Nearly $6 Billion in Bitcoin and Ethereum Options Expire Amid Bearish Market Sentiment

Bitcoin and Ethereum options markets flash warning signs as traders load up on downside protection, reflecting fragile confidence after renewed volatility, macro uncertainty, and the Selini Capital crisis.

Nearly $6 billion in Bitcoin and Ethereum options expire today, rattling the market as bearish bets surge. Traders prepare for further downside after recent losses, with puts dominating volume.

Large-scale expiries often shift short-term trends and signal stress among investors. Heightened uncertainty, both political and within crypto, intensifies the defensive mood across markets.

Massive Options Expiry Triggers Market Jitters

Bitcoin is trading around $108,969, hovering just above key support levels as derivatives traders continue to price in more downside risk.

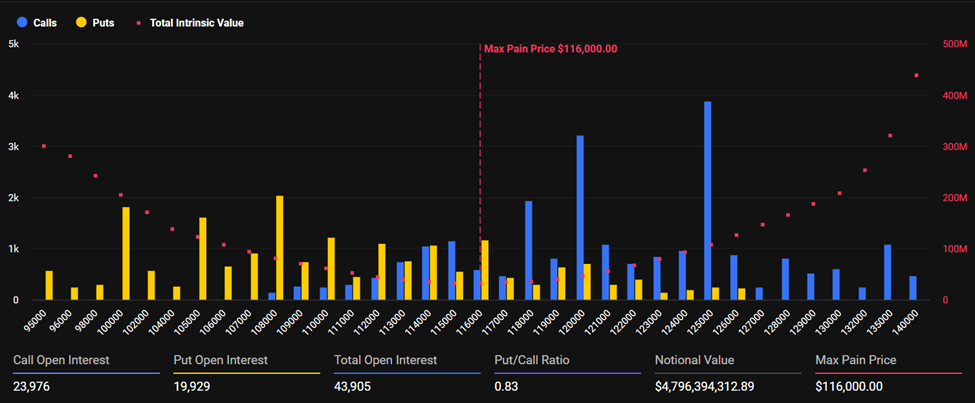

Data from Deribit shows a put-to-call ratio of 0.83, with a total open interest of 43,905 BTC and a notional value exceeding $4.79 billion.

The max pain point currently sits near $116,000. This is the strike level where most options would expire worthless. It suggests traders see limited short-term upside potential.

Bitcoin Expiring Options. Source:

Bitcoin Expiring Options. Source:

According to Greeks.Live, more than $1.15 billion has recently flowed into short-term out-of-the-money (OTM) puts. This accounts for roughly 28% of total options volume.

The options skew has turned sharply negative. It reflects the heaviest demand for downside protection since the market’s pullback on the 11th.

Bitcoin options–market data indicate that over the past 24 hours, the share of bearish trades has risen markedly. More than US$1.15 billion, or about 28 % of total options volume, has flowed into shallow out‑of‑the‑money (OTM) puts expiring this week and this month, with the… pic.twitter.com/6jXjERGaIz

— Greeks.live (@GreeksLive) October 16, 2025

Market makers and liquidity providers appear to be aggressively positioning for a retracement, signaling growing anxiety about broader market stability.

This shift in sentiment suggests hedging via puts is currently the most prudent strategy, especially given ongoing political and macroeconomic turbulence.

Fragile Sentiment and Macro Overhangs

Broader sentiment across crypto remains cautiously bearish, with traders eyeing $93,500 as a potential bottom and $100,000 as a short-term upside target should a bounce occur.

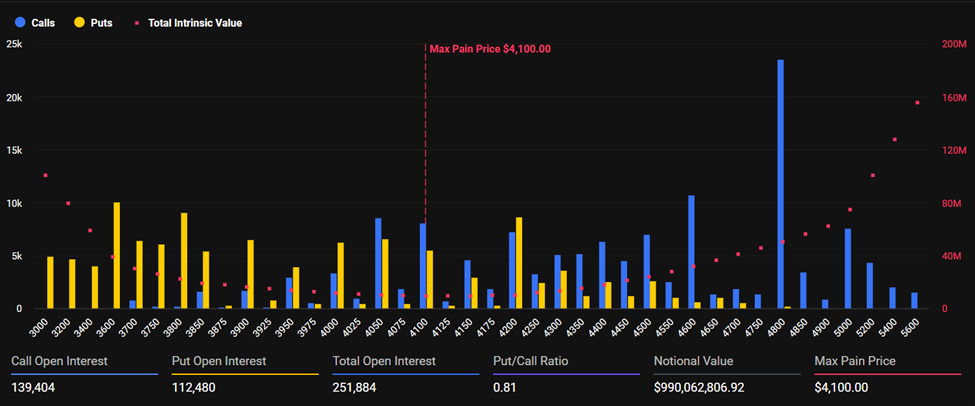

Ethereum, meanwhile, trades at $3,921, just below its max pain level of $4,100. Open interest is 251,884 ETH, and the put-to-call ratio is 0.81, reflecting similar defensive positioning.

Ethereum Expiring Options. Source:

Ethereum Expiring Options. Source:

Part of the unease stems from the Selini Capital crisis, which reportedly saw the fund lose $50 million through a failed basis trade unwind.

😬 Selini Capital Just Got HyperliquidatedSelini Capital reportedly took a $15–16M hit on @HyperliquidX after sub-account liquidations wiped them out during the market bloodbath. 🔹 Around $50–70M — ranking them the 12th biggest loser on the platform. Ouch.🔹 $BTC crashed… pic.twitter.com/LWNzQ5lpvA

— 0xkenyaz Ⓜ️Ⓜ️T (@0xkenyaz) October 13, 2025

The incident has weighed heavily on derivatives markets, with traders citing IBIT’s discount and the need for Selini to stabilize before any meaningful bullish catalyst can emerge.

At the same time, political volatility continues to inject uncertainty. Frustration exists over the Trump administration’s erratic remarks on tariffs and oil sanctions, which nuke markets with unpredictable swings.

https://t.co/n0OcjSHcin Community Daily Digest #daily=====Published: 2025-10-16Overall Market Sentiment=====The group is cautiously bearish with expectations of further downside, though some members see potential bounce opportunities near lower support levels. Key levels…

— Greeks.live (@GreeksLive) October 16, 2025

The combination of policy noise and leveraged distress is killing risk appetite across the board.

Despite the pressure, some participants are cautiously selling puts near perceived bottoms, a strategy in options trading that seeks to profit from potential rebounds.

However, Asian-session flows have remained notably bearish, with traders expecting continued selling.

Technical Tensions Mount

With skew deepening into negative territory across maturities and option flows dominated by downside hedges, the market narrative has turned defensive.

The put-to-call ratios reflect traders bracing for near-term volatility rather than long-term capitulation. Bitcoin’s battle lines fall around $93,500 as potential bottom support and $100,000 as a recovery threshold. The $116,000 level, however, presents as the pain point looming above.

Unless macro conditions improve or Selini’s crisis stabilizes, the bearish tilt in options markets suggests that crypto’s next major move could still unfold to the downside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When Tether Becomes More Valuable Than ByteDance: Who Is Paying for the Crypto World's "Money Printer"?

Tether’s pursuit of a $500 billion valuation has sparked controversy. Its high profits rely on the interest rate environment and stablecoin demand, but it faces challenges related to regulation, competition, and sustainability. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of the generated content are still in an iterative update phase.

French Banking Titan Launches Groundbreaking Stablecoin Tied to the Euro

In Brief ODDO BHF launches Euro-pegged stablecoin EUROD on Bit2Me for broad market access. EUROD aligns with E.U.'s MiCA framework, enhancing trust with bank support. EUROD aims to fill corporate demand and diversify currency in a dollar-dominated arena.

Top 3 Altcoins Set for Huge Gains — Buy Before the Next Rally

XRP Tests Critical $2.21 Level While Oversold RSI Suggests Possible Short-Term Reboun