Bank of Japan officials reportedly see no need to rush a rate hike this month

According to a report by Jinse Finance, sources familiar with the matter revealed that Bank of Japan officials believe that although the Japanese economy is progressing toward achieving its price target, there is no urgent need to raise the benchmark interest rate next week. The sources said that as economic and inflation developments are generally in line with expectations, officials believe the likelihood of realizing their vision continues to gradually increase. They stated that while they do not rule out the possibility of another rate hike before the end of the year, so far there is no conclusive factor convincing them that a rate hike must be made when setting policy on October 30. In any case, the central bank will carefully study economic data and other factors next week, making a final decision at the last moment. The sources indicated that these factors will include developments in financial markets, as the yen is now more likely to affect inflation compared to the past. (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google discovers North Korean hackers using EtherHiding malware to attack Ethereum and BNB Chain

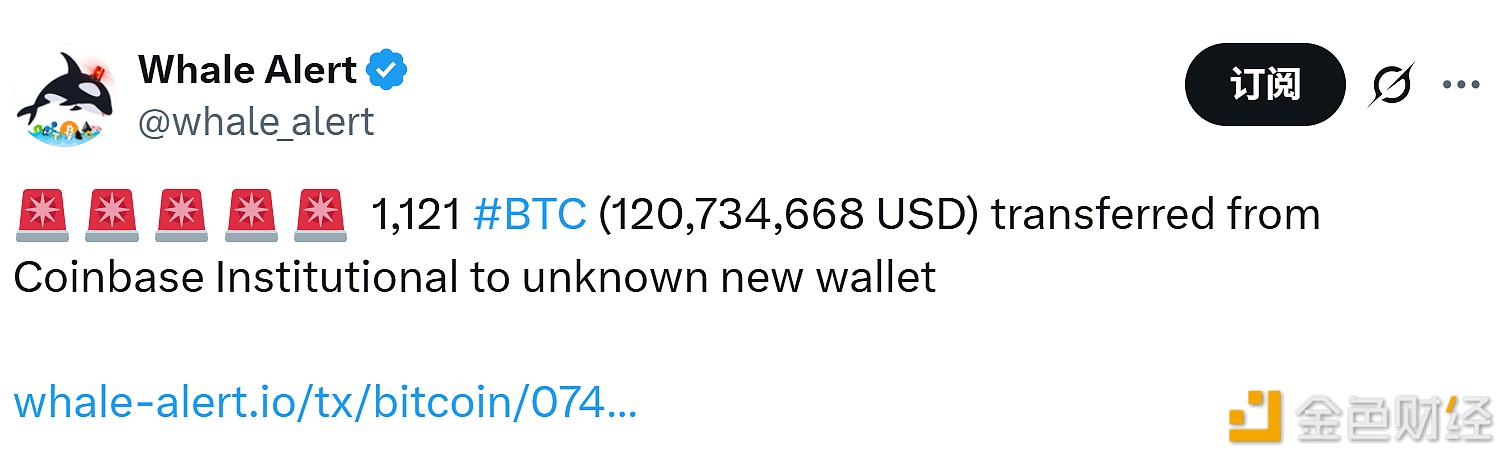

1,121 BTC transferred from an institutional account of a certain exchange

Indian Enforcement Directorate freezes $270 million in crypto assets related to OctaFX scam