Massive Bitcoin whale transfers 2,000 BTC to 51 wallets, here’s why

A long-dormant Bitcoin whale has resurfaced, moving a large batch of coins amid renewed market volatility and uncertainty over Bitcoin’s price direction.

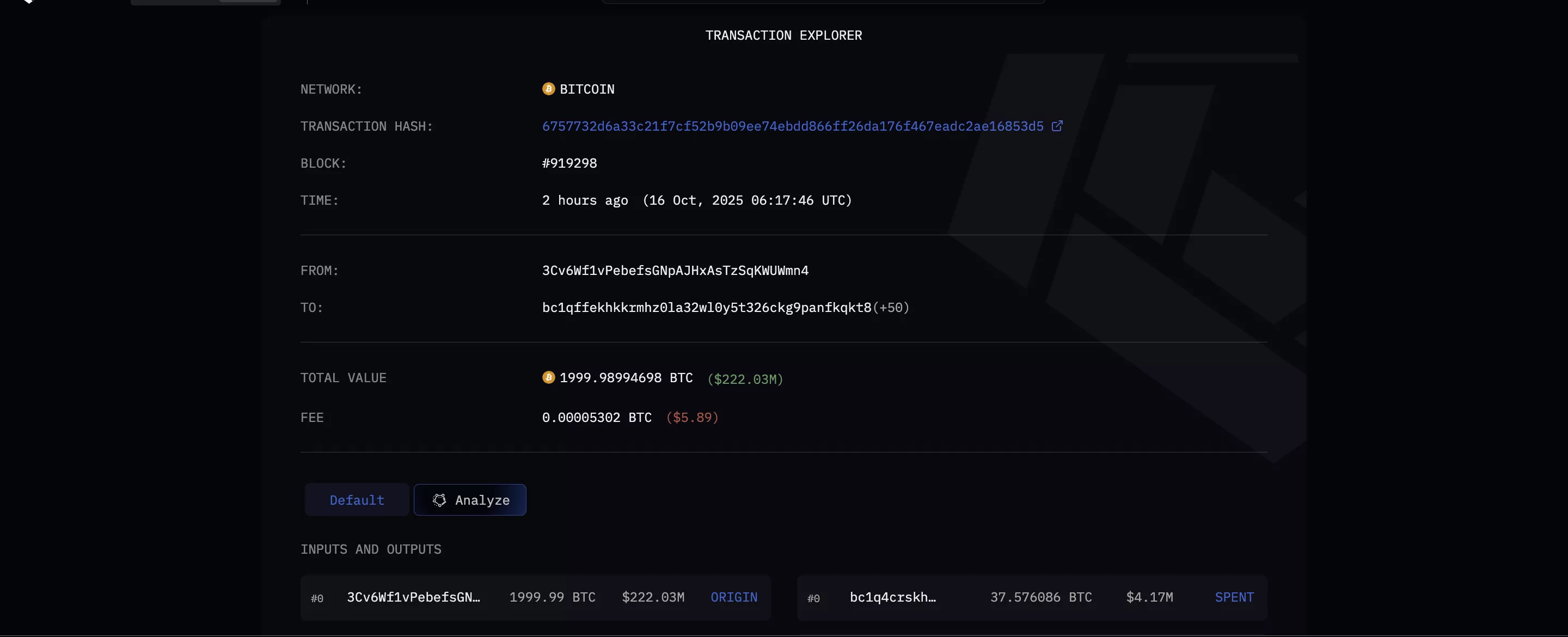

- A long-dormant Bitcoin wallet has transferred 2,000 BTC, valued at over $222 million, to 51 new addresses.

- The funds were evenly split, with 50 wallets receiving about 37.576 BTC each and one receiving 121.18 BTC.

- The structured transfer suggests deliberate reorganization or security upgrades rather than random activity.

- Bitcoin is hovering near $110,000, following a retreat from recent highs above $126,000.

A long-time Bitcoin whale has transferred 2,000 BTC, worth about $222 million at current prices, into dozens of new wallets in what appears to be a carefully coordinated move.

Blockchain data from Arkham Intelligence shows that the funds were distributed across 51 fresh addresses. Fifty wallets each received 37.576 BTC ( BTC ), worth roughly $4.2 million, while one wallet received 121.18 BTC, around $13.4 million.

Bitcoin whale moves 2k BTC to 51 wallets | Source: Arkham

Bitcoin whale moves 2k BTC to 51 wallets | Source: Arkham

The transfers mark the first significant movement of these coins in years, originating from an address tied to Bitcoin’s early days. The structured and even distribution of the assets points to a deliberate move rather than a spontaneous transaction, likely aimed at reorganizing or securing holdings.

However, the timing of the transfers has sparked speculation about intent, particularly as Bitcoin struggles to regain strong momentum following the recent market downturn .

OG Bitcoin whale stirs, is a dump coming?

The reappearance of long-dormant whales from Bitcoin’s early days is often linked to profit-taking. BTC has risen sharply since these early accumulation periods, and such large movements typically fuel speculation that a holder may be preparing to offload part of their stash to realize gains.

With BTC hovering around $110,000 after dipping from recent highs above $126,000, market attention has turned to the potential for such a sale to further exert downward pressure on price.

Still, not every major on-chain movement signals a dump. Some early holders periodically move funds to strengthen security, upgrade storage infrastructure, or shift coins into institutional custody. It is also possible that the wallet restructuring is part of an internal reorganization rather than an exchange-bound transfer.

For now, there’s no evidence that the coins have reached any exchange addresses. Bitcoin itself remains relatively stable, down roughly 2.4% on the day, with no immediate market reaction to the latest whale movement.

If the coins eventually move toward exchanges, it could confirm selling intent and add near-term pressure on price. But if they stay dormant in fresh wallets, the move may simply reflect routine portfolio management by the Bitcoin whale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."