- LINK stabilizes near $17.80, a crucial 0.618 Fib level for potential recovery.

- Rising open interest signals speculative buildup despite ongoing investor outflows.

- Break above $19.45 EMA cluster could trigger a short-term rally toward $21.00.

Chainlink (LINK) continues to trade under short-term pressure, but price behavior on the 4-hour chart suggests that a pivotal moment may be near. The token’s structure indicates consolidation between crucial Fibonacci levels, where both buyers and sellers are actively contesting control. As broader market volatility rises, LINK appears to be stabilizing around its recent lows while futures and on-chain data reflect growing market engagement.

Technical Overview and Price Structure

At press time, LINK trades near $18.34 after recovering slightly from the $17.80 zone. This level aligns with the 0.618 Fibonacci retracement from the $8.21 to $23.73 swing a region that often acts as a turning point during corrective phases.

Despite the rebound, the price remains under key exponential moving averages. The 20 EMA at $18.64 and 50 EMA at $19.45 now serve as resistance, while the 100 EMA at $20.36 and 200 EMA at $21.20 mark stronger recovery barriers. Hence, the short-term outlook still favors consolidation until the market confirms a directional breakout.

LINK Price Dynamics (Source: TradingView)

LINK Price Dynamics (Source: TradingView)

If the price slips below $17.80, downside targets appear around $15.97 and $14.14, levels that coincide with earlier accumulation zones. Conversely, a clean break above $19.45 could trigger renewed bullish interest, with potential targets between $21.00 and $22.00. Maintaining stability near the 0.618 Fib level will be essential for restoring buyer confidence.

Related: Tron Price Prediction: TRX Attempts Recovery as Traders Eye Key Resistance

Open Interest and Market Participation

Data from derivatives markets reveals rising optimism among traders. Chainlink’s open interest surged from under $400 million in early June to approximately $713 million by mid-October 2025. This consistent climb indicates a buildup of leveraged positions and increased market activity.

Source: Coinglass

Source: Coinglass

Moreover, the combination of growing open interest and moderate price recovery signals new capital inflows rather than position rotations. Consequently, the derivatives market is showing early signs of preparing for a potential volatility expansion phase.

Exchange Flows and Investor Behavior

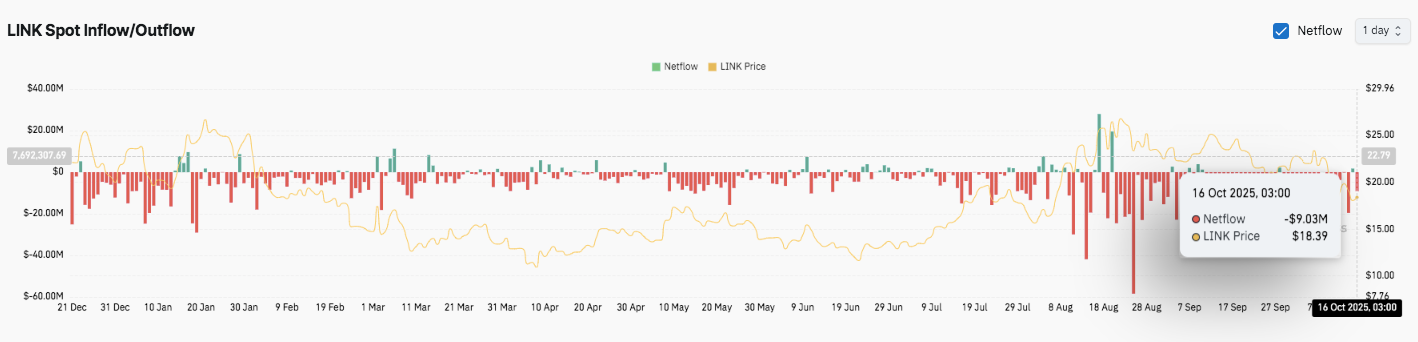

Despite the derivatives optimism, on-chain flows depict a different sentiment. Chainlink registered $9.03 million in net outflows on October 16, continuing a trend seen throughout 2025. Persistent outflows often signal investors taking profits or reducing exposure after minor price upticks.

Source: Coinglass

Source: Coinglass

Limited inflow events suggest that accumulation remains weak compared to distribution. However, if LINK stabilizes near support and open interest continues climbing, a stronger rebound phase may emerge in the coming weeks as confidence gradually returns.

Related: Cardano Price Prediction: ISO 20022 Hype Sparks Attention

Technical Outlook for Chainlink (LINK)

Key levels for Chainlink remain clearly defined as the token navigates a crucial support area around $17.80. This zone aligns with the 0.618 Fibonacci retracement of the $8.21–$23.73 swing, a level that often determines whether a corrective phase deepens or reverses.

- Upside Levels: Immediate resistance emerges between $18.64 and $19.45, where short-term exponential moving averages cluster tightly. A breakout above this range could open the path toward $20.41 (0.786 Fib) and possibly $21.20–$23.70, marking the next medium-term resistance area. Sustained movement above these levels may shift momentum back in favor of buyers.

- Downside Levels: On the downside, $17.80 remains the primary line of defense. A break below it could extend the pullback toward $15.97 and $14.14, both aligning with earlier accumulation zones. These levels represent potential demand areas if selling pressure increases.

Will Chainlink Rebound Soon?

Chainlink’s price outlook depends on whether buyers can defend the $17.80 zone long enough to regain bullish momentum. Rising open interest hints at speculative buildup, while persistent outflows reflect cautious investor behavior. If momentum improves alongside broader market recovery, LINK could retest $21.00 in the short term.

However, continued weakness below the EMA cluster might extend consolidation before a stronger trend reversal occurs. For now, LINK trades in a pivotal area where stability above $17.80 remains the key to confirming a recovery phase.

Related: Ethereum Price Prediction: Traders Eye Key Support as BitMine Adds $417M in ETH