XRP Records 7,400% Exchange Outflow Surge—But There’s A Catch

XRP price is hovering near $2.41 after a sharp 7,400% surge in outflows. While retail traders appear to be driving the latest buying wave, large investors remain cautious, and technical indicators warn that the bounce may fade. With bearish EMAs forming and key supports under pressure, XRP could be at risk of another leg down.

XRP price has dropped nearly 14% in the past week and 3.6% in the last 24 hours, even as exchange outflows jump sharply. At first glance, that looks like an accumulation — but deeper signals suggest the latest buying wave could be a trap.

While retail enthusiasm is clear, the largest investor groups and key technical patterns are sending a warning that XRP’s bounce might not last.

Key Groups Are Reducing Exposure, Not Accumulating

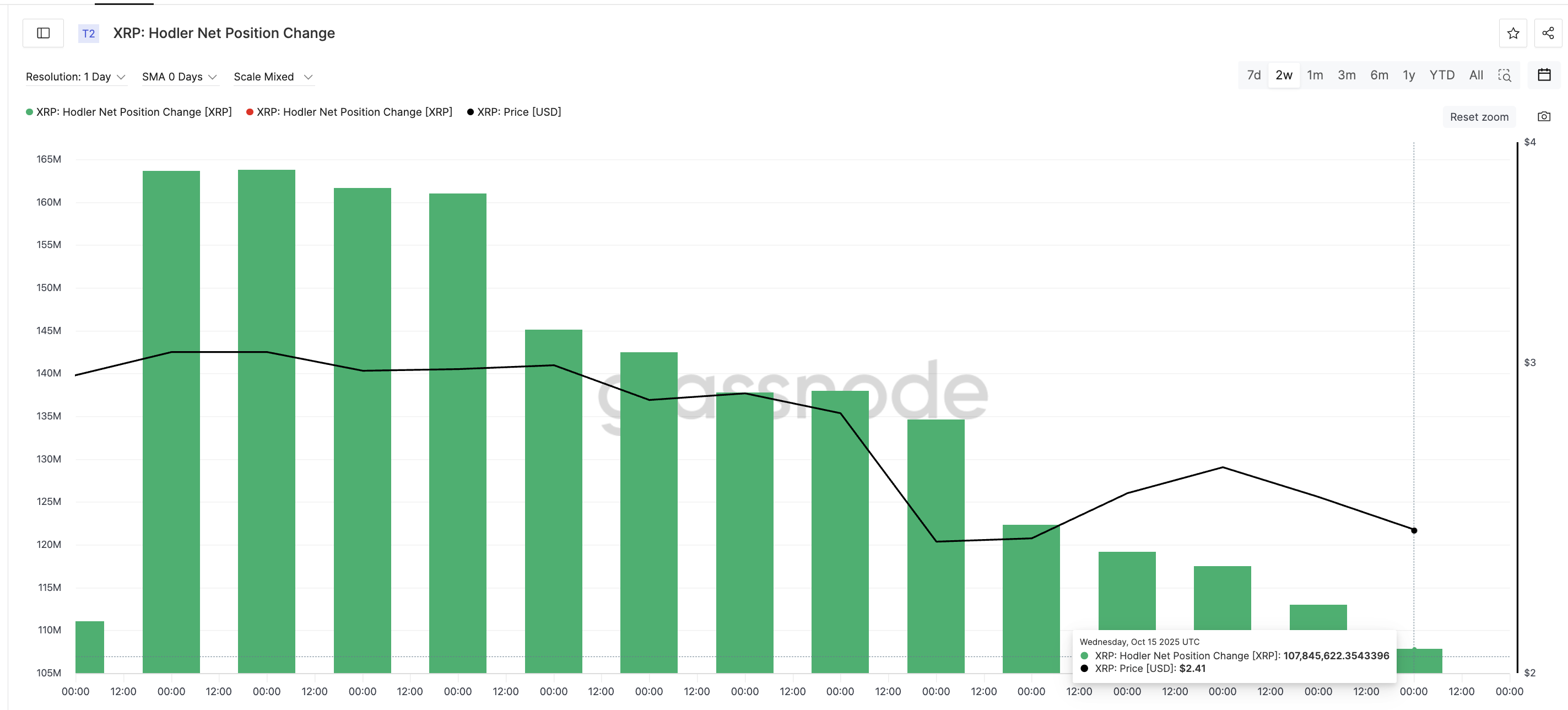

The Hodler Net Position Change, which tracks how much long-term investors are adding or selling, has declined sharply in the past two weeks. Between October 2 and October 15, holdings dropped from 163.68 million XRP to 107.84 million XRP, a 34% fall. This means long-term holders are exiting rather than positioning for recovery.

XRP Holders Keep Dumping:

XRP Holders Keep Dumping:

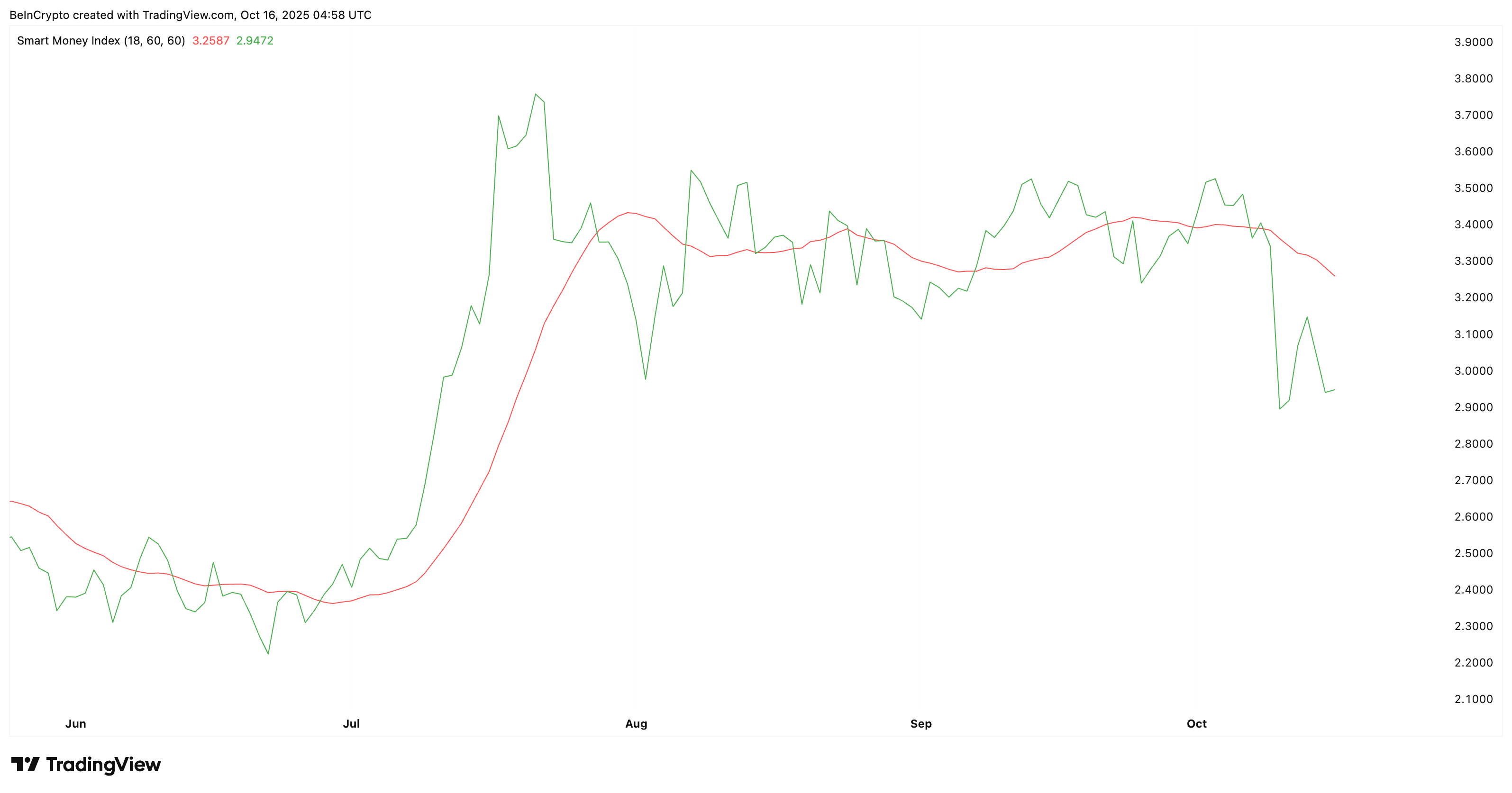

Two additional metrics back this up. The Smart Money Index (SMI), which tracks how experienced traders are positioning, has dropped to its second-lowest level since early October. This shows that rebound confidence is fading.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Smart Money Loses Interest:

Smart Money Loses Interest:

The Chaikin Money Flow (CMF), which tracks how much money large wallets are adding or removing, remains below zero. It is a key signal that big wallets aren’t buying the dip aggressively enough.

Large Holder Accumulation Remains Muted:

Large Holder Accumulation Remains Muted:

Together, these indicators show large players are stepping back, even as price volatility draws in several traders.

Exchange Outflows Rise — But It May Be Retail Buying the Top

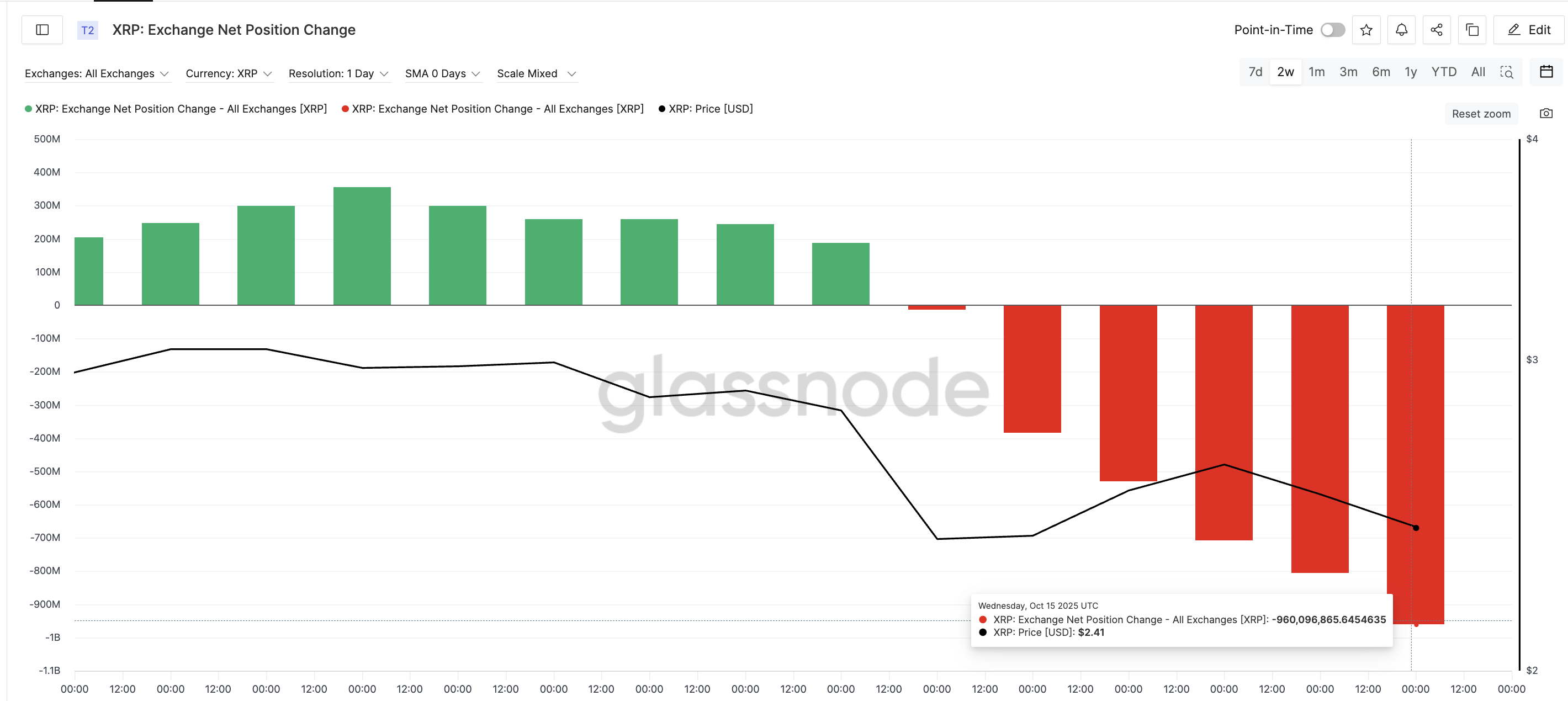

Despite weak conviction among large holders, exchange outflows have surged, often seen as a bullish signal. The Exchange Net Position Change, which measures how much XRP is moving in or out of exchanges, has deepened from –12.7 million XRP on October 10 to –960 million XRP on October 15 — a 7,400+% increase in outflows. That usually means investors are moving tokens out of exchanges, reducing immediate sell pressure.

XRP Buyers Still Active:

XRP Buyers Still Active:

But here, it could be misleading. Since long-term holders, whales, and smart money are staying on the sidelines, this activity likely reflects possible retail accumulation — smaller investors chasing the bounce.

Historically, when buying momentum is led by retail without whale support, the rally tends to fade quickly, trapping late buyers as prices reverse.

Technical Patterns Still Warn of Downside Risk for XRP Price

XRP trades near $2.41, but the chart structure remains fragile. Two death crossovers are forming — a bearish setup where short-term moving averages fall below long-term ones, often signaling a deeper downtrend ahead.

The Exponential Moving Average (EMA), a technical indicator that gives more weight to recent prices, shows two key crossovers forming. The 20-day EMA (red line) is nearing a drop below the 200-day EMA (deep blue), and the 50-day EMA (orange) is close to crossing under the 100-day EMA (sky blue). If both confirm, XRP’s bearish phase could extend, deepening the current slide.

XRP Price Chart Still Leans Bearish:

XRP Price Chart Still Leans Bearish:

For the XRP price $2.57–$2.72 is the breakout zone that could provide short-term relief, invalidating bearishness.

However, a close below $2.32 ( a mere 3.5% dip) risks a fall to $2.14 or even $2.06, confirming a breakdown. Overall, the setup points to a growing buyer trap. Exchange data shows strong retail optimism, but every major cohort and technical indicator warns of further weakness.

XRP Price Analysis:

XRP Price Analysis:

Until whales and long-term holders return, the latest buying spree may only delay another leg down.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ether retail longs metric hits 94%, but optimism could be a classic bull trap

Bitcoin options markets highlight mounting fears as traders brace for more pain

$15 Billion Changes Hands: How Was the So-Called Decentralized BTC "Seized" by the US Government?

With the transfer of 127,271 BTC, the United States has become the world's largest sovereign holder of bitcoin.