XPL surges 38.5% within a day as technical rebound sparks sharp and unpredictable short-term price swings

- XPL surged 38.5% in 24 hours on Oct 16 2025, contrasting with 5385.15% monthly and 6327.41% annual declines. - Technical analysis suggests stabilization above key support levels after sharp depreciation, potentially triggering short-covering activity. - Despite short-term volatility and 1848.95% 7-day gains, long-term bearish trends persist, undermining investor confidence.

On October 16, 2025,

This sharp 24-hour increase signals a notable turnaround for XPL, which has otherwise experienced significant losses over longer periods. The asset’s recent short-term gains suggest it may be finding stability after a substantial downturn in previous weeks. Market participants are closely monitoring whether this rally signals a sustained recovery or is simply a brief reaction in the market. The 1848.95% rise in the past week is a dramatic contrast to the 5385.15% monthly drop, highlighting a rapid shift in sentiment within a turbulent and uncertain market.

From a technical perspective, XPL appears to be forming a possible bottom on the daily chart, holding above important support levels after a period of steep losses. The recent 38.5% jump could have triggered stop-losses and forced short sellers to cover, fueling the upward movement. Despite this, the broader trend remains negative, as the substantial 12-month decline continues to impact overall market sentiment and investor trust.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

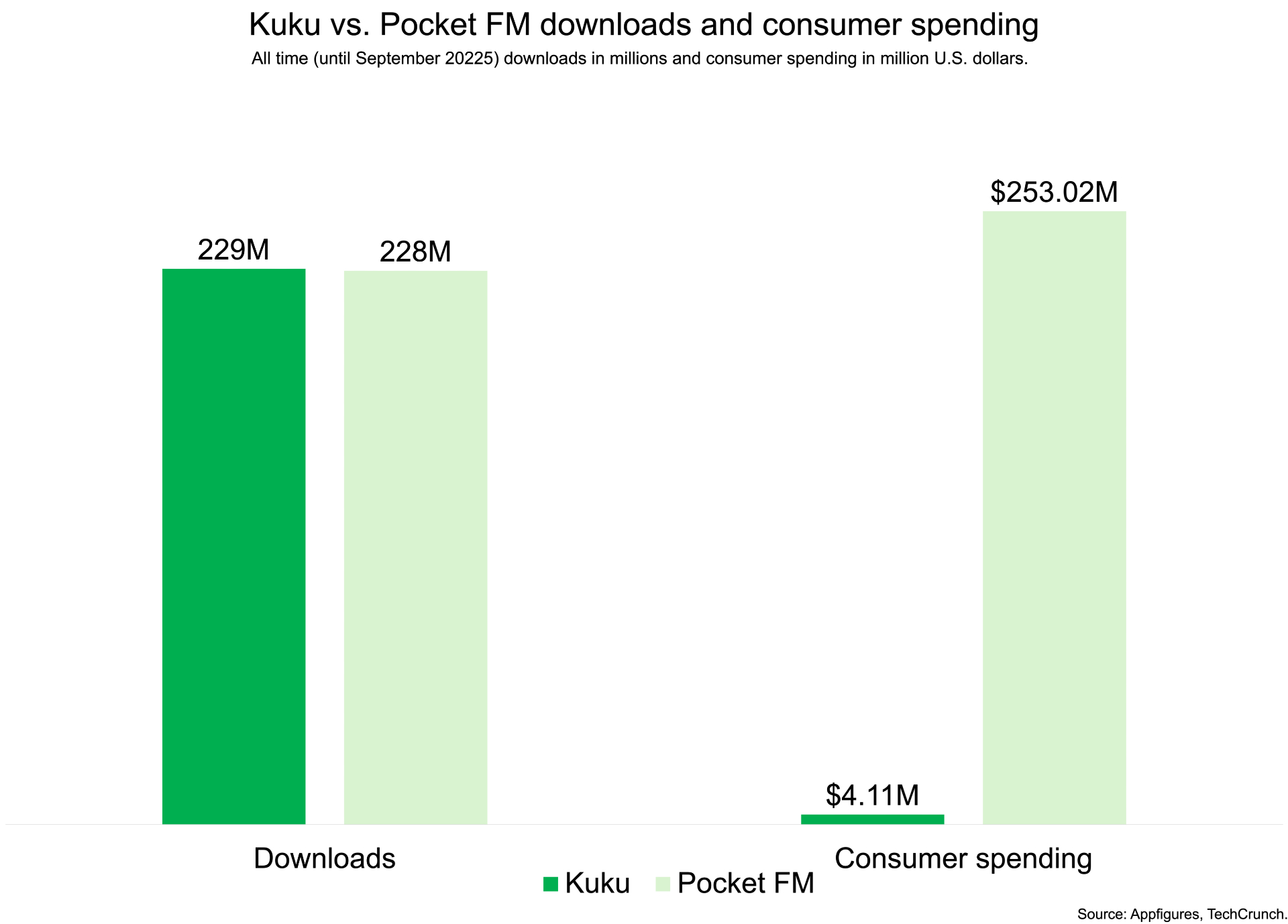

India’s Kuku secures $85 million amid escalating competition in the mobile content space

Only 48 hours left to take advantage of savings before the TechCrunch Disrupt 2025 flash sale concludes