Zcash Shielded Pool Surpasses 4.5 Million — What Does It Mean for ZEC’s Price?

Zcash’s shielded pool milestone highlights increasing trust in its privacy technology. With fewer coins circulating, investors see potential for a sustained ZEC price rally driven by real adoption, not speculation.

Zcash (ZEC), once a forgotten privacy coin, has made a remarkable comeback. In October’s fearful market conditions, it has become one of the most notable assets investors are watching closely.

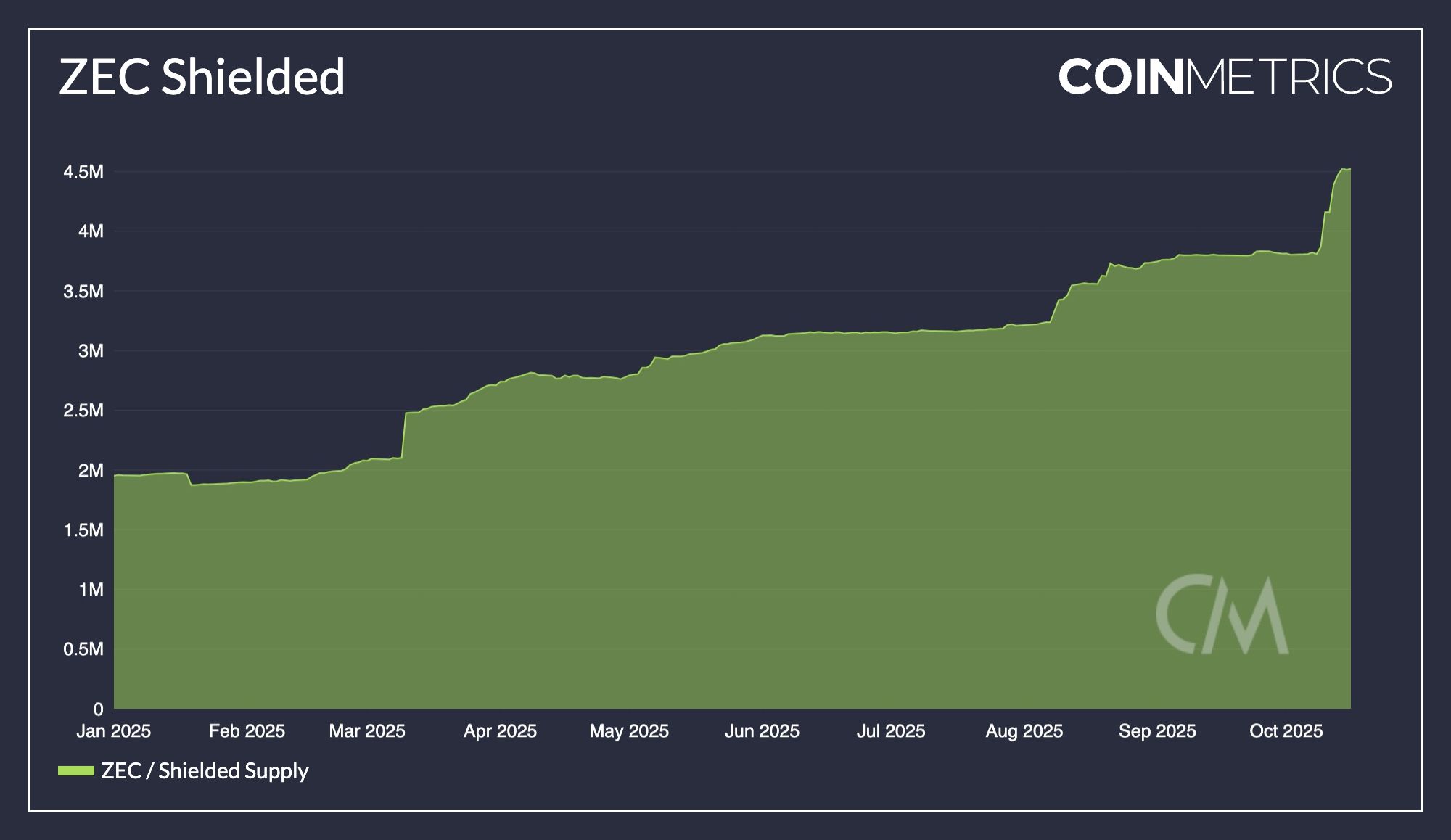

The altcoin also achieved a major milestone: its Shielded Pool has surpassed 4.5 million ZEC. What does this mean, and how might it affect the price?

Evidence Shows Interest in Zcash Goes Beyond Price

Zcash (ZEC) recently hit a significant milestone — its shielded pool exceeded 4.5 million ZEC, according to CoinMetrics data.

Zcash shielded pool. Source:

Coinmetric

Zcash shielded pool. Source:

Coinmetric

Within just three weeks, around 1 million ZEC were moved into shielded pools, while ZEC’s price surged fivefold. However, instead of selling to take profits, users continued transferring their coins into shielded wallets.

Shielding in Zcash is the process of transferring funds from transparent addresses (t-addresses) to shielded addresses (z-addresses or u-addresses). This hides transaction details such as sender, receiver, and amount.

The technology relies on zk-SNARKs to ensure privacy without compromising the blockchain’s overall transparency. The growing number of users choosing to shield their coins reflects strong confidence in both the project and its privacy technology.

“Signal: watch the Zcash shielded pool relative to ZEC price. Those who shield their ZEC don’t sell.” — Josh Swihart, CEO of Electric Coin Co. said.

What Does This Mean for ZEC’s Price?

The expansion of the shielded pool suggests a decline in circulating supply. Coins that are shielded are typically held for longer periods instead of being traded frequently.

According to Coingecko data, ZEC’s total circulating supply is 16.34 million, with 4.5 million currently in shielded pools. That’s roughly 27.5% of the circulating supply, and the figure continues to rise. This dynamic adds upward pressure on price, especially if demand keeps increasing.

Victor, a developer within the Zcash ecosystem, described the phenomenon as a sign of real adoption rather than speculation.

“Normal crypto behavior: pump → exchange → dump.Zcash behavior: pump → shield → zodl.This isn’t speculation. It’s adoption of privacy tech.” — Victor said.

A recent BeInCrypto report noted that some analysts even predict ZEC could surge beyond $60,000.

Meanwhile, on the Myriad prediction platform, investors are betting that ZEC will hit $300 before November, with the odds reaching 69%.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

High-Value STEM Initiatives Opening Doors to New Technology Investment Prospects

- High-impact STEM programs aligned with industry needs are key indicators for emerging tech investment opportunities in AI, clean energy, and advanced manufacturing. - U.S. EDA's $500,000 STEM Talent Challenge addresses 449,000 unfilled manufacturing jobs through workforce training and industry partnerships. - Universities like UCLA and Ohio State drive VC growth: 80% success rate in STEM accelerators, with 75% underrepresented founders securing $374M in funding. - Venture capital prioritizes STEM-linked

SOL struggles as Solana TVL slides and memecoin demand fades

Why is the COAI Index Plummeting in Late 2025? Investor Confidence, Policy Changes, and What Lies Ahead for AI-Powered Learning

- COAI Index collapsed 96% in late 2025 due to governance failures, regulatory ambiguity, and AI-generated misinformation. - Centralized token distribution (97% in 10 wallets) and C3 AI's $116.8M loss exposed systemic vulnerabilities in AI-driven crypto assets. - AI-generated deepfakes and fake news triggered panic selling, accelerating the crash in emerging markets like Indonesia. - Post-crash, investors are prioritizing STEM/vocational education over speculative crypto, but funding delays and infrastruct

The Rise of MMT Token: Analyzing Driving Forces and Assessing Its Sustainability in the Cryptocurrency Market

- Momentum (MMT) token surged 1,300% in November 2025, driven by product innovation, regulatory clarity, and institutional investment. - Strategic moves included a Sui-based perpetual futures DEX, CLARITY Act/MiCA 2.0 compliance, and $10M funding for cross-chain expansion. - Institutional holdings rose 84.7%, while on-chain activity showed growing utility in real-world asset tokenization and governance models. - Risks persist: 3M tokens moved to OKX, $109M in liquidations, and 20.41% circulating supply cre