Hyperliquid Leads $1.4 Billion Token Buyback Wave Sweeping Crypto in 2025

Token buybacks have exploded in 2025, surpassing $1.4 billion as protocols like Hyperliquid, LayerZero, and Pump.fun lead the charge. The trend reflects growing profitability and a shift toward sustainable, value-driven tokenomics.

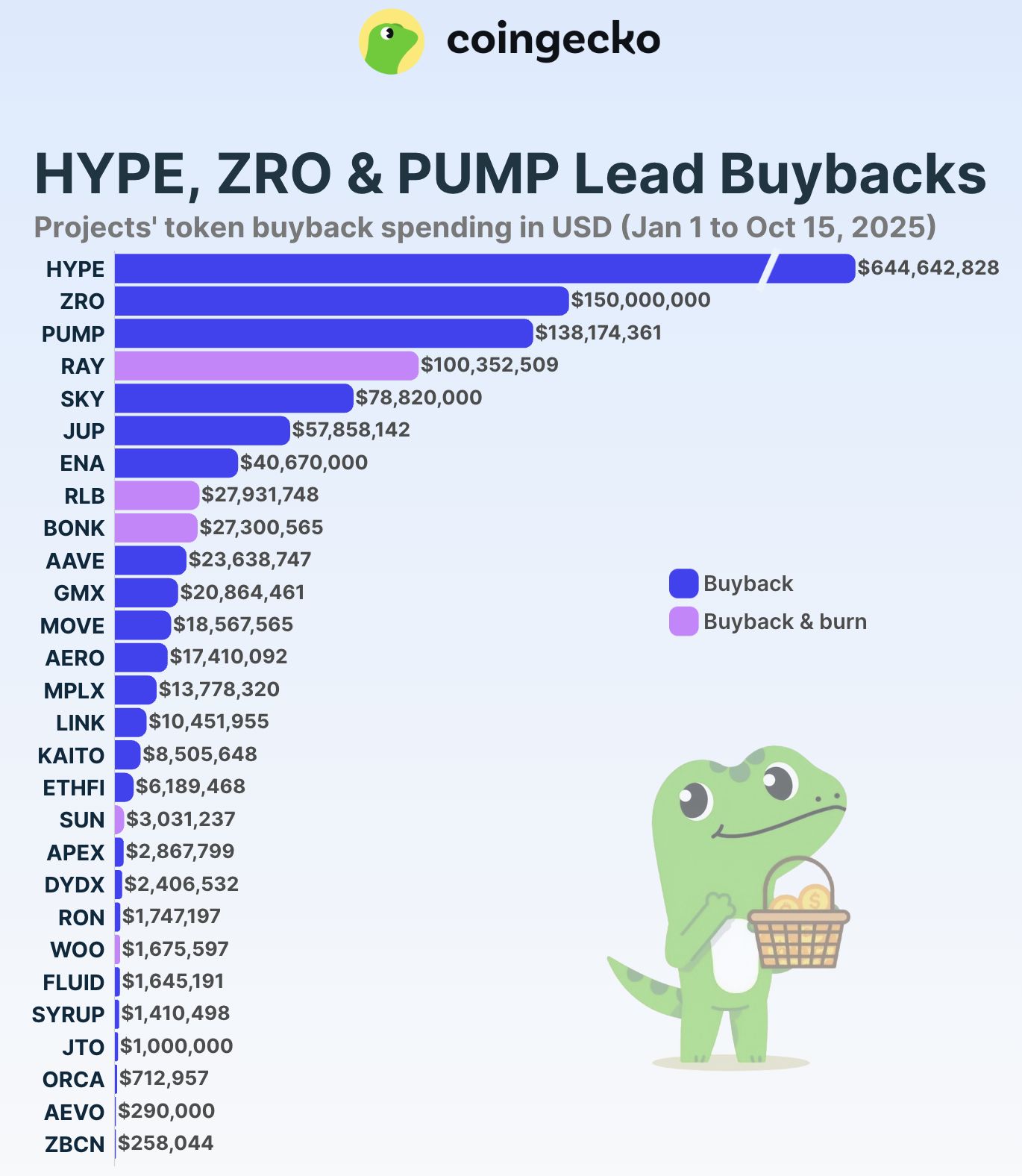

Cryptocurrency projects have poured over $1.4 billion toward token buybacks in 2025, with just 10 projects capturing 92% of the total expenditure.

Hyperliquid, a decentralized perp exchange protocol, led the market with roughly $645 million committed. That represented nearly half of all token buyback activity recorded across the crypto market this year.

Token Buybacks Accelerate In 2025

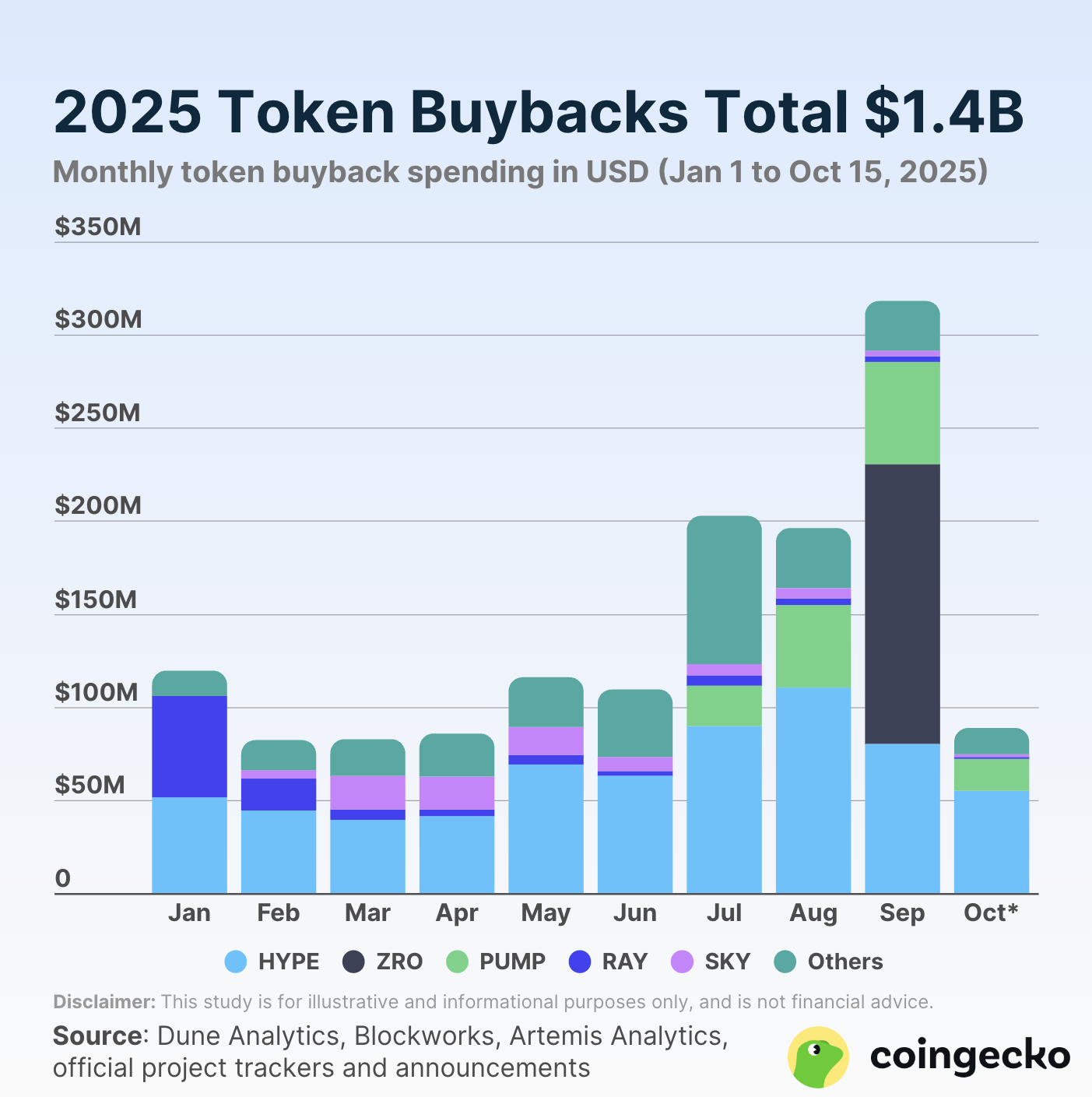

According to the latest report by CoinGecko, 28 cryptocurrency projects devoted substantial resources to token buybacks this year. The pace picked up in the second half of 2025, with buyback spending surging by 85% month over month in July.

“Although a jump in token buyback spending was attributed to September, this was due to the one-off LayerZero repurchase announcement, which did not specify when it was carried out. Excluding the ZRO buyback, September only saw $168.45 million in token buyback spending,” CoinGecko’s research analyst Yuqian Lim noted.

By mid-October, buyback spending had already reached $88.81 million. This suggests the market is on track for a fourth straight month exceeding the first-half monthly average of $99.32 million.

On average, around $145.93 million has been spent each month, signaling growing enthusiasm for the mechanism across the sector.

Token Buyback Spending. Source:

CoinGecko

Token Buyback Spending. Source:

CoinGecko

Hyperliquid Dominates Token Buybacks This Year

Hyperliquid stands out as the undisputed leader in token repurchases this year. The project has spent more than $644.64 million in revenue through its Assistance Fund. This amount equals the combined total of the next nine largest projects.

Furthermore, the protocol accounted for 46% of all token buyback activity in 2025. So far, the network has bought back 21.36 million HYPE tokens, representing 2.1% of the total supply.

According to earlier OAK Research estimates, Hyperliquid’s model has the potential to repurchase up to 13% of its total supply each year.

LayerZero followed Hyperliquid with a $150 million one-off buyback of ZRO tokens, acquiring 5% of its supply. Pump.fun invested $138 million in PUMP repurchases since July, covering 3% of supply.

“While this puts PUMP buyback spending on the lower end compared to HYPE so far, it is worth noting that Pump.fun has already bought back a higher 3.0% share of total supply,” Lim highlighted

Meanwhile, Raydium directed $100 million toward buybacks and burns of RAY tokens. Lastly, rounding out the top 10 list were Sky Protocol (SKY), Jupiter (JUP), Ethena (ENA), Rollbit (RLB), Bonk (BONK), and Aave (AAVE).

Top Protocols Leading Token Buybacks. Source: CoinGecko

Top Protocols Leading Token Buybacks. Source: CoinGecko

In terms of the share of supply retired, GMX outperformed with repurchases equating to 12.9% of its supply for $20.86 million, highlighting efficiency in smaller-scale efforts.

“Excluding buyback-and-burn programs, the 23 token buybacks examined here have repurchased on average 1.9% of their respective total supply. So far, 14 out of the 23 projects have only bought back less than 1.0% of total supply,” the report added.

Token Buybacks: What’s Driving the Surge?

Several forces fueled the 2025 buyback boom. According to DWF Labs, the surge stemmed from a convergence of profitability, governance maturity, and market psychology across the Web3 space.

“With an increasing number of projects achieving profitability, buybacks have become an essential strategy to reward long-term users, reduce circulating supply, and generate positive feedback loops that benefit both users and projects,” the report read.

As more decentralized protocols achieved sustainable revenue, they began channeling earnings into token repurchases to reinforce long-term value and community trust. DWF pointed out that mature DAO governance and disciplined treasury management—such as Aave’s structured “Aavenomics” buybacks—helped institutionalize these practices.

At the same time, investors gravitated toward scarcity-based token models following a volatile 2024. Meanwhile, automated on-chain systems from projects like Hyperliquid and Raydium turned buybacks into transparent, continuous mechanisms.

Together, these dynamics transformed buybacks into a hallmark of disciplined tokenomics and a defining trend in 2025’s decentralized economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trend Research: The "Blockchain Revolution" is underway, remaining bullish on Ethereum

In a scenario of extreme fear, where capital and sentiment have not yet fully recovered, ETH is still in a relatively good buying "strike zone."

Should You Still Believe in Crypto

No industry has always been right along the way, until it truly changes the world.

Gavin Wood: After EVM, JAM will become the new industry consensus!

You Should Also Believe in <strong>Crypto</strong>

No industry has ever been right all the way until it truly changed the world