Institutions Stay Optimistic, But Bitcoin’s Bull Run May Be Nearing Its Peak

Despite a $19B leverage flush, a Coinbase report shows most investors are optimistic on Bitcoin's near-term. Institutions, however, are wary of a "late-stage bull market."

A majority of institutional and non-institutional investors maintain an optimistic outlook on Bitcoin for the next three to six months. This finding comes from a joint report released Monday by Coinbase and the on-chain data platform Glassnode.

The report indicates a “cautiously optimistic stance” for the cryptocurrency market in the fourth quarter of 2025.

Near-Term Gains, But an End in Sight?

The report identifies several tailwinds supporting a Bitcoin upswing. These include robust global liquidity, a strong macroeconomic background, and favorable regulatory dynamics.

However, the authors temper this optimism by pointing to the need for a cautious market approach. This caution follows the massive $19 billion leverage flush event on October 10.

A key investor focus, the US Federal Reserve’s interest rate policy, is expected to see two further rate cuts this year. Coinbase projects that these two cuts could attract approximately $7 trillion currently held in Money Market Funds (MMFs) back into risk-on assets.

Charting Crypto Q4 Navigating Uncertainty. Source: Coinbase

Charting Crypto Q4 Navigating Uncertainty. Source: Coinbase

Liquidity Squeeze Ahead

On the liquidity front, the global M2 money supply index, a key measure of worldwide liquidity, showed positive signals at the start of the quarter. However, the situation has since shifted.

The report warns that a liquidity contraction is expected in early November. This is due to the combined effects of the US government shutdown and the Federal Reserve’s Quantitative Tightening (QT).

Beware the Macroeconomic Headwinds

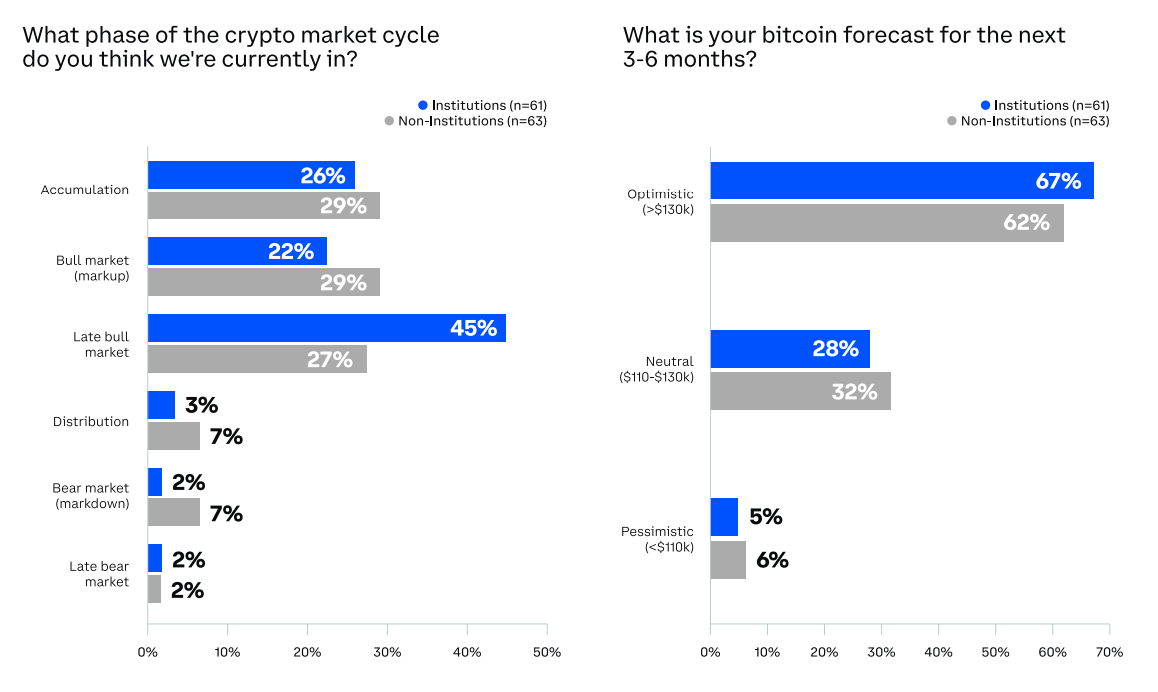

The report cites a survey of 120 global investors, revealing that 67% of institutional investors and 62% of non-institutional investors are optimistic about Bitcoin’s prospects over the next 3 to 6 months.

However, a clear difference emerges regarding the cycle’s sustainability. Nearly half (45%) of institutional investors believe the market is in the “late-stage bull.” This is signaling an expectation that the growth cycle will soon conclude. In contrast, only 27% of non-institutional investors share this view.

When asked about the primary “Tail Risk” for the crypto market in the near term, both institutional (38%) and non-institutional (29%) respondents cited the macroeconomic environment. This indicates a shared concern among different investor groups.

On the other hand, it is also important to note that this survey was conducted between September 17 and October 3, before the October 10 crash.

Analysts Stand By Lofty Year-End Forecasts

The “Uptober” rally that many investors anticipated appears to be faltering amid the sudden escalation of US-China tensions. Consequently, year-end Bitcoin price forecasts from major financial institutions are under intense scrutiny.

In early October, Citigroup projected a year-end Bitcoin price of approximately $133,000, conditional on continued ETF inflows and increased demand from DAT firms. Standard Chartered offered an even higher forecast, predicting Bitcoin could hit $200,000 if weekly ETF inflows maintain the $500 million level.

Similarly, JPMorgan projected a year-end price of $165,000, arguing that Bitcoin was undervalued relative to gold. Goldman Sachs also looked to gold for a reference point, suggesting that if gold were to reach $5,000 per ounce, Bitcoin could potentially surge to $220,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K

Fed rate cut may pump stocks but Bitcoin options call sub-$100K in January

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.