Date: Fri, Oct 17, 2025 | 06:14 PM GMT

The cryptocurrency market remains in a state of choppiness as both Bitcoin (BTC) and Ethereum (ETH) record modest declines of around 2%. This ongoing weakness has spilled across the altcoin space, pushing total liquidations close to $1 billion in the past 24 hours — with $700 million coming from long positions.

Among the affected tokens, Cardano (ADA) has dropped around 3% today, but beneath the bearish momentum, a potential harmonic pattern on BTC’s daily chart is hinting at a rebound.

Source: Coinmarketcap

Source: Coinmarketcap

Bearish Gartley Pattern in Play?

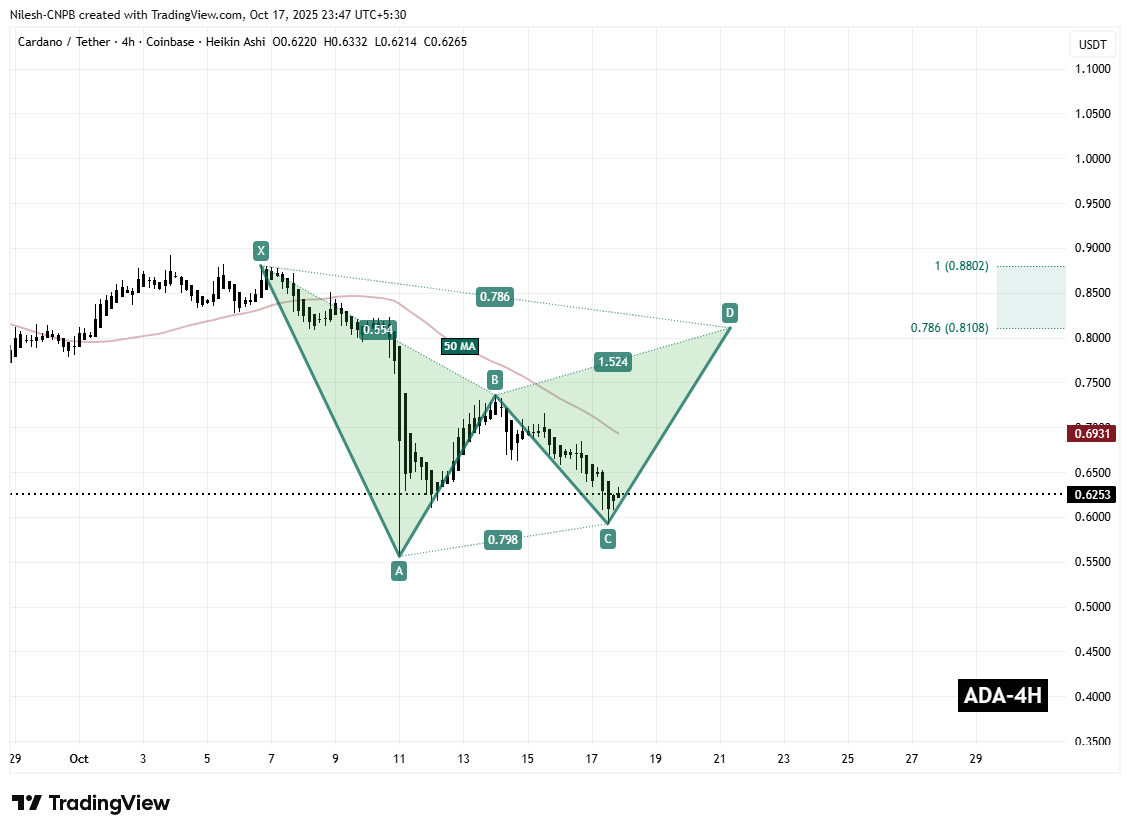

On the 4-hour chart, ADA appears to be appears to be forming a Bearish Gartley harmonic pattern. This formation is often known for marking reversal zones, where the final leg of the structure (point D) completes and price tends to reverse higher.

The formation began at Point X near $0.8802, followed by a sharp decline to Point A, a rebound toward Point B, and another pullback that brought prices lower to Point C near $0.5923. After hitting that level, ADA has shown early signs of stability, currently consolidating around $0.6253 as traders await confirmation of the next move.

Cardano (ADA) 4H Chart/Coinsprobe (Source: Tradingview)

Cardano (ADA) 4H Chart/Coinsprobe (Source: Tradingview)

Adding to the technical setup, ADA’s 50-hour moving average — now hovering around $0.6931 — is a crucial level to watch. A breakout and sustained hold above this MA could confirm a bullish shift, potentially turning it into a strong support base for the next rally.

What’s Next for ADA?

For this bullish setup to stay intact, Cardano must hold above the $0.5923 support (Point C) while attempting to reclaim the 50-hour MA. If successful, the harmonic structure projects a possible move toward the Potential Reversal Zone (PRZ) between $0.8108 and $0.8802 — aligning with the 0.786 to 1.0 Fibonacci retracement levels.

This target range represents a potential 40% upside from current levels, suggesting that ADA could be setting up for a meaningful rebound if the market stabilizes.

However, traders should remain cautious. The pattern is still in its developing phase, and any decisive drop below Point C could invalidate the setup and extend downside pressure before a stronger base forms.