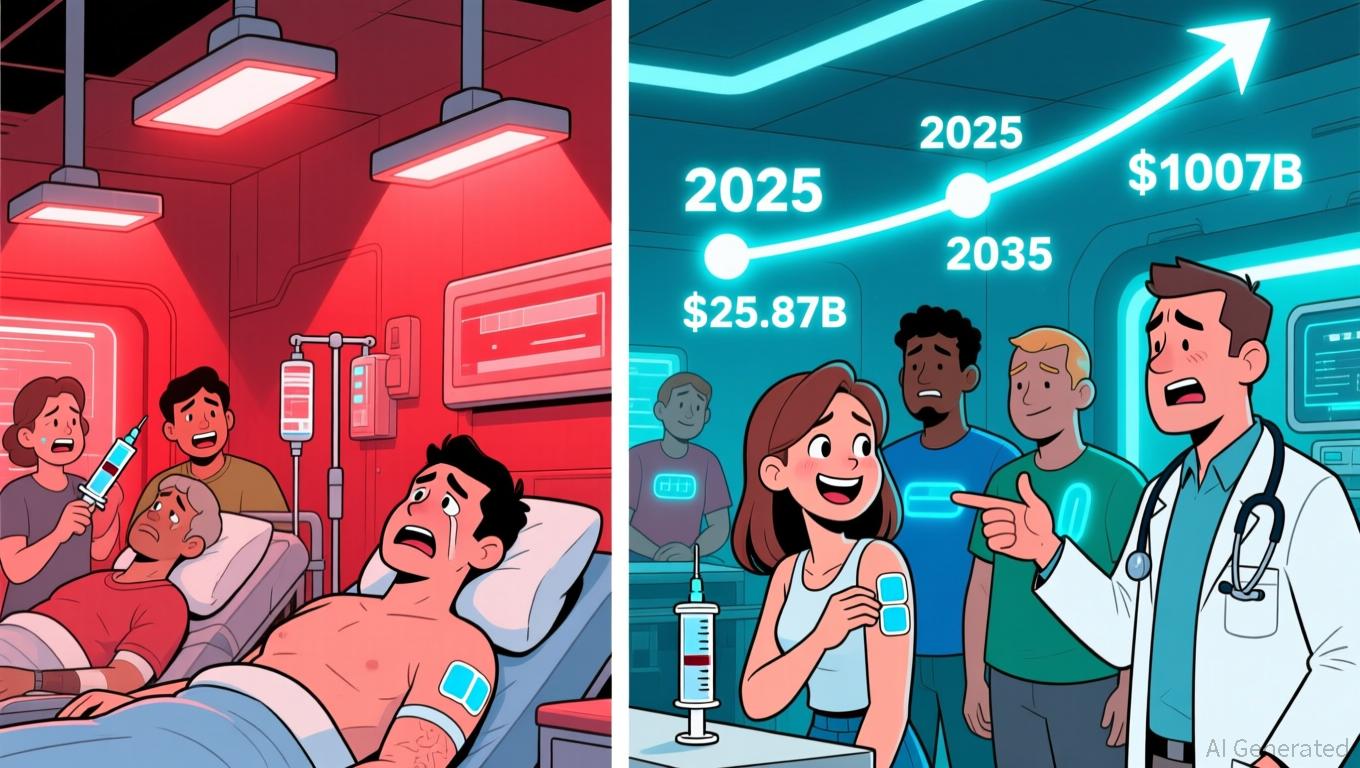

LIR Life Sciences and the Transformation of Obesity Treatments Through Needleless Administration

- Global obesity therapies market projected to reach $100B by 2035, driven by GLP-1 agonists and demand for non-invasive treatments. - LIR Life Sciences develops CPP-based transdermal delivery systems for GLP/GIP therapies, addressing patient adherence challenges in a $25.87B market. - Post-2025 acquisition by Blackbird, LIR pivoted to biopharma with $1M funding, but faces liquidity risks (-$32,388 net cash) despite 283.75% EBITA growth. - CPP technology enables needle-free delivery with injectable-like ef