Extreme Fear Grips Crypto: What a 22 Fear & Greed Score Tells About Bitcoin’s Next Move

The Crypto Fear & Greed Index dropped to “extreme fear” for the first time in six months, echoing past market bottoms. Analysts suggest Bitcoin’s stability could signal opportunity, though macro fears still cloud short-term sentiment.

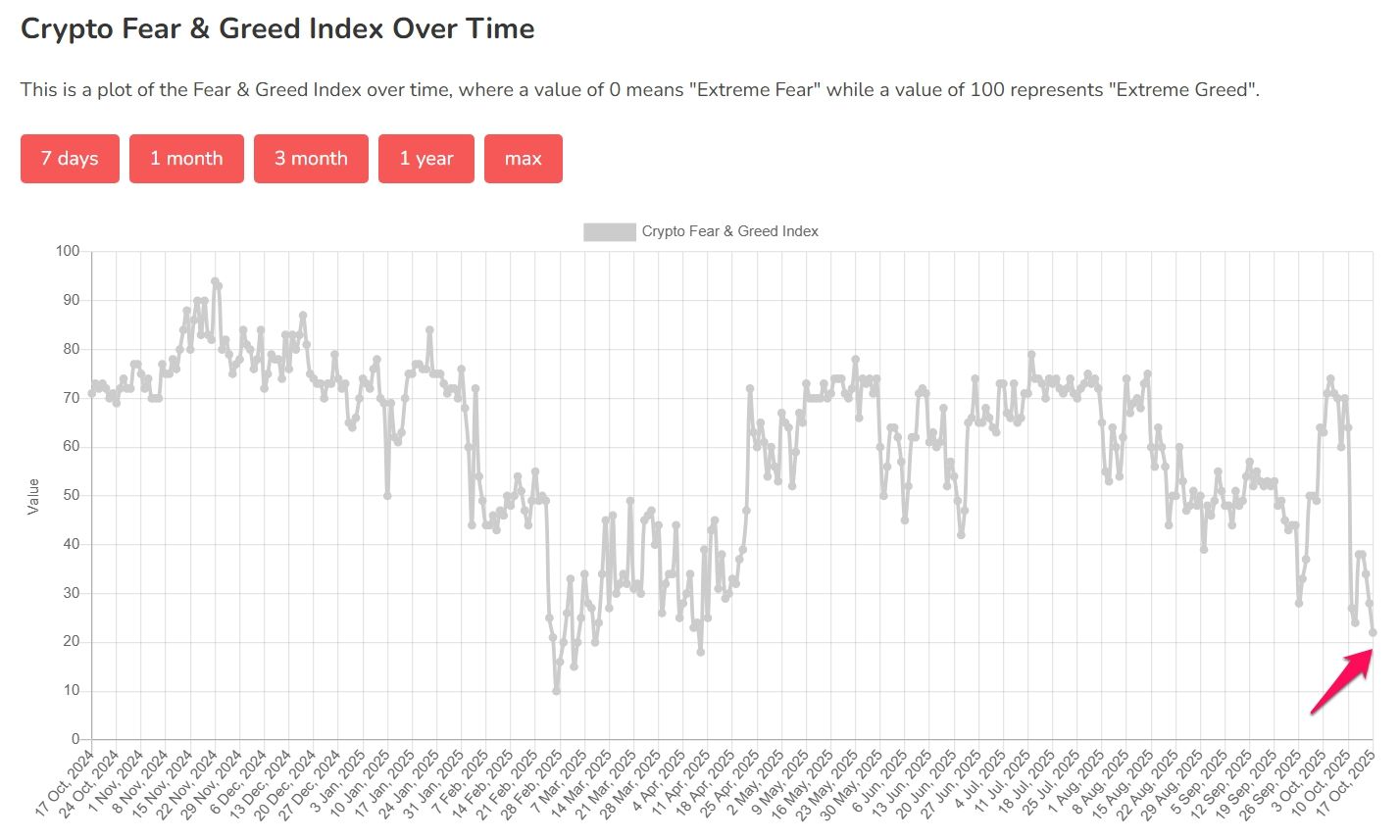

On October 17, 2025, the Crypto Fear & Greed Index plunged to 22 points, marking a state of “extreme fear” – the lowest level since April.

What could this mean for the market? Historical data and analysts’ insights offer clues to the answer.

Is October the Time to Be Greedy When Others Are Fearful?

The Fear & Greed Index is calculated based on several factors: price volatility (25%), market momentum/trading volume (25%), social media sentiment (15%), surveys (15%), Bitcoin dominance (10%), and Google Trends (10%).

A reading below 25 often signals excessive fear, creating buying opportunities. However, it also warns of the risk of further downside.

According to data from alternative.me, the index plunged from 71 (Greed) just a week earlier — a sharp shift in investor sentiment within days.

Crypto Fear & Greed Index. Source:

Crypto Fear & Greed Index. Source:

The last time the index dropped this low, in April, it coincided with a major market bottom. That period was followed by a strong rebound, during which Bitcoin surged more than 70% over the next six months.

Analyst Ted also noted that Bitcoin’s funding rate on Binance recently turned negative, meaning traders holding short positions now pay fees to those holding long positions.

Bitcoin Funding Rate on Binance. Source:

Bitcoin Funding Rate on Binance. Source:

Historically, this signal has often marked a market bottom, followed by a strong rally, a pattern seen in mid-2025.

An investor on X calculated that there were seven negative funding rates in the past two years, each followed by an average gain of 22% within 15 days.

“Historically, this has resulted in a market bottom and rally. Will it happen again?” Ted said.

But This October Feels Different

The current fear extends beyond crypto. It has spread into the broader stock market as well.

On October 17, Barchart reported that equities had also been struck by “extreme fear” for the first time in six months.

JUST IN 🚨: Extreme Fear hits the Stock Market for the first time in 6 months 👻😱🫂 Here we go!!!

— Barchart (@Barchart) October 16, 2025

This negative sentiment likely reflects broader macroeconomic worries, including geopolitical tensions resulting from President Trump’s trade policies toward China and recession and inflation fears tied to recent Federal Reserve rate decisions.

Despite the gloom, André Dragosch, PhD, Head of Research at Bitwise, expressed confidence in Bitcoin’s relative resilience:

“Remember we have already seen a significant capitulation in cryptoasset sentiment. It’s TradFi sentiment that’s doing the catch up to the downside here. That’s why Bitcoin will most likely stay relatively resilient during this turmoil. Bitcoin once again the canary in the macro coalmine,” André Dragosch said.

Historical trends and Dragosch’s comments highlight Bitcoin’s potential as a store of value during times of fear. This may suggest an opportunity for investors to build positions at attractive levels.

However, the strategy of being “greedy when others are fearful” can backfire if fear persists or deepens over time.

Despite hopes for “Uptober,” a month that historically brings strong returns for Bitcoin, analysts note that 2025 is shaping up to be Bitcoin’s fourth-worst year since its creation, with year-to-date gains of less than 19% so far.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Cysic Network (CYS)

Decoding 30 Years of Wall Street Experience: Asymmetric Opportunities in Horse Racing, Poker, and Bitcoin

A horse race, a poker book, and the wisdom of three legendary investors led me to discover the most underestimated betting opportunity of my career.

Fed cuts rates again: Internal divisions emerge as three dissenting votes mark a six-year high

This decision highlights the unusual divisions within the Federal Reserve, marking the first time since 2019 that there have been three dissenting votes.

Antalpha highlights strong alignment with industry leaders on the vision of a "Bitcoin-backed digital bank" at Bitcoin MENA 2025

Antalpha confirms its strategic direction, emphasizing the future of bitcoin as an underlying reserve asset.