COAI Price Eyes a New All-Time High Post-Breakout, but One Risk Remains

ChainOpera’s (COAI) price has surged over 50% in a day after breaking out of a symmetrical triangle on the 4-hour chart. On-chain signals show improving buying pressure, but weakening momentum hints that the rally might pause before extending. A clean move above $31 could send COAI to a new all-time high, yet one key risk remains that could trigger a short-term pullback first.

ChainOpera’s (COAI) price has surged more than 50% in the past 24 hours after a breakout on the 4-hour chart. The newly listed AI-focused token, part of Binance’s Alpha Spotlight program, has drawn quick attention from traders.

The pattern suggests more upside could follow, but one technical signal still hints that a short-term pullback may interrupt the rally.

Money Flow Leans Positive, but Momentum Might Stall

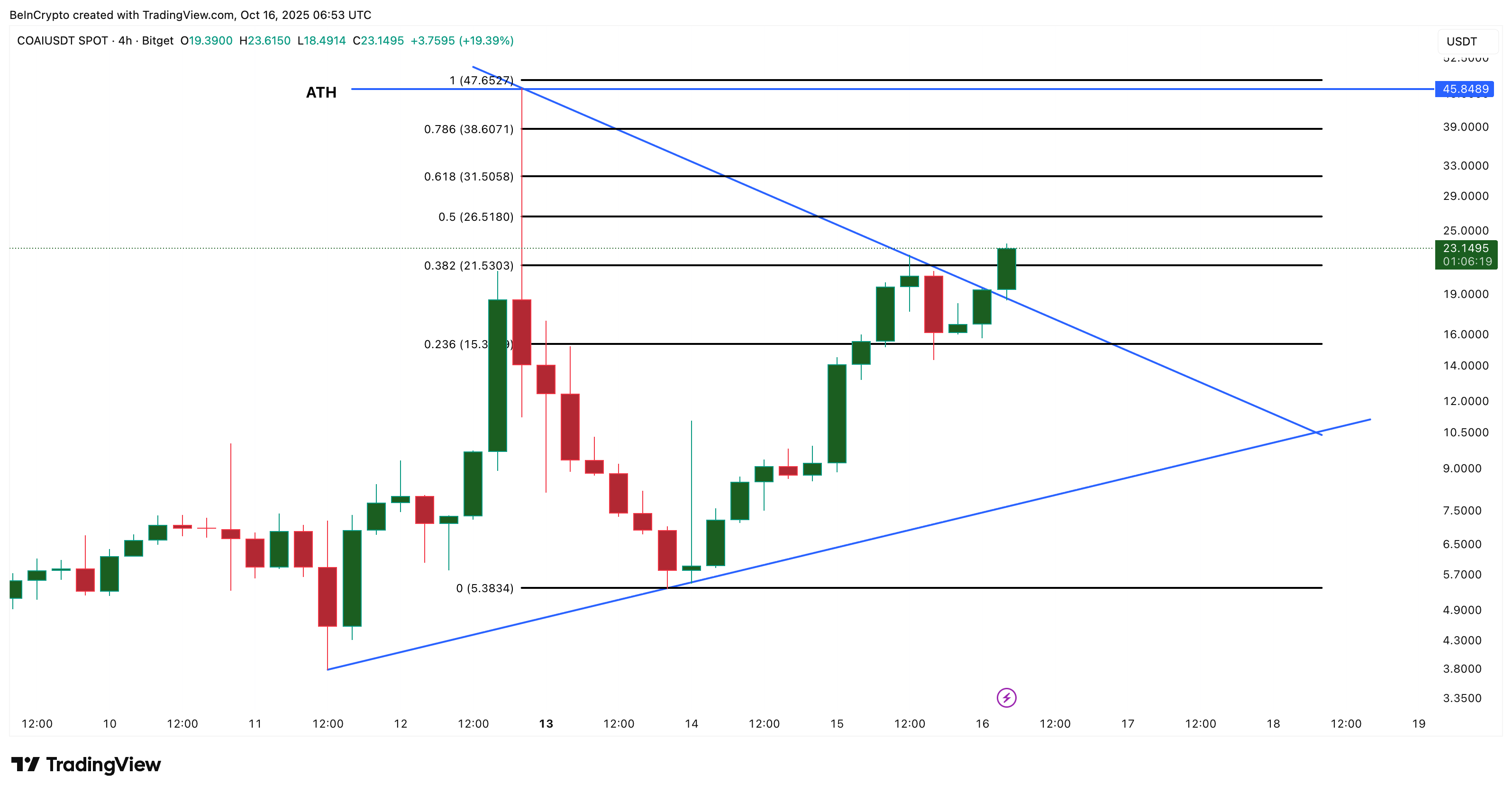

COAI broke out of a symmetrical triangle, a pattern that forms when price makes lower highs and higher lows, showing consolidation before a large move. A confirmed close above this structure usually signals trend continuation, which is now visible on COAI’s 4-hour chart.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Bullish COAI Pattern:

TradingView

Bullish COAI Pattern:

TradingView

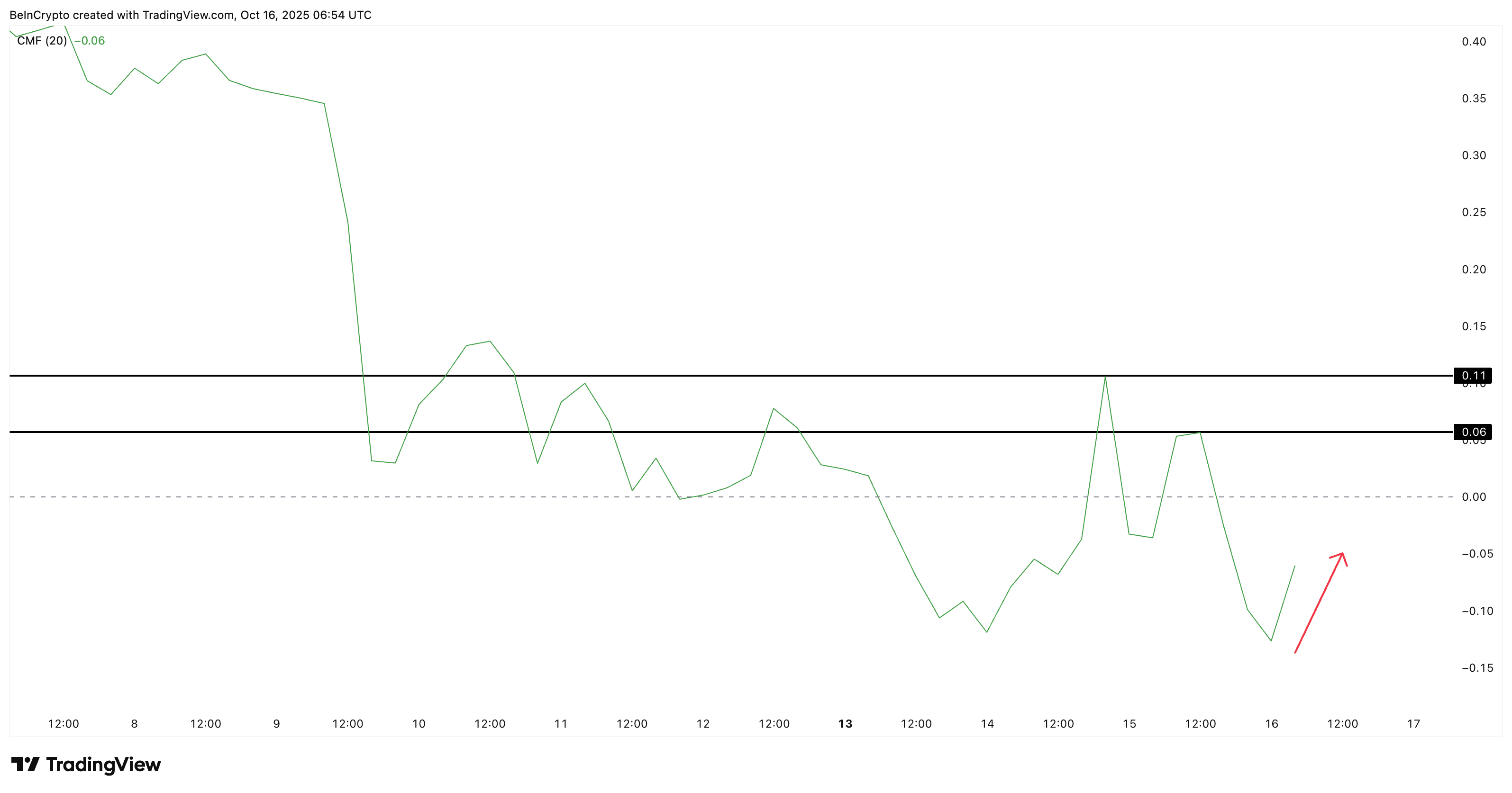

Supporting this breakout, the Chaikin Money Flow (CMF) — an indicator that tracks the flow of money from large investors — has started to turn upward after dipping below zero. This shows that large wallets are returning slowly, though conviction is still limited.

Large Wallets Have Restarted COAI Accumulation:

TradingView

Large Wallets Have Restarted COAI Accumulation:

TradingView

If CMF crosses above 0.06, it would confirm renewed accumulation, while a move toward 0.11 would mark strong inflows and higher whale confidence.

The Money Flow Index (MFI), which measures buying pressure using both price and volume, has climbed steadily since October 14. It indicates active retail participation, but the pattern shows they’re mostly buying strength instead of dips. Every time the COAI price has dipped, MFI has also dipped, indicating a lack of dip-buying money. This pattern might signal a slightly weaker conviction.

Retail Buying Active But Not Exactly On Dips:

TradingView

Retail Buying Active But Not Exactly On Dips:

TradingView

Meanwhile, the Relative Strength Index (RSI) — which gauges the pace and intensity of price movement — reveals the only key risk. Although COAI’s price made higher highs, RSI has formed a lower high, a bearish divergence that points to slowing momentum.

COAI Price Showing Bearish Divergence:

TradingView

COAI Price Showing Bearish Divergence:

TradingView

This may lead to a brief correction before the uptrend resumes. And with MFI not rising during dips, the support levels halting a correction might not be as strong for ChainOpera (COAI).

Key Levels That Could Decide Next COAI Price Move

COAI currently trades near $23, right above its breakout zone. The next resistance levels sit at $26, $31, and $38. A daily close above $31 would confirm a continuation pattern, opening the COAI price target path to a retest of the previous all-time high near $45. If that level is breached, COAI could set a new record near $47, per the Fibonacci extension target projection.

COAI Price Analysis:

TradingView

COAI Price Analysis:

TradingView

However, if RSI weakness triggers a pullback, supports lie near $21 and $15. These levels will decide whether the breakout holds or fails. A rebound from them would suggest buyers still control the structure of this AI-focused token, but a fall below $15 would risk undoing the recent gains.

For now, COAI’s setup remains bullish: the triangle breakout is valid and buying activity is improving. Still, traders should stay alert — the momentum loss shown by RSI could pause the rally before another attempt at new highs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

Fed rate cut may pump stocks but Bitcoin options call sub-$100K in January

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.