What to Expect in the Crypto Market This Week?

The crypto market is walking into one of the most data-heavy and sentiment-driven weeks of October. Bitcoin, Ethereum, and XRP are all showing early signs of stabilization after a sharp sell-off, but macroeconomic forces—especially the delayed U.S. inflation report and a flood of corporate earnings—could dictate whether this bounce has legs or fizzles out.

How Macroeconomic Tensions Are Shaping Crypto Market

This week’s spotlight isn’t just on digital assets—it’s on the broader economic pulse. A delayed U.S. Consumer Price Index (CPI) report f or September could determine whether the Federal Reserve continues rate cuts or pauses to combat sticky inflation. With markets already pricing in dovish expectations, any upside surprise in inflation could crush risk appetite across crypto and equities alike.

Simultaneously, investors are watching Tesla, Intel, and major automakers’ earnings for insight into AI, EV adoption, and supply chain resilience. If these reports surprise to the upside, they could rekindle broader tech optimism, indirectly supporting crypto’s speculative appeal.

Bitcoin and Ethereum are reacting to macro liquidity cues, not just internal market momentum. The week’s direction hinges on how inflation data and Fed commentary reshape risk sentiment.

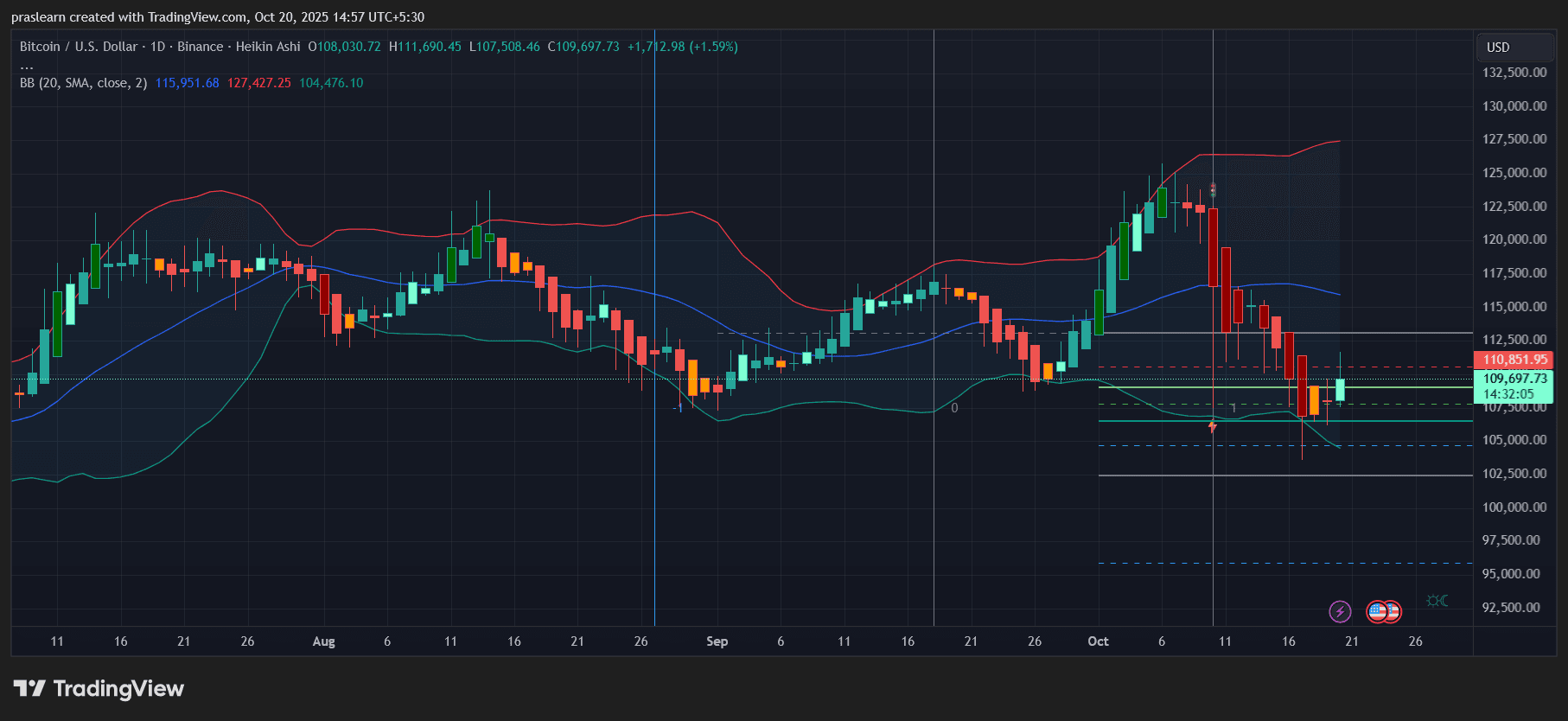

Bitcoin (BTC): A Battle Between Fear and FOMO Around $110,000

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Bitcoin’s daily chart shows a short-term bounce from $107,500 after an intense correction from its $122,000 peak. The candles have shifted to mild bullish Heikin Ashi prints, hinting at slowing bearish pressure. The price is now testing resistance near the mid-Bollinger Band around $110,850, which coincides with the 20-day SMA—a classic pivot zone between recovery and renewed selling.

If BTC manages to close above $111,000, the next test lies near $115,500. A breakout above that could ignite momentum toward $120,000 again. But a rejection here may push BTC back to the $105,000–$107,000 support band.

Volume analysis suggests that buyers are returning cautiously, but sentiment remains fragile. With CPI data approaching, Bitcoin’s volatility could spike. A softer inflation print could reaccelerate BTC toward $120,000 , but a hot CPI number would likely drag it back below $108,000.

$BTC likely trades between $107,000 and $115,000 this week, with CPI deciding the breakout direction.

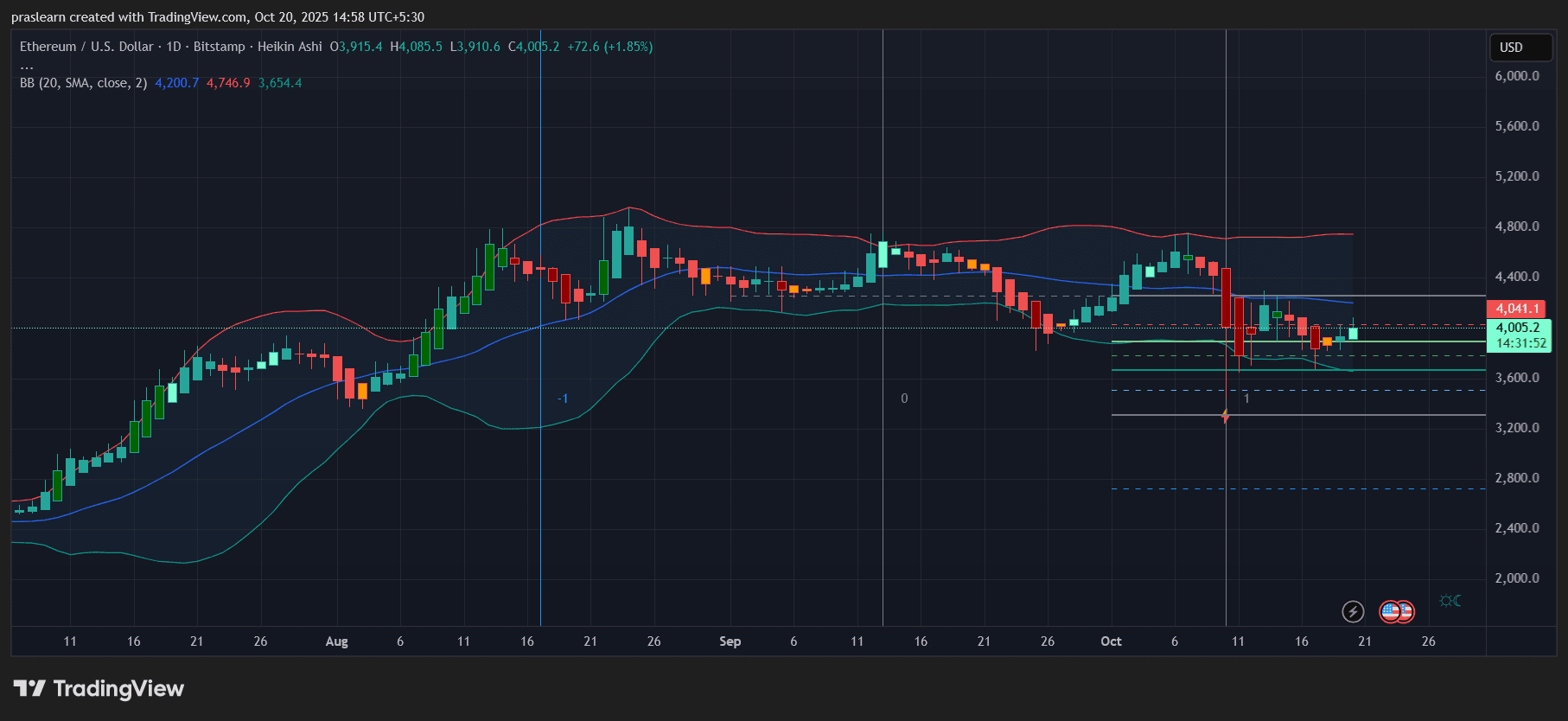

Ethereum (ETH): Trying to Reclaim Its Momentum Above $4,000

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

Ethereum’s chart reflects similar dynamics. After bottoming near $3,650, ETH has crawled back toward $4,005, forming early signs of reversal candles. The Bollinger Bands are tightening—a precursor to a volatility expansion. The mid-band near $4,200 is the immediate resistance; reclaiming it could push ETH toward $4,400 .

However, ETH’s structure still leans cautious. The lower band near $3,650 remains critical support. A failure to defend it could reopen downside targets toward $3,300.

ETH’s price action this week will mirror Bitcoin’s macro response but may also benefit from renewed AI and tech optimism following earnings from Intel and Nvidia-linked commentary. If Tesla and Intel deliver bullish AI narratives, ETH’s correlation with tech could drive additional speculative inflows. $ETH could see a breakout toward $4,400 if Bitcoin holds above $111,000. Otherwise, it risks revisiting $3,650.

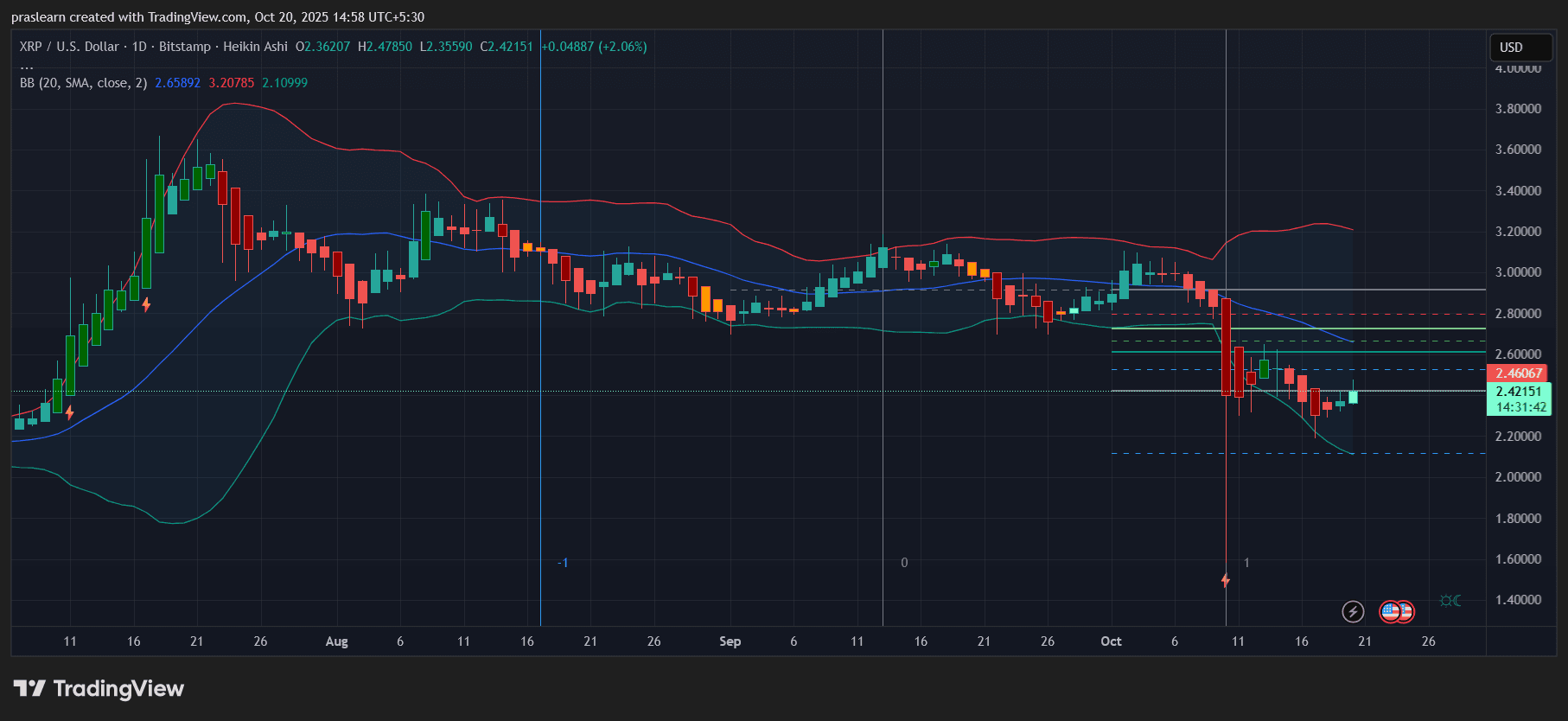

XRP (XRP): Oversold or Fundamentally Weak?

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

Among the majors, XRP looks the weakest. The token recently dropped from $2.80 to $2.35, breaching its lower Bollinger Band before rebounding slightly. It’s now hovering near $2.42 with mild upward candles but remains below key resistance at $2.60.

Momentum indicators hint at a potential short-term relief, but structurally, XRP is trapped in a downtrend channel. Until it breaks above $2.60, any move upward is just corrective. If Bitcoin strengthens, XRP could follow toward $2.70–$2.80 , but a failure to clear $2.50 will likely drag it back to $2.20.

The broader sentiment around XRP remains fragile due to legal uncertainties and a lack of major catalysts. However, traders watching for oversold bounces could see opportunity in the short term.

Expect $XRP to oscillate between $2.20 and $2.60, with limited upside unless macro tailwinds align.

Market Outlook: The CPI and Fed Playbook Will Define Direction

This week is all about macro confirmation. A lower CPI print could revive the narrative of aggressive Fed easing, propelling risk assets and crypto higher. Conversely, if inflation surprises to the upside, expect Bitcoin and Ethereum to face another leg down before stabilizing into November.

With major corporate earnings, AI hype, and inflation data converging, volatility is inevitable. For traders, this week isn’t about chasing momentum—it’s about reacting to how macro events align with technical breakout zones.

If CPI cools and earnings impress, crypto could finally see its first strong rally in weeks. If not, prepare for another retest of the October lows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple’s $1B Acquisition of GTreasury Bolsters Treasury Management Solutions

Third Major Purchase of 2025: Ripple Expands Portfolio with $1B GTreasury Acquisition Following Hidden Road and Stellar Rail Deals

Who is the real "controller" behind the evaporation of $1.9 billion?

XRP Mirrors 2017 Setup as Falling Wedge Near $2.36 Signals Potential Breakout

Dogecoin (DOGE) Eyes $0.21 Breakout as RSI Momentum Confirms Bullish Continuation