Alibaba Subsidiary Drives Attention to its Ethereum Layer 2 Blockchain

Jovay Network, an Ethereum Layer 2 (L2) network backed by Ant Digital, a subsidiary of Alibaba, is catching eyes today after it proclaimed its alignment with Ethereum on social media.

Despite many investors being surprised by the news, Jovay was originally revealed as an Ethereum L2 in April at the RWA Real Up conference in Dubai.

Jovay touts itself as financial-grade blockchain infrastructure, focused on global real-world asset (RWA) tokenization via its “modular Layer2 infrastructure that bridges Web2 and Web3.”

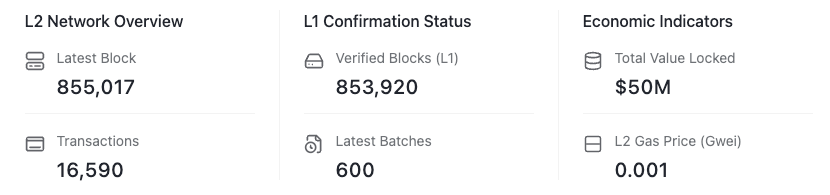

According to the chain’s block explorer, the network currently hosts $50 million in total value locked, but has only finalized 16,600 total transactions.

Alibaba Group ($BABA) is the 30th-largest company in the world by market capitalization, with a $385 billion valuation, making it the second-largest company in China.

The company first began exploring blockchain via Ant in 2019 with Alibaba Cloud, its blockchain-as-a-service (BaaS) platform for supply chain management tasks such as product traceability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Update: Thumzup Leverages Dogecoin’s Fast Transactions and Affordable Fees for Global Creator Payments

- Thumzup (TZUP) plans to integrate Dogecoin (DOGE) as a rewards option for its app users, leveraging low fees and fast cross-border payments. - The move aims to diversify monetization for creators while reducing reliance on traditional banking systems, complementing existing cash rewards. - The company already holds 7.5M DOGE tokens and invests in Dogecoin mining, aligning with broader blockchain adoption trends in remittance markets. - Implementation depends on technical validation and regulatory complia

Yesterday, US spot Bitcoin ETFs saw a net outflow of $104.12 million.

XRP News Today: XRP's Surge Struggles to Match Bitcoin's Market Strength

- XRP forms lower highs against Bitcoin's rally, signaling weakening momentum and potential drop to $2.00. - XRP's institutional adoption and 2024 SEC victory challenge Bitcoin's dominance but face regulatory hurdles. - Bitcoin's $1.5T market cap and "digital gold" status maintain its lead, while XRP's future depends on legal outcomes and ETF approvals.

HEMI's value has plunged by 5270.51% since the start of the year due to turbulent market fluctuations

- HEMI token fell 5270.51% year-to-date, with 3069.05% decline in one month. - Technical analysis shows sustained bearish trend despite oversold indicators and no upward corrections. - Analysts link extreme volatility to macroeconomic factors and speculative trading rather than token-specific events. - Proposed backtesting strategy examines post-event performance after 10% single-day price drops in selected assets.