Stablecoin Surge Signals Renewed Crypto Market Momentum

Quick Breakdown

- Tether and Circle record a combined $74 billion inflow, signaling renewed strength in crypto liquidity.

- Stablecoin growth defies market volatility, reinforcing investor confidence in digital assets .

- Rising demand for stablecoins reflects accelerating de-dollarization and shifting global liquidity trends.

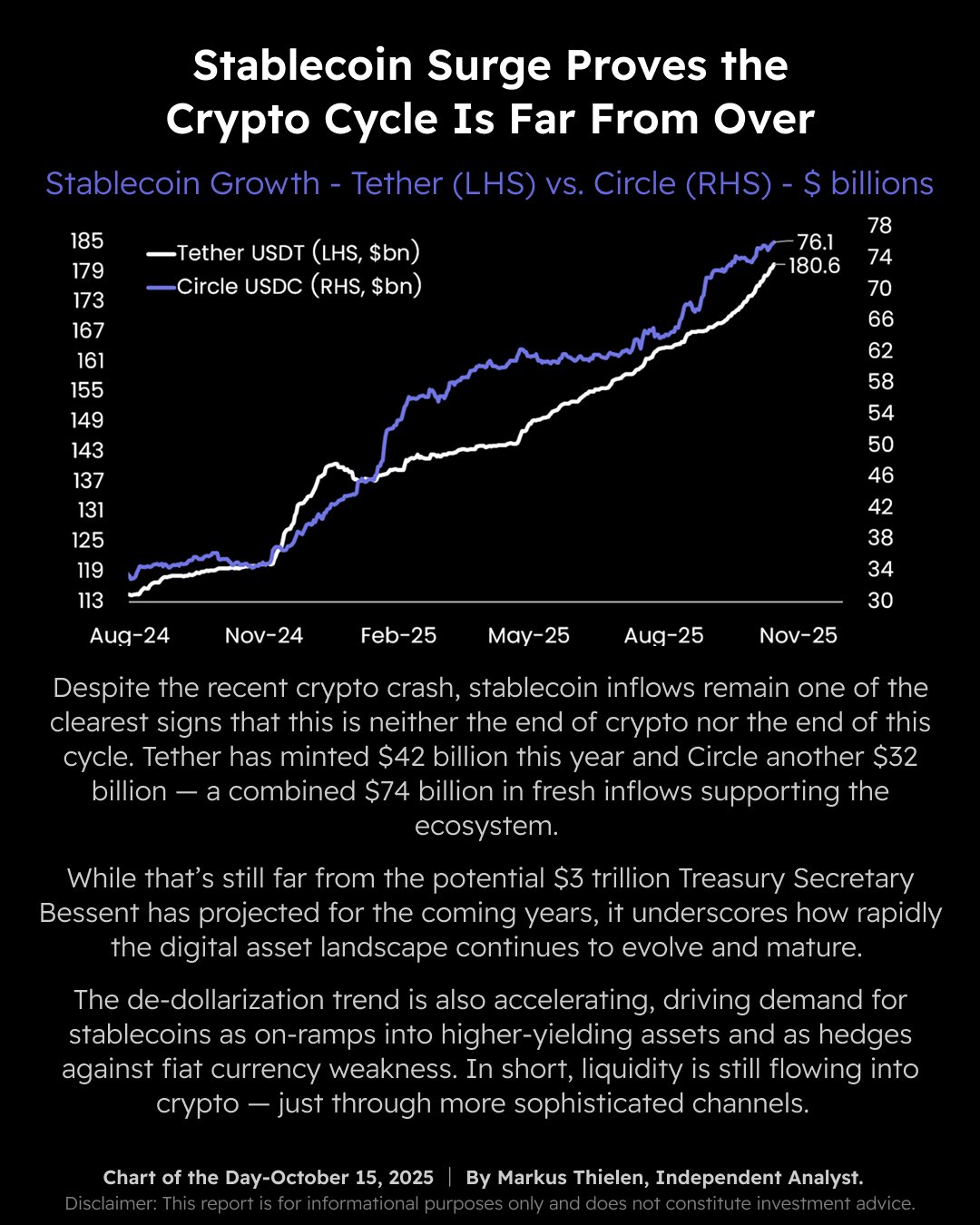

Stablecoin growth is reigniting optimism across the crypto market, defying predictions of a prolonged downturn. According to data from independent market strategist Markus Thielen, combined inflows into Tether (USDT) and Circle (USDC) have surpassed $74 billion in 2025, underscoring stablecoins’ pivotal role as the primary liquidity engines of the digital asset ecosystem.

Stablecoin Surge Signals Renewed Crypto Market Momentum. Source: Matrixport

Stablecoin Surge Signals Renewed Crypto Market Momentum. Source: Matrixport

Despite market volatility, liquidity remains robust

Tether has issued roughly $42 billion in new USDT this year, while Circle added another $32 billion in USDC circulation. Their total supplies now stand at $180.6 billion and $76.1 billion, respectively — representing one of the fastest expansion phases since 2021.

Thielen noted that even amid this year’s market correction, “liquidity is still flowing into crypto — just through more sophisticated channels.” The data suggests investors are not exiting digital markets, but rather repositioning capital through stablecoins, which are increasingly viewed as low-risk, yield-bearing assets during volatile periods.

Stablecoins reflect global economic shifts

Analysts say the surge in stablecoin usage highlights a wider macroeconomic transformation, as investors seek stability amid currency weakness and fluctuating traditional markets. Stablecoins are now being used not only as hedging tools but also as gateways to yield-generating digital assets.

This trend is also driving a gradual de-dollarization of the global economy. By offering borderless, 24/7 financial access without reliance on banks, stablecoins are rapidly gaining traction in Asia and Latin America, where they’re used for remittances, cross-border trade, and DeFi participation.

While the digital asset market has yet to reach the projected $3 trillion capitalization forecasted by U.S. Treasury Secretary Janet Bessent, the sustained expansion of stablecoins points to deepening institutional confidence and a more mature crypto financial system.

In a related development, the Solana Foundation has partnered with Korea’s Wavebridge Inc. to build a Korean won-pegged (KRW) stablecoin and institutional-grade tokenization products, further advancing the real-world adoption of blockchain-based finance.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FF - 310.94% decrease in 24 hours following a turbulent 7-day increase of 2342.59%

- FF token plunged 310.94% in 24 hours after a 2342.59% 7-day surge, highlighting extreme volatility. - The sharp correction reflects speculative retail trading and algorithmic patterns, with no stable price anchors. - A 3691.77% 30-day drop and 5654.36% annual depreciation reveal structural bearishness and lack of long-term investor confidence. - High leverage and short-term trading dominate FF's dynamics, contrasting with fundamental value-driven markets.

WAL surged by 535.79% within 24 hours as a result of significant rapid gains.

- WAL surged 535.79% in 24 hours on Oct 16, 2025, becoming the top-performing token in its market segment. - The token gained 811.18% in 7 days and maintained 46.06% growth over 1 month and 1 year, showing sustained momentum. - Technical indicators confirm no reversal signals, suggesting WAL's rapid gains reflect growing investor demand and confidence.

Bittensor recovery subnet registration and deregistration mechanism