BTC trove represents 66% of market cap, Hyperscale Data shows

Hyperscale Data revealed that the value stored in its Bitcoin treasury now represents around 66% of the company’s total market capitalization based on the previous closing stock price.

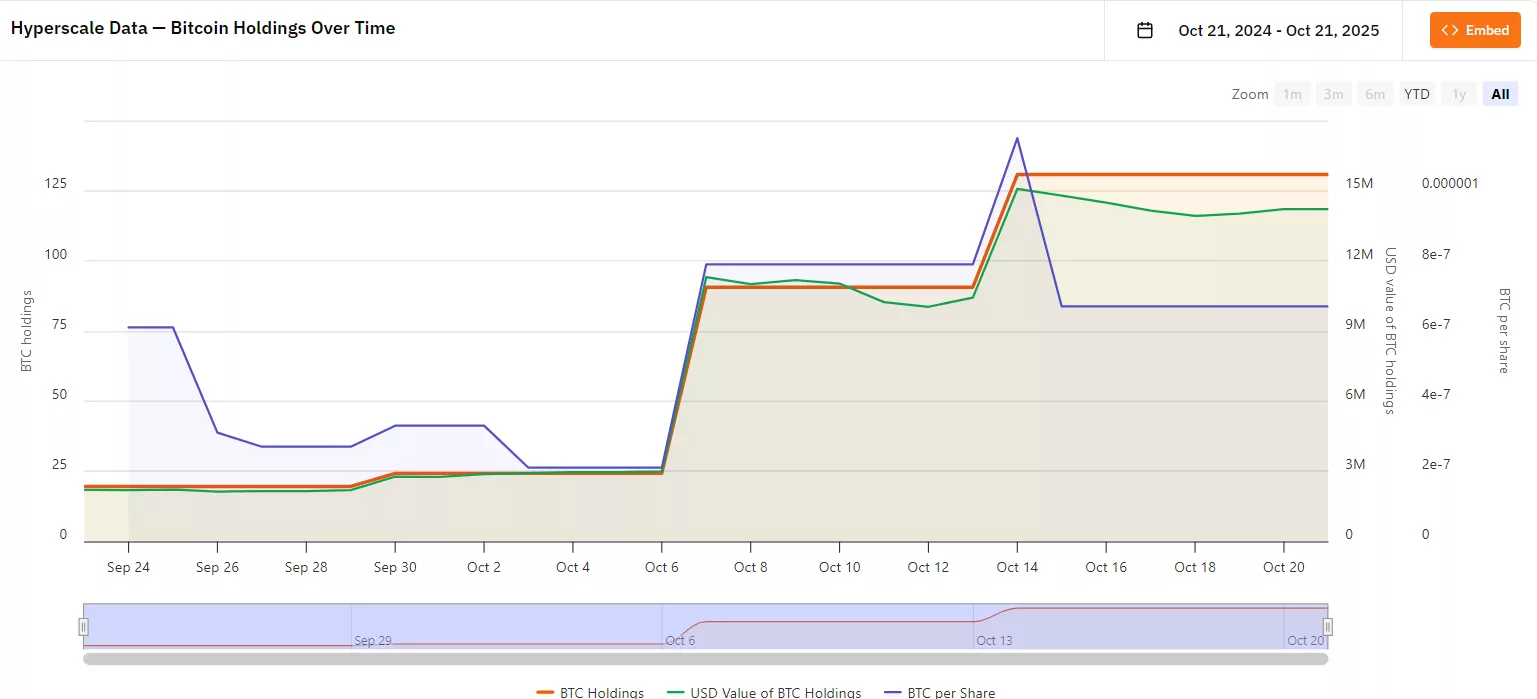

- Hyperscale Data’s Bitcoin holdings have reached around 150.21 BTC ($16.3 million) through mining and open-market purchases, with $43.7 million in additional funds.

- The company aims to build a $100 million Bitcoin treasury, equivalent to 100% of its market capitalization, reporting weekly progress. So far, it has managed to make it into the top 100 public companies ranked by Bitcoin holdings.

According to a press release shared by the company, the firm’s Bitcoin treasury holds assets and funds to be allocated for purchases amounting to approximately $60 million. The company claims that this amount represents about 66% of the company’s total market cap, which is stated as $75 million according to Bitcoin Treasuries.

As of Oct. 19, the company’s Bitcoin ( BTC ) treasury subsidiary Sentinum reportedly held about 150.21 Bitcoin ($16.2 million). This amount consists of Bitcoin acquired from mining operations, which is 32.632 BTC or equal to $3.52 million, as well as Bitcoin purchased from the open-market.

So far, the company has purchased as much as 117.58 BTC. Its latest purchase took place during the week of Oct. 19, when the firm bought 15.88 BTC. Based on the Bitcoin closing price of $108,666 on October 19, 2025, these holdings were valued at approximately $16.3 million.

Hyperscale Data’s total Bitcoin holdings have reached $60 million in value | Source: Bitcoin Treasuries

Hyperscale Data’s total Bitcoin holdings have reached $60 million in value | Source: Bitcoin Treasuries

Moreover, the company claims to have allocated around $43.7 million in corporate funds for Sentinum to buy more Bitcoin on the open-market. The company stated that it plans to keep investing funds using what it calls a “measured dollar-cost averaging approach” that aims to limit the impact of market fluctuations while also increasing the value of its long-term reserve holdings.

“Volatility in Bitcoin’s price has provided meaningful opportunities to build our position methodically and at favorable long-term averages,” said Executive Chairman of Hyperscale Data Milton “Todd” Ault III in his statement.

Hyperscale Data’s plan to hold 100% of its market cap in BTC

Hyperscale Data stated that it will continue acquiring more Bitcoin to fulfill its long-term goal of building up a Bitcoin treasury with a value that matches 100% of its market capitalization. As part of its broader digital asset treasury strategy, it aims to stockpile as much as $100 million worth of Bitcoin from open-market purchases and self-mined BTC.

“Hyperscale will continue to issue weekly reports every Tuesday morning detailing its Bitcoin holdings as it advances toward its $100 million DAT target,” said the firm in its official statement.

According to data from Bitcoin Treasuries, Hyperscale Data has only been acquiring BTC for less than a month. It started holding BTC in September 23 of this year. So far, its Bitcoin holdings have reached 130.8 BTC or equal to $14.18 million. With an average cost of $115,460, the company has accumulated a loss of about 6.02% after the value of Bitcoin plummeted below $110,000.

Compared to larger and more established Bitcoin treasury companies like Strategy, Metaplanet, Tesla and Galaxy Digital, it still has a long way to go. However, it has managed to make it into the top 100 public companies that hold Bitcoin despite its late start. Bitcoin Treasuries has ranked Hyperscale Data in 98th place with 131 BTC, beating Mac House and Bitcoin Depot.

At press time, Bitcoin has dropped 2.5% in the past 24 hours, continuing its downward trend of 2.75% within the past week. The largest cryptocurrency by market cap is currently trading hands at $108,153 as it attempts to climb back up to the $110,000 threshold.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

KITE Price Forecast Post-Listing: Understanding Institutional Attitudes and Market Fluctuations

- KITE's post-IPO price fell 63% by Nov 2025 amid divergent institutional strategies and retail sector uncertainty. - Analysts split between "Buy" ($30 target) and "Hold" ratings, citing operational gains vs. macro risks like the $3.4T deficit bill. - Q3 net loss (-$0.07 EPS) and 5,400% payout ratio highlight structural risks despite industrial real estate pivots and 7.4% dividend hike. - Institutional trading directly impacted price swings, with COHEN & STEERS' stake increase briefly stabilizing shares be

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving

Aster DEX’s Latest Protocol Update and What It Means for DeFi Liquidity Providers

- Aster DEX's v2 upgrade enhances capital efficiency and privacy for liquidity providers (LPs) through ASTER token collateral and leveraged trading features. - The "Trade & Earn" functionality boosted TVL to $2.18B by November 2025, leveraging yield-bearing assets as trading margin. - However, 300x leverage and reduced tick sizes increase liquidation risks during volatility, while fee stagnation below $20M contrasts with $2B daily trading volumes. - Upcoming Aster Chain's privacy tools aim to attract insti

PEPE Steadies at $0.054711 With Narrow Range Shaping Short-Term Outlook