Cardano Is In The “Opportunity Zone” And Investors Are Cashing In

Cardano’s price enters a key accumulation phase as its MVRV ratio signals an opportunity zone. Rising inflows and investor demand could push ADA past $0.661 toward recovery.

Cardano (ADA) continues to struggle with bearish pressure after multiple failed recovery attempts. However, the recent decline appears to have opened a window of opportunity for investors.

As ADA’s price enters a key accumulation range, buyers are showing renewed interest, potentially setting the stage for a rebound.

Cardano Finds Opportunity

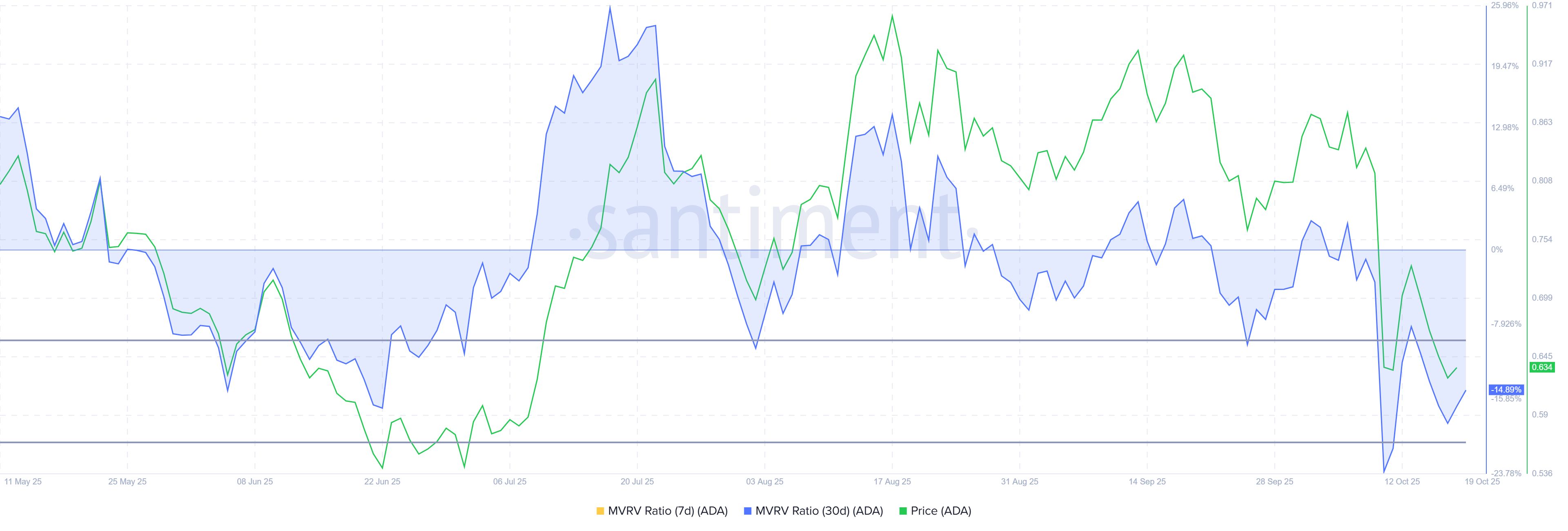

The Market Value to Realized Value (MVRV) ratio shows that Cardano is currently sitting in the opportunity zone. With values ranging between -9% and -19%, this indicator reflects that most ADA holders are experiencing unrealized losses.

Historically, this range often marks a local market bottom where selling typically slows and accumulation begins.

Such a development could be the first sign of a shift in market sentiment. As holders stop selling and investors begin buying at lower prices, the resulting demand could provide ADA with the fuel it needs to stabilize.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Cardano MVRV Ratio. Source:

Cardano MVRV Ratio. Source:

Cardano MVRV Ratio. Source:

Cardano MVRV Ratio. Source:

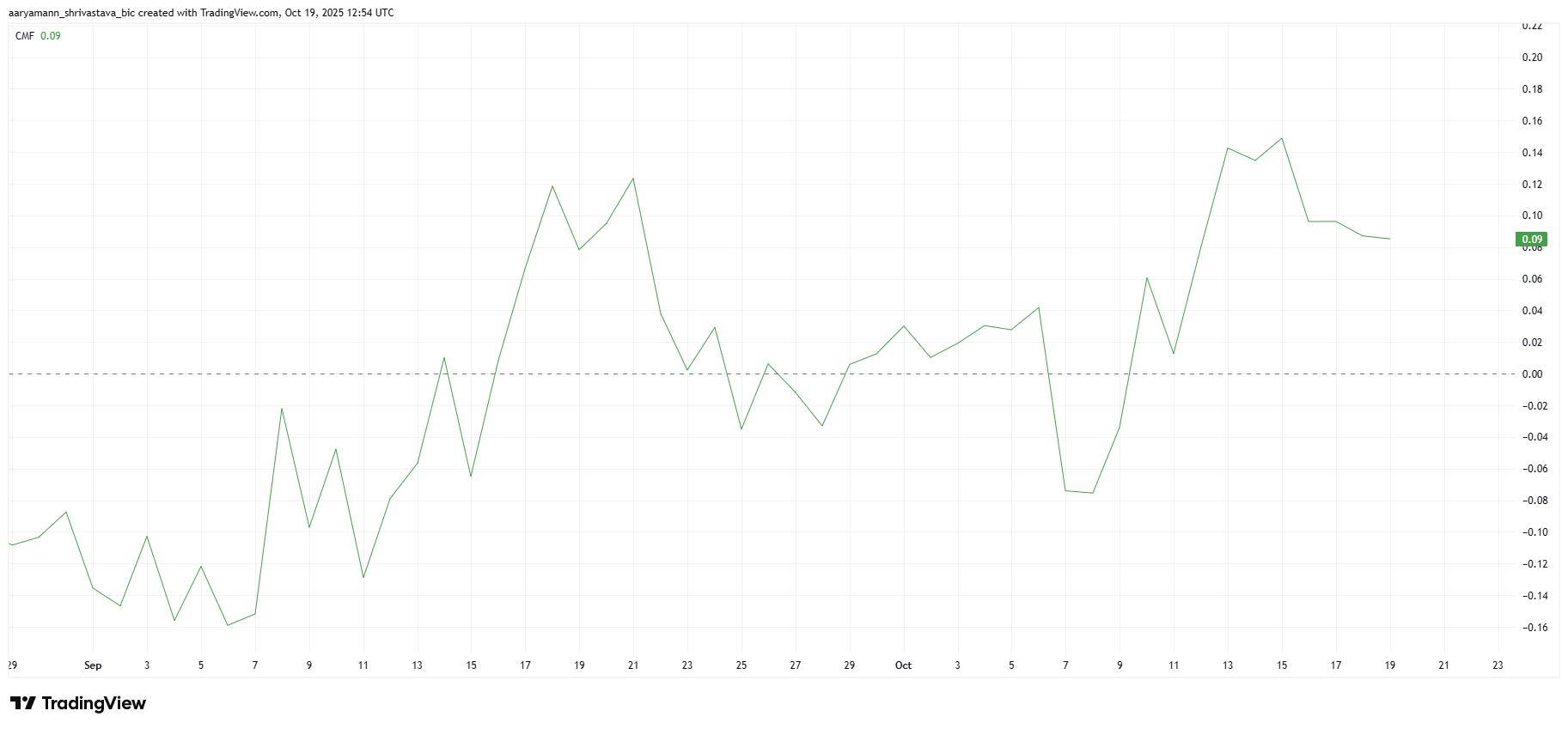

The Chaikin Money Flow (CMF) indicator reinforces this potential turnaround. Data shows that Cardano has recorded consistent inflows over the last several days, signaling a return of investor confidence.

The CMF is currently positioned in the positive zone above the zero line, confirming active capital movement into ADA.

Sustained inflows often precede price recoveries, particularly when coupled with reduced selling pressure. If this trend continues, Cardano could gradually regain momentum in the short term.

Cardano CMF. Source:

Cardano CMF. Source:

Cardano CMF. Source:

Cardano CMF. Source:

ADA Price Can Bounce Back

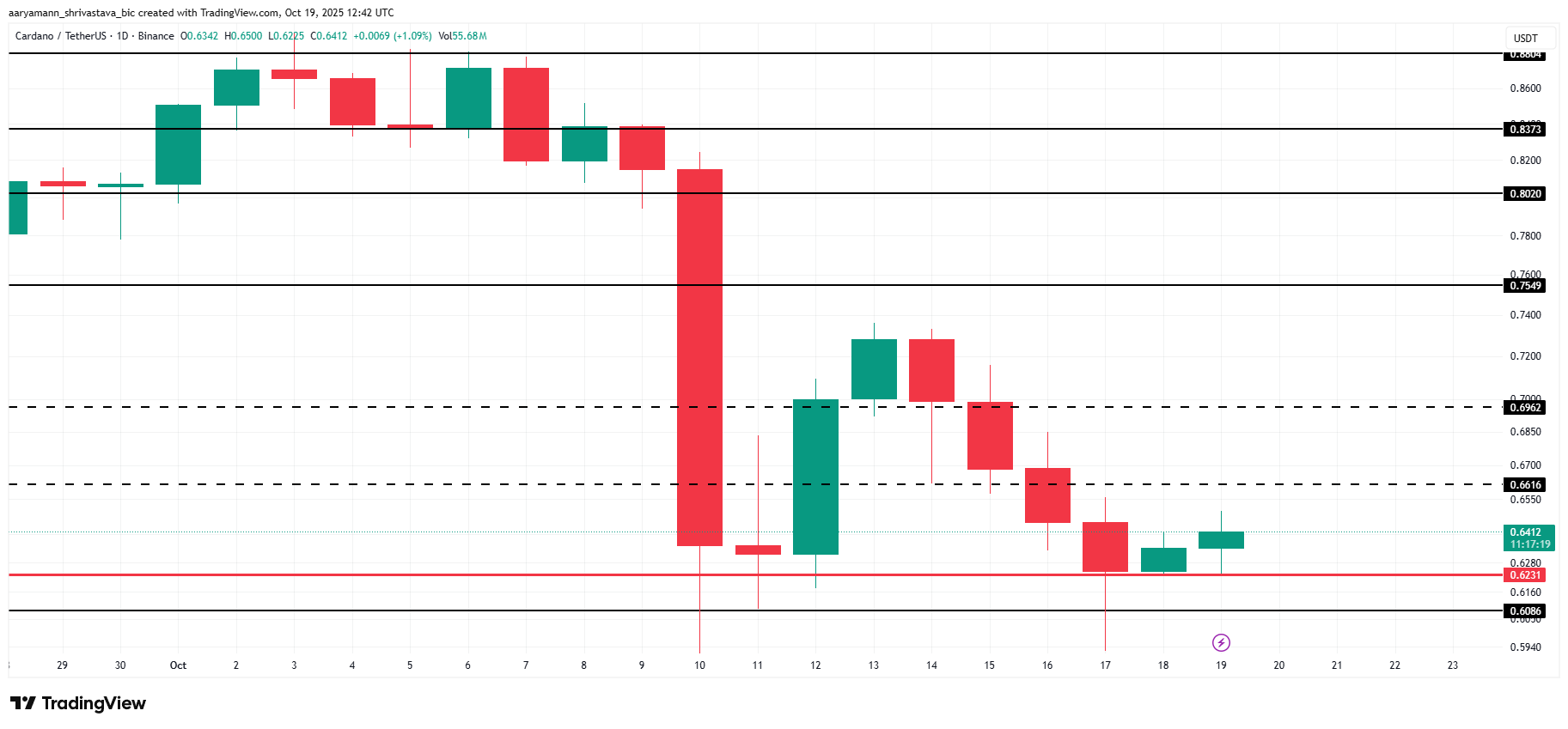

At the time of writing, Cardano’s price stands at $0.641, holding above the $0.623 support. The altcoin remains under the $0.661 resistance, where repeated rejections have hindered its upward progress over the past week.

If current conditions persist, ADA could breach $0.661 and aim for $0.696. However, for Cardano to mark a true recovery, it must reach and sustain levels above $0.754. Such a move would confirm renewed market strength and investor optimism.

Cardano Price Analysis. Source:

Cardano Price Analysis. Source:

Cardano Price Analysis. Source:

Cardano Price Analysis. Source:

Conversely, if ADA faces renewed selling, the price could drop below $0.623 and test $0.608. A failure to hold these supports would invalidate the bullish outlook and potentially trigger further downside pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin FOMO trickles back at $94K, but Fed could spoil the party

Beyond Cryptocurrency: How Tokenized Assets Are Quietly Reshaping Market Dynamics

Tokenization is rapidly becoming a key driving force in the evolution of financial infrastructure, with an impact that may go beyond short-term fluctuations, reaching the deeper logic of market structure, liquidity, and global capital flows.

On the eve of the interest rate decision, hawkish rate cuts loom, putting the liquidity gate and the crypto market to the year-end test

A divided Federal Reserve and a possible "hawkish" rate cut.

Gensyn launches two initiatives: a quick look at the AI token public sale and the model prediction market Delphi

Gensyn has launched its public sale with a valuation cap of 1 billion USD, offering the same entry price as a16z for AI computing infrastructure.