Ethereum’s Price Falls Below $4,000 Again, But A Reversal Awaits

Ethereum’s slide under $4,000 has sparked renewed investor interest, with on-chain and technical indicators suggesting a recovery phase may soon begin.

Ethereum has slipped below the $4,000 mark for the first time this month, trading around $3,727 at press time.

The decline reflects the lack of broad market support that has affected most major cryptocurrencies. Still, investors appear to be stepping in, signaling potential for a recovery in the coming days.

Ethereum Investors Show Support

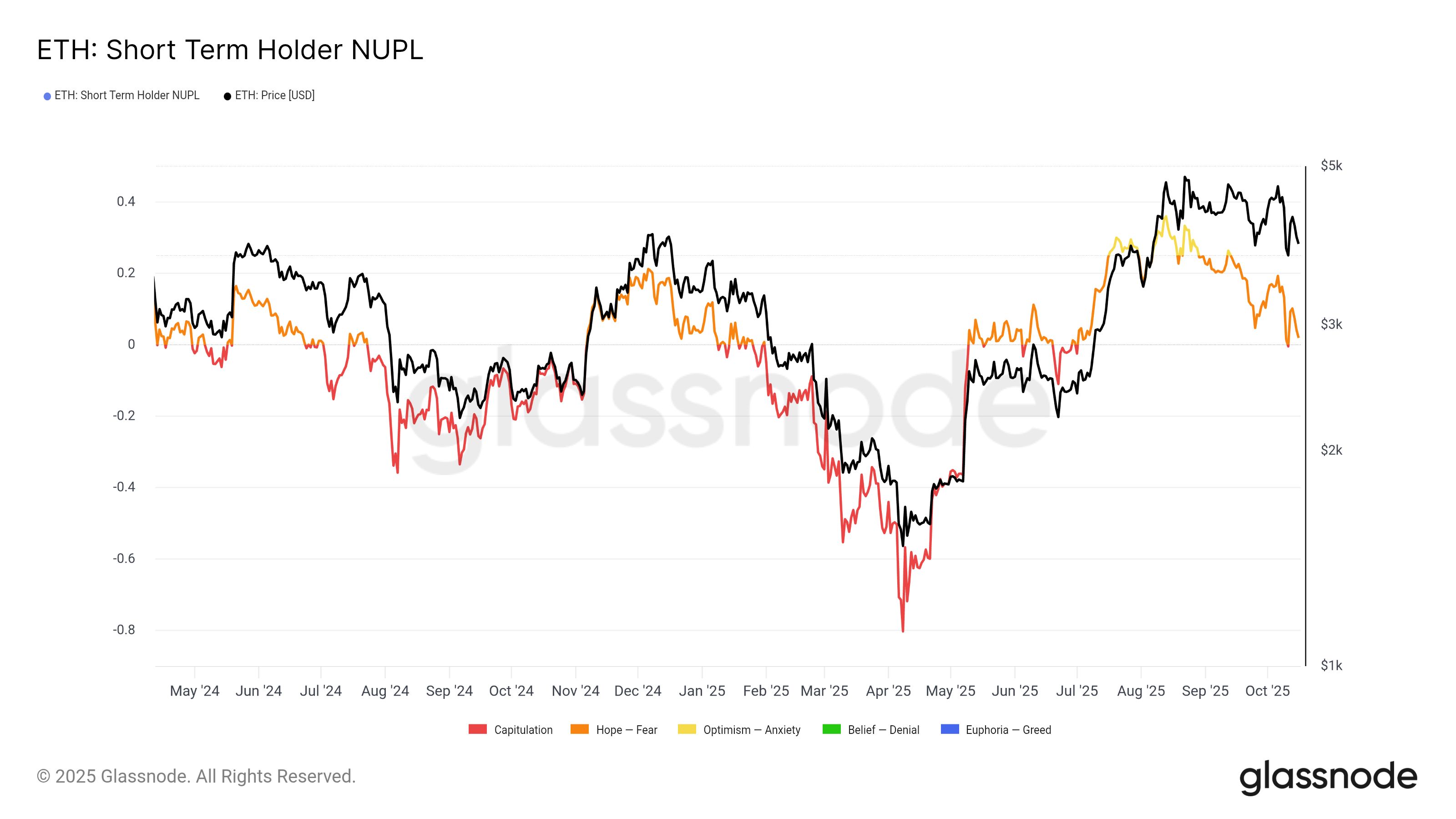

The short-term holder Net Unrealized Profit/Loss (STH-NUPL) ratio recently dipped into the capitulation zone, indicating that most short-term holders are now realizing losses. Historically, this phase often precedes a market rebound as selling pressure eases and new demand begins to build. Ethereum’s current position mirrors past cycles where such loss conditions triggered a price reversal.

Many speculative holders who entered during the recent rally are now facing losses, but this may not be entirely negative. These market conditions typically lead to renewed optimism as investors look to reaccumulate at lower levels. The same pattern could soon apply to Ethereum, with long-term holders reinforcing market confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Ethereum STH NUPL. Source:

Glassnode

Ethereum STH NUPL. Source:

Glassnode

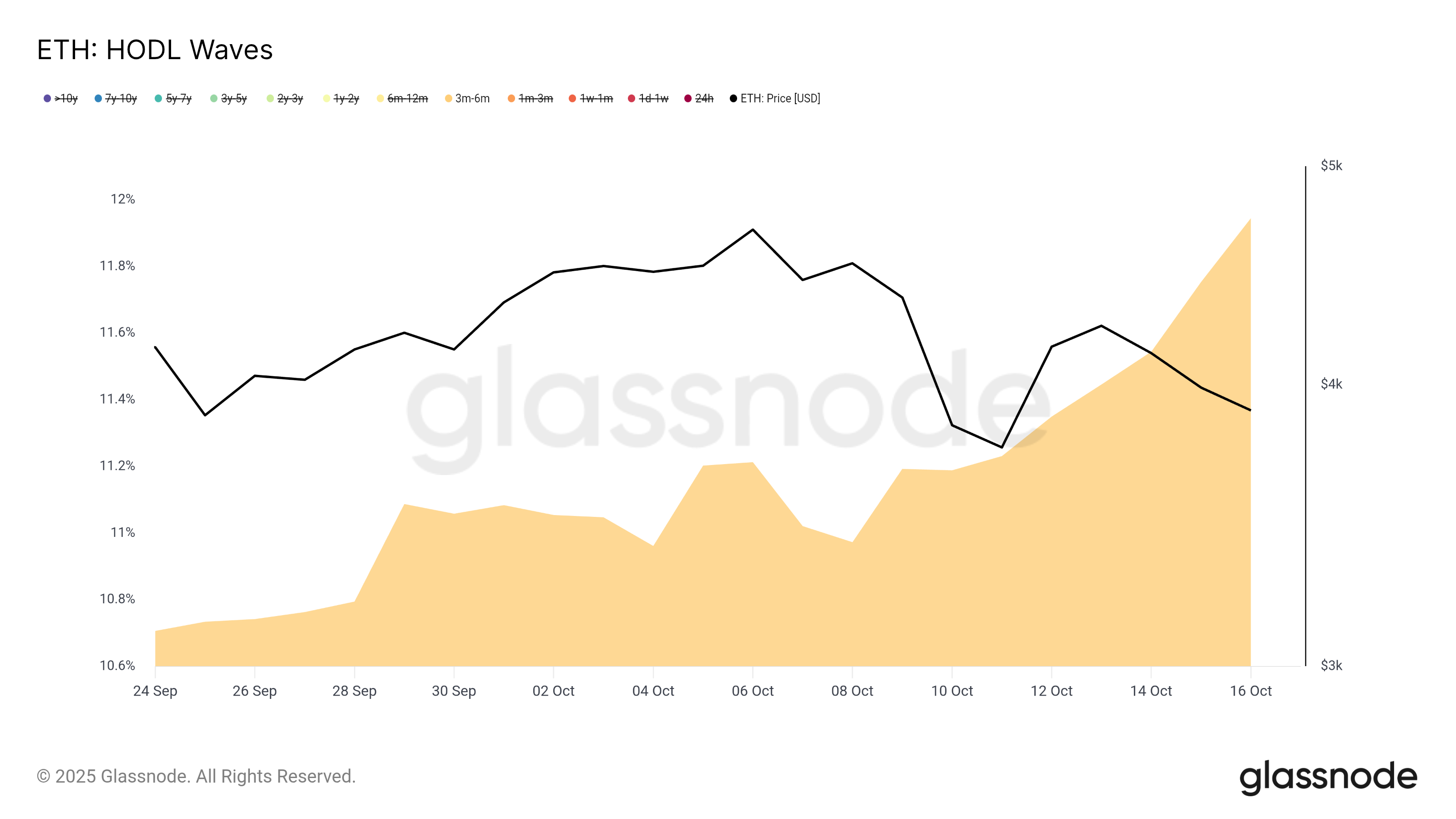

Despite the recent pullback, Ethereum’s on-chain data reflects resilience among holders. HODL waves show that the majority of investors are maintaining their positions rather than exiting. This suggests growing conviction that Ethereum remains on track for a medium-term recovery.

Interestingly, many short-term holders have transitioned into the 3–6 month holding bracket, which now controls 11.94% of the total ETH supply. Such accumulation typically supports market stability and can act as a base for upward movement.

Ethereum HODL Waves. Source:

Glassnode

Ethereum HODL Waves. Source:

Glassnode

ETH Price May Bounce Back

Ethereum’s price currently sits at $3,727, having fallen from $4,000 in the past 48 hours. However, technical indicators suggest that the altcoin may soon see a reversal, with investors preparing to defend key support levels.

If Ethereum bounces off the $3,742 support line, it could climb back toward $4,000. A successful breach of that barrier would likely push ETH higher, targeting the $4,221 level once again. This movement would align with historical recovery trends seen after periods of capitulation.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

Still, a failure by investors to sustain momentum could trigger a deeper correction. Should the market sentiment turn bearish, Ethereum may decline toward $3,489. A drop below this level would invalidate the short-term bullish outlook, delaying any potential rebound.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenSea plans $SEA token launch in Q1 2026 with 50% supply for users and 50% revenue for buybacks

Ethena’s ENA Price Stabilizes Near $0.43 as Market Eyes $1.30 Target

Solana Slides to $195 as RSI Steadies and Buyers Defend $189 Support Zone