Bitcoin’s Record Run Reverses After $19B Futures Wipeout and Cooling ETF Inflows

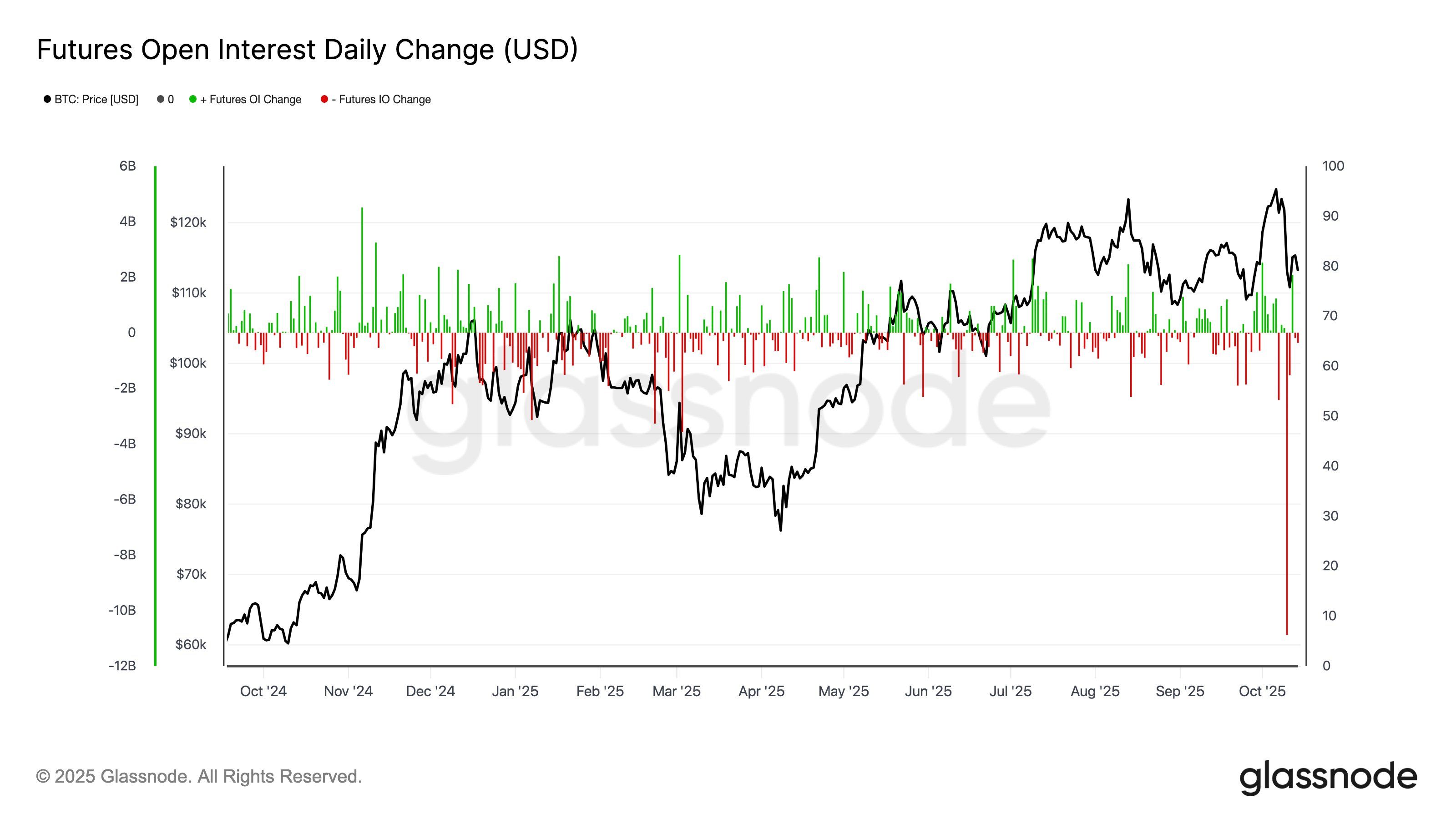

Bitcoin’s rapid surge to an all-time high of $126,100 has been abruptly reversed , following one of the largest futures deleveraging events in history and weakening ETF inflows that signal cooling institutional appetite.

Bitcoin’s Record Run Reverses. Source: Glassnode

Bitcoin’s Record Run Reverses. Source: Glassnode

Massive leverage flush hits bitcoin derivatives

According to Glassnode’s latest on-chain report, over $19 billion in futures open interest was wiped out amid intensifying macroeconomic concerns, including renewed U.S.–China tariff tensions. The crash sent Bitcoin tumbling below the $117,000–$114,000 cost-basis zone.

The Estimated Leverage Ratio collapsed to multi-month lows as traders rapidly unwound positions, echoing the 2021 and 2022 market flushes. Funding rates also plunged to FTX-era lows, showing traders were paying to stay short after bullish leverage evaporated. Analysts described the event as a structural reset rather than a full capitulation — a necessary purge of excess leverage that could restore long-term stability.

Spot trading volumes surged during the drawdown, with Binance leading the sell pressure while Coinbase saw institutional buying, suggesting U.S.-based investors absorbed some of the shock. Despite heightened volatility, Glassnode noted the sell-off was “sharp but orderly,” underscoring that the market remains cautious but not in panic.

Institutional demand weakens as volatility returns

While derivatives markets faced a historic purge, ETF inflows turned negative by 2,300 BTC, marking a decline in institutional demand that had previously fueled Bitcoin’s record highs. Long-Term Holders (LTHs) have also continued to distribute since July, adding steady sell-side pressure as the market enters a consolidation phase.

Meanwhile, Bitcoin options markets saw open interest rebound swiftly, even as volatility spiked to 76% and short-term skew flipped sharply positive — signaling traders’ rush to hedge downside risks.

Bitcoin now sits in a fragile recovery zone, with analysts warning that a drop below $108,000 could deepen the correction unless renewed ETF inflows and on-chain accumulation restore momentum.

Still, beneath the turbulence, confidence among corporates remain strong — the number of publicly traded companies holding Bitcoin rose 38% between July and September, signaling that institutional conviction, while cooling short term, remains structurally intact.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!