Investors have turned their gaze toward Ethereum (ETH) and Mutuum Finance (MUTM) amid shifting crypto news today. John Bollinger recently spotlighted a potential "W" bottom formation in ETH's Bollinger Bands, suggesting buyers edge closer to control after dual price dips.

This pattern, absent in Bitcoin's setup, has fueled talks of capital rotation into Ethereum, with its price climbing 1.52% to $3,891 in the last day. Meanwhile, Mutuum Finance (MUTM), positioned as a top DeFi contender, draws crowds through its recent momentum—phase 6 now 70% filled at $0.035, urging swift action before the window slams shut.

Holders number 17,340 since launch, with $17,750,000 raised overall. Such dynamics underscore why this duo grips the market this month, blending established resilience with fresh DeFi promise.

Ethereum's Technical Edge Emerges

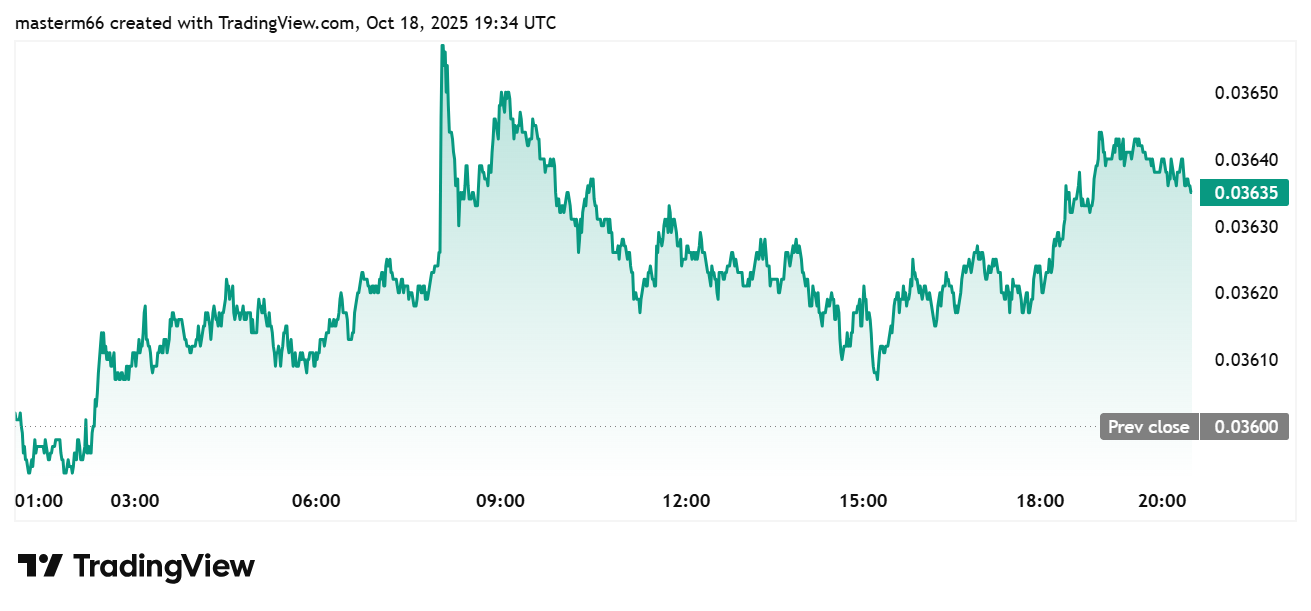

Analysts have noted Ethereum gaining ground against Bitcoin lately, as the ETH/BTC ratio surged over 7% weekly. Bollinger flagged this divergence on October 18, 2025, via X, where ETH/USD traced a "W" bottom—prices dipping twice, the second low higher than the first.

Confirmation could ignite an upward pivot, echoing Kiyosaki's praise for Ethereum as "real money" amid turmoil. Yet, while ETH outperforms, its consolidation phase lingers. BlackRock trimmed Bitcoin stakes but boosted Ethereum exposure during dips, signaling institutional tilt.

Solana mirrored ETH's pattern, up 2.15% to $186, but Ethereum leads the altcoin charge. Still, these moves pale against emerging DeFi crypto like MUTM, where utility drives deeper yields.

Mutuum Finance Updates

The project, a DeFi crypto powerhouse, builds a lending-borrowing protocol on Ethereum, letting users earn on idle assets or borrow against holdings without custody loss. V1 hits Sepolia Testnet in Q4 2025, featuring liquidity pools, mtTokens, debt tokens, and a liquidator bot, starting with ETH and USDT.

Recent Safeguards Bolster Confidence

Mutuum Finance finalized its CertiK audit successfully. MUTM earning a 90/100 token score that reassures backers. The team launched a bug bounty program alongside CertiK. The program allocates $50,000 USDT across four severity tiers rewarding every vulnerability level.

Meanwhile, a new dashboard tracks the top 50 holders via a 24-hour leaderboard, resetting at 00:00 UTC daily. The top spot claims a $500 MUTM bonus, tied to one transaction in that window. Past day's leaders bought $7,036.48, $500, and $6,619.13, proof of surging interest. These steps weave security into growth, making MUTM a strong option for yield seekers.

Protocol Advances Yield Utility

Mutuum Finance announced its lending-borrowing protocol development, blending peer-to-contract pools for instant access with peer-to-peer deals for custom terms. Lenders deposit assets like USDC, earning mtTokens that accrue interest redeemable anytime.

Borrowers overcollateralize to unlock funds, repaying to reclaim holdings seamlessly, all on-chain. Borrow rates tie to utilization: low when liquidity floods in, spiking to draw deposits during squeezes. Stable rates lock predictability for some, though rebalancing guards against gaps.

Caps on deposits and borrows curb risks, while enhanced collateral efficiency boosts limits for correlated assets. Liquidations trigger at thresholds, bonuses luring swift actors to stabilize positions. Such mechanics position MUTM as a noteworthy DeFi solution, outshining ETH's broader but less targeted appeal.

Dynamic Duo Fuels Altcoin Surge

Ethereum's "W" signals have sparked altcoin rotations, yet Mutuum Finance (MUTM) captures the edge with tangible DeFi tools and recent momentum—phase 6 vanishing fast at $0.035.

Investors eyeing the best opportunities now find this pair's synergy irresistible, blending ETH's stability with MUTM's yields. Back MUTM today to lock gains before prices climb.