Gold Breaking $5000 - What Does It Mean for Bitcoin?

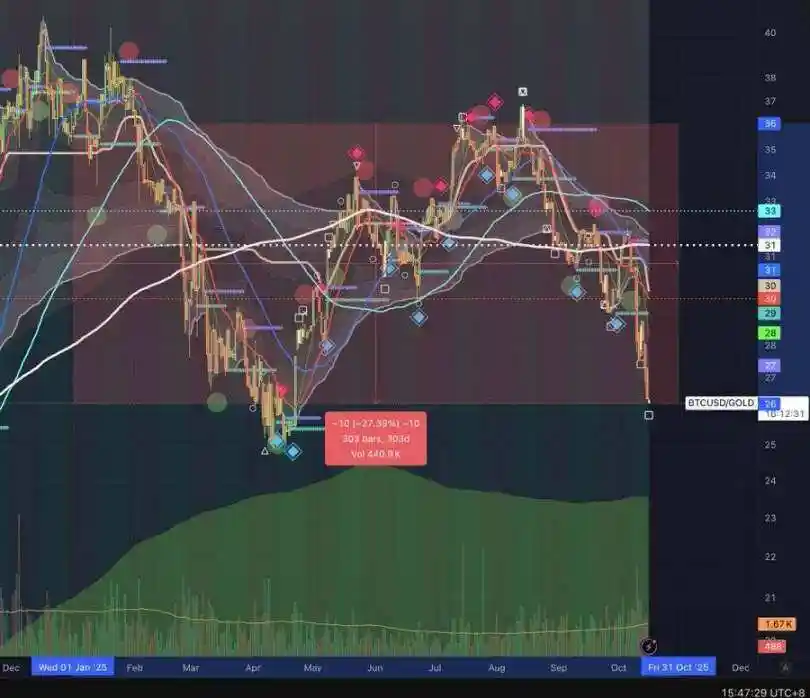

So far this year, the Bitcoin-to-Gold exchange rate has fallen by over 25%.

Original Article Title: Why gold is going to $5k

Original Article Author: Fishmarketacad, DeFi Researcher

Original Article Translation: Deep Tide TechFlow

Seeing the CT's attention on gold today, I have been following gold for a while, so I decided to share some quick thoughts (possibly wrong).

Why Does Gold Only Rise and Not Fall?

Since the 2020 era of unlimited quantitative easing (QE infinity) and fiat devaluation, I have been paying attention to precious metals as a non-market-correlated store of value.

The price of gold has already exceeded $4200, rising 25% in less than two months. Let's explore the reasons behind this phenomenon:

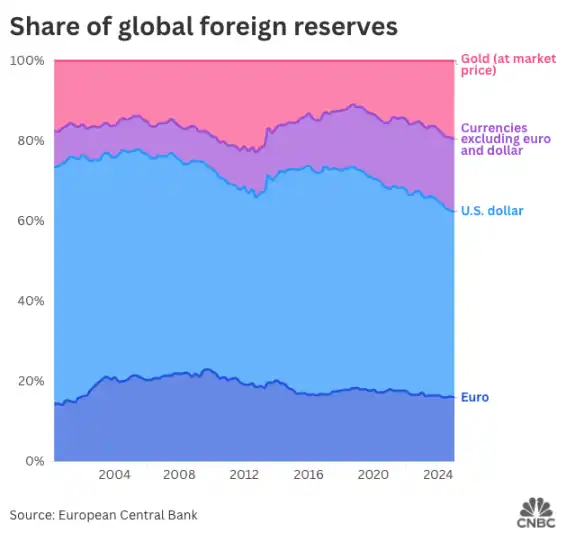

1. De-Dollarization / Central Bank Gold Buying

Central banks, especially China, are crazily buying gold. As far as I know, they are expected to purchase over 1000 tons of gold for the fourth consecutive year, and surveys show that they plan to continue buying.

Why? The U.S. national debt is expected to reach $37.5 trillion this year, with interest alone exceeding $1 trillion (tax revenue is about $4-5 trillion). There are only two ways to deal with such massive debt: default or devaluation, and the U.S. never needs to default because they can devalue the debt by printing more money.

2. Stablecoins as a Debt Socialization Tool

The U.S. devalues its debt through currency inflation, essentially printing more money to decrease the value of each dollar, thereby reducing the real value of the debt. This situation has been ongoing for decades, and you should be familiar with it.

The new twist is that if the U.S. shifts part of this debt to the crypto field, such as stablecoins, it could get very interesting because cryptocurrency is more easily accessible worldwide.

Stablecoins are increasingly backed by loans. Stablecoins pegged to the dollar, such as USDT and USDC, are currently mostly backed by U.S. treasuries. Originally purely 1:1 tools have gradually evolved to over 90% backed by U.S. treasuries.

Therefore, whenever people from other countries hold a stablecoin, they are indirectly buying U.S. debt. This process globalizes the U.S. 'inflation tax'. The more widely adopted the U.S. stablecoin is globally — a figure we know is in the trillions — the more the U.S. can export its debt and hand off its 'losses' to the world outside the U.S.

If this is indeed part of the plan, it ties back to the previously mentioned demand for de-dollarization, where gold as a safe store of value becomes crucial.

3. Physical Gold Shortage

Another key point is that this gold rally is not solely driven by paper gold or derivatives. If you're familiar with the potential short squeeze when open interest (OI) exceeds token liquidity in the perpetuals market, this is a similar idea.

In 2025, for example, the open interest in COMEX gold futures typically runs into hundreds of thousands of contracts (each representing 100 troy ounces of gold), whereas the total physical gold available for delivery is only a small fraction of this.

This means that the demand for physical gold at any point far exceeds the deliverable amount. This is also why the gold delivery time has extended from days to weeks. It indicates genuine physical demand (akin to spot demand), often not coming from short-term investors, thus forming a structural price floor.

4. Overall Uncertainty

Gold has once again affirmed its safe-haven status during uncertain times. Current factors such as U.S.-China competition, trade war concerns, domestic U.S. turmoil, Fed rate cuts, U.S. economy dependent on AI infrastructure support, economic uncertainties, etc., have led to global de-dollarization and investment in gold.

In my view, the main circumstances for gold to see a significant decline are when there is no need for a safe haven. The following conditions need to be met, but are not expected to happen in the short term:

· High employment rate: Poor U.S. economic prospects

· Funds flowing into risk assets: Stocks not being cheap (although not cheap right now)

· Political stability: U.S. needing to be friendly towards China

· Rising interest rates, i.e., increased cost of funds: Current situation is a complete opposite

Due to Trump's unpredictability, these conditions could also change rapidly (or at least the market perception around them), so caution is advised.

What Does This Mean for BTC?

Believe it or not, Bitcoin has fallen more than 25% against gold year-to-date.

I still believe that Bitcoin is not yet ready to become "digital gold." Although it shares many similarities with gold, it is gradually approaching gold each year (except for the unclear solution to the quantum computing issue).

However, if you try to buy gold, you will find that the premium for physical gold is very high, making it more suitable for buying and holding long term, which is not as fun. Therefore, I think retail investors may choose to buy Bitcoin instead of gold, but the purchasing power of retail investors is relatively lower compared to central banks.

Bitcoin is highly associated with U.S. politics today, which in turn hinders other central banks from buying Bitcoin to achieve their de-dollarization goals. As far as I know, U.S. miners now account for approximately 38% of Bitcoin's hashrate, and U.S. entities (ETFs, publicly traded companies, trusts, and the government) control about 15% of the total Bitcoin supply, with this percentage possibly increasing further.

So, I am uncertain about what will happen between Bitcoin and gold, but I believe that in the short term (until the end of this year), Bitcoin will continue to weaken against gold.

What Am I Doing?

Going long on Bitcoin dominance (BTC DOM): I believe de-dollarization has a larger impact on Bitcoin compared to other altcoins. With the recent "Black Friday" crash, it is evident that Bitcoin is the only asset with true order book liquidity and buying interest, and the Bitcoin dominance rate currently appears to be in an uptrend. If I see altcoins performing well, I may exit this trade, but usually, this is after Bitcoin hits a new all-time high, which should further boost Bitcoin dominance.

Going long on gold: Essentially, this involves buying paper gold, selling put options, or buying call options. However, the principle of "not your keys, not your coins" also applies here. I may just be holding a useless piece of paper, but I currently have no opinion on this.

Final Thoughts

In summary, I believe that due to the aforementioned structural changes, gold remains a solid choice. However, I would not be surprised by a short-term 20-30% pullback, which could be a good long-term buying opportunity, provided that the mentioned uncertainties have not dissipated.

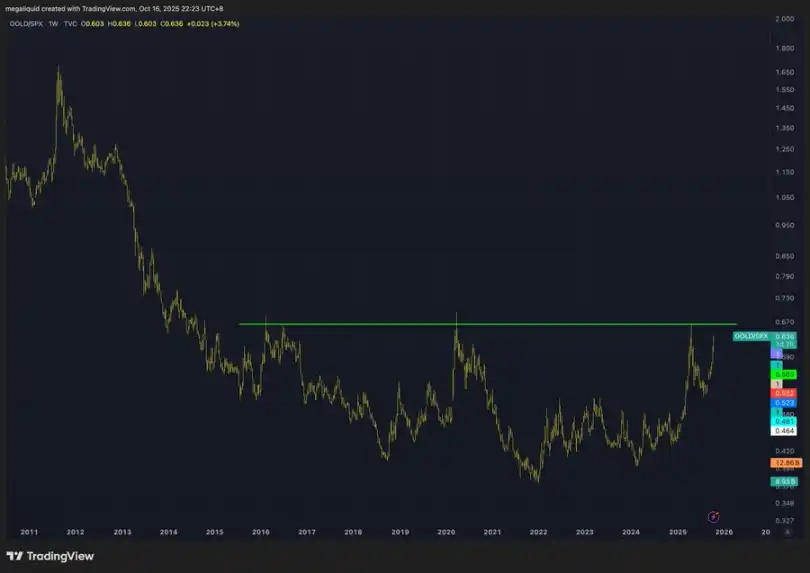

Additionally, gold is about to reach its resistance point relative to the S&P 500 index (SPX) and is approaching a market cap of $30 trillion. Therefore, these two factors could be potential local tops, and you may need to wait for a while before entering a FOMO state.

Finally, this is my another take on gold, as a quick conclusion, I still see gold having room to go up:

· If the US economy or global stability is uncertain, gold goes up

· If the US economy or global stability is more uncertain, gold goes up

· If the US economy or global stability is more stable, gold goes down

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum Eyes $5,000 as Whales Accumulate Amid Bitcoin Withdrawals and Broader Economic Challenges

- Ethereum (ETH) trades at $3,957, with technical indicators suggesting potential for a $5,000 rally if $3,750–$3,800 "triple bottom" support holds and $4,000 resistance breaks. - Whale accumulation and on-chain data hint at institutional buying, contrasting with $127M ETH ETF outflows versus Bitcoin's $20M inflows amid macroeconomic uncertainty. - Key risks include $3,700 support breakdown triggering $3,600 losses, while rising U.S. Treasury yields and Bitcoin dominance complicate ETH's short-term recover

"Time-Based Tokenomics Ignite 500% RIVER Rally, Transforming the Airdrop Landscape"

- RIVER token surged 500% to $10 after Binance listing and a time-encoded dynamic airdrop conversion model. - The 180-day conversion mechanism incentivizes long-term holding, with River Pts rising 40x and creating arbitrage opportunities. - Perpetual futures on major exchanges generated $100M+ daily volume, while 120,000+ addresses engaged in ecosystem campaigns. - Critics question sustainability as short-term incentives wane, though the model redefines tokenomics by encoding time into value formation. - R

Dogecoin News Today: DeFi Drives Institutional Adoption: Transforming Crypto Market Fluctuations Into Steady Earnings

- Dogecoin (DOGE) remains a passive income focus despite a 25% monthly price drop to $0.20, with community-driven initiatives like House of Doge acquiring an Italian soccer team to boost real-world utility. - XDC Network's $10M XDC Surge program targets DeFi growth by incentivizing liquidity provision on DEXes like Curve Finance, aiming to enhance trading efficiency and institutional readiness. - Crypto investors increasingly leverage BTC, SOL, and DOGE through staking/yield farming while balancing risks f

Bitcoin News Update: AWS Disruption Underscores Centralization Risks; Decentralization Efforts in Crypto Accelerate

- A 2025 AWS outage disrupted global services, exposing centralized cloud infrastructure risks as 4M users faced outages across finance, government, and aviation sectors. - Experts warned of systemic vulnerabilities in over-reliance on major cloud providers, while UK regulators questioned AWS's lack of critical infrastructure designation. - Zelle's stablecoin expansion aims to challenge traditional cross-border payments, with $1T+ annual transactions already processed through its network. - Bitcoin markets