Solana Fails To Hold Above $200 Amid $130 Million SOL Selling

Solana faces $132 million in selling as holders offload tokens, yet historical patterns hint that a rebound above $200 could soon follow.

Solana’s price movement has remained largely stagnant over the past few days as the broader crypto market shows uncertainty.

Despite a strong start earlier in the month, SOL has struggled to maintain upward momentum. Investor sentiment appears divided, with some holders taking profits while others brace for potential recovery.

Solana Investors Sell Sharply

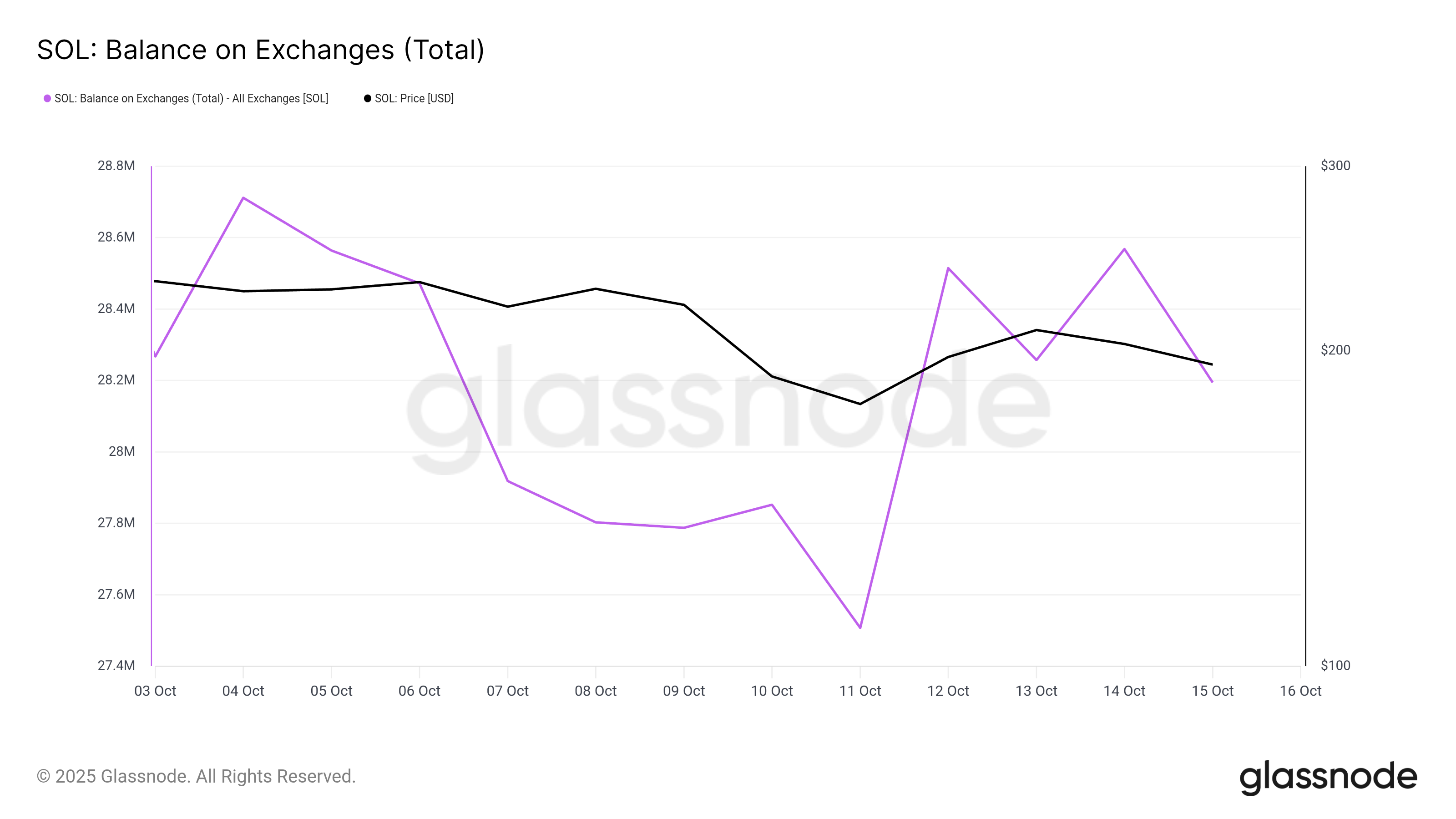

Over the past week, Solana investors have been turning to the selling side. On-chain data shows that more than $132 million worth of SOL has been sent to exchanges during this period. This influx reflects heightened sell-side pressure as traders move to secure gains or exit amid uncertainty.

Even though the SOL sold is relatively less, it does show that panic selling has been evident; others are liquidating positions at minor rallies, suggesting a lack of confidence in sustained price growth. However, this selling is not strong enough to hold Solana price’s recovery back even if it caused a minor dip in price.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Solana Exchange Balance. Source;

Glassnode

Solana Exchange Balance. Source;

Glassnode

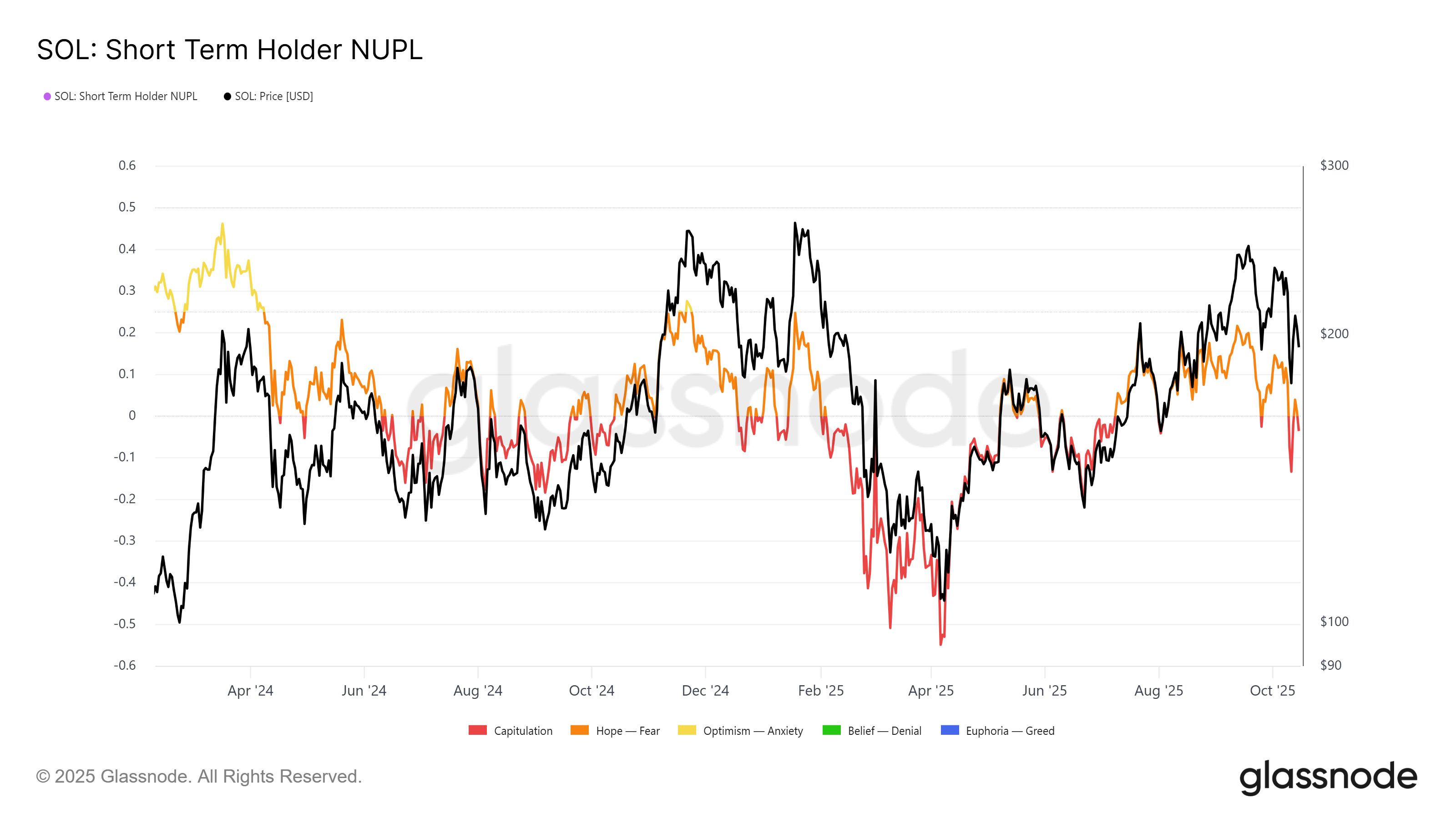

The short-term holder Net Unrealized Profit/Loss (STH NUPL) indicator currently sits in the capitulation zone, signaling that most short-term holders are selling at a loss. Historically, when this occurs during a broadly positive market, it has marked the beginning of a rebound phase. This pattern has been observed multiple times in Solana’s previous cycles.

When investors stop selling at losses and begin waiting for profit-taking opportunities instead, market pressure tends to ease. This dynamic could trigger a shift toward accumulation, potentially leading to a short-term rally.

Solana STH NUPL. Source;

Glassnode

Solana STH NUPL. Source;

Glassnode

SOL Price Can Bounce Back

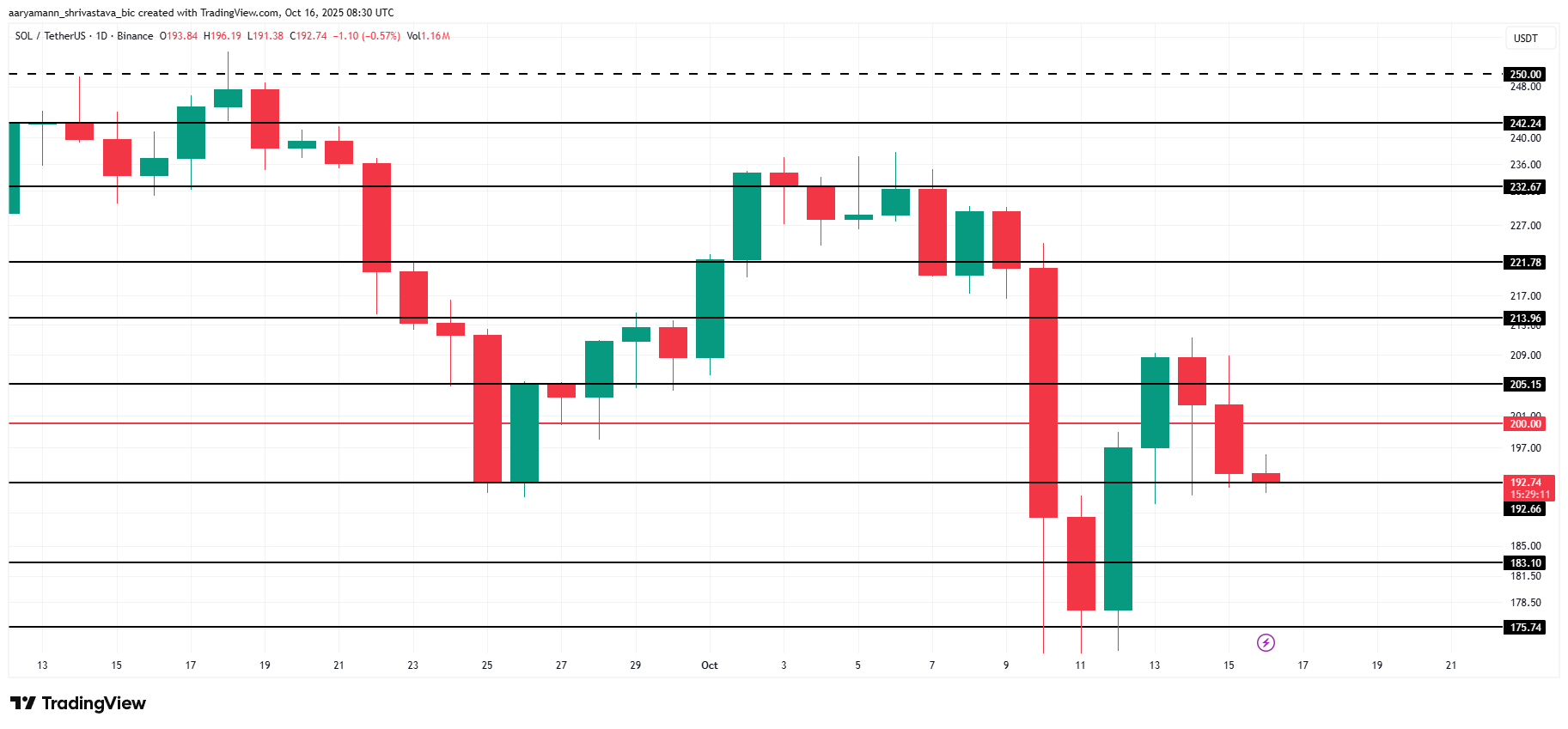

Solana’s price currently stands at $192, holding just above a key support level at the same mark. The altcoin recently dipped after failing to secure a foothold above $200, but resilience at this level remains a positive sign.

Given the current on-chain dynamics, SOL may soon reverse its recent losses. A successful breakout above $200 and $205 could pave the way toward $213, signaling renewed bullish momentum.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

However, if selling continues to dominate and confidence remains weak, Solana’s price could fall to $183. Such a decline would invalidate the bullish outlook and deepen the short-term downtrend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.

Historic Fundraising: Real Finance Attracts $29 Million to Revolutionize RWAs