Current mainstream CEX and DEX funding rates indicate the market is turning increasingly bearish.

BlockBeats News, October 17, according to Coinglass data, the current funding rates on major CEX and DEX platforms show that after further declines last night, the bearish trend in the market has intensified, and the number of trading pairs with negative funding rates has continued to increase compared to yesterday. The specific funding rates are shown in the figure below.

BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the prices of underlying assets, usually applied to perpetual contracts. It is a capital exchange mechanism between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or profit of holding contracts for traders, so that the contract price remains close to the price of the underlying asset.

When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates a generally bullish market. When the funding rate is less than 0.005%, it indicates a generally bearish market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Typus Finance: Vulnerability fix completed, no liquidation risk during perpetual contract suspension

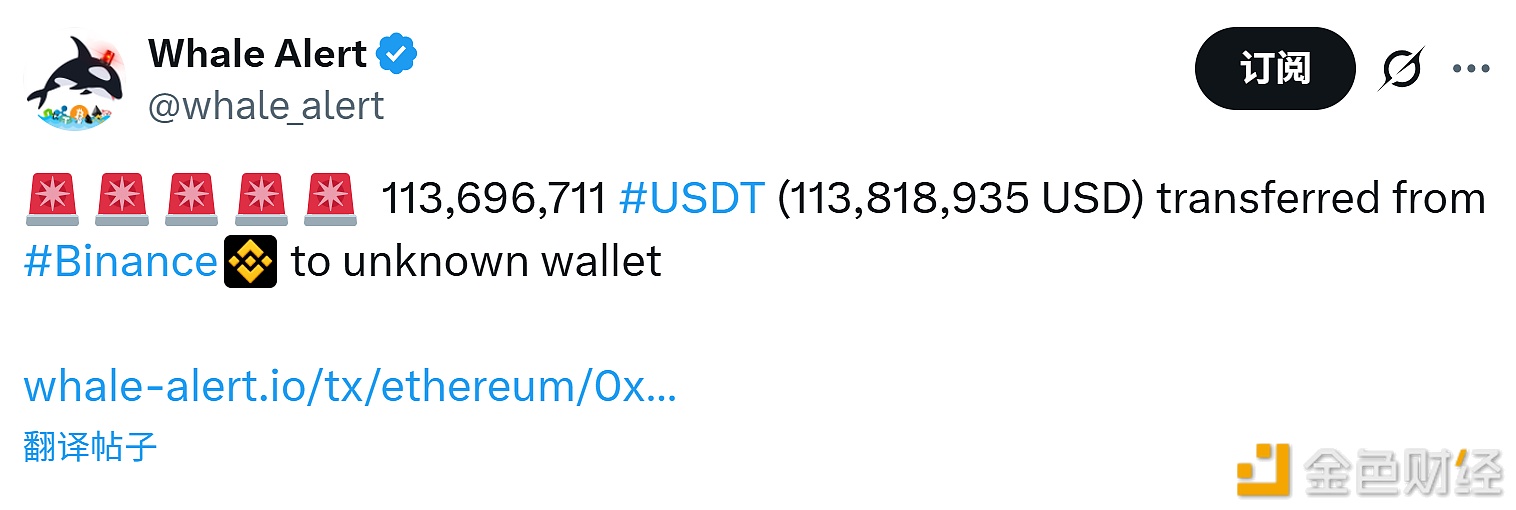

113,696,711 USDT transferred out from a certain exchange

Data: Machi's ETH long position is less than $25 away from liquidation