Zcash (ZEC) Breakout Stalled By Big Money — Here’s Why It Might Not Affect The Price

ZEC price has cooled off after a sharp multi-month rally, but the uptrend still looks intact. With whales easing out, retail traders stepping in, and hidden bullish signals flashing again, Zcash might be setting up for its next strong leg higher.

Zcash (ZEC) price has been one of the strongest performers among privacy coins, gaining nearly 470% over the past three months. The token is now trading near $250 after a brief pullback, cooling off from its recent surge but still holding most of its gains.

At first glance, the pause (even one since yesterday might seem like fading momentum. But the signals suggest something different. Whales are taking a step back, retail conviction remains strong, and technical patterns continue to hint that the broader uptrend is far from over.

Whales Ease Off, But Retail Traders Ride The Conviction

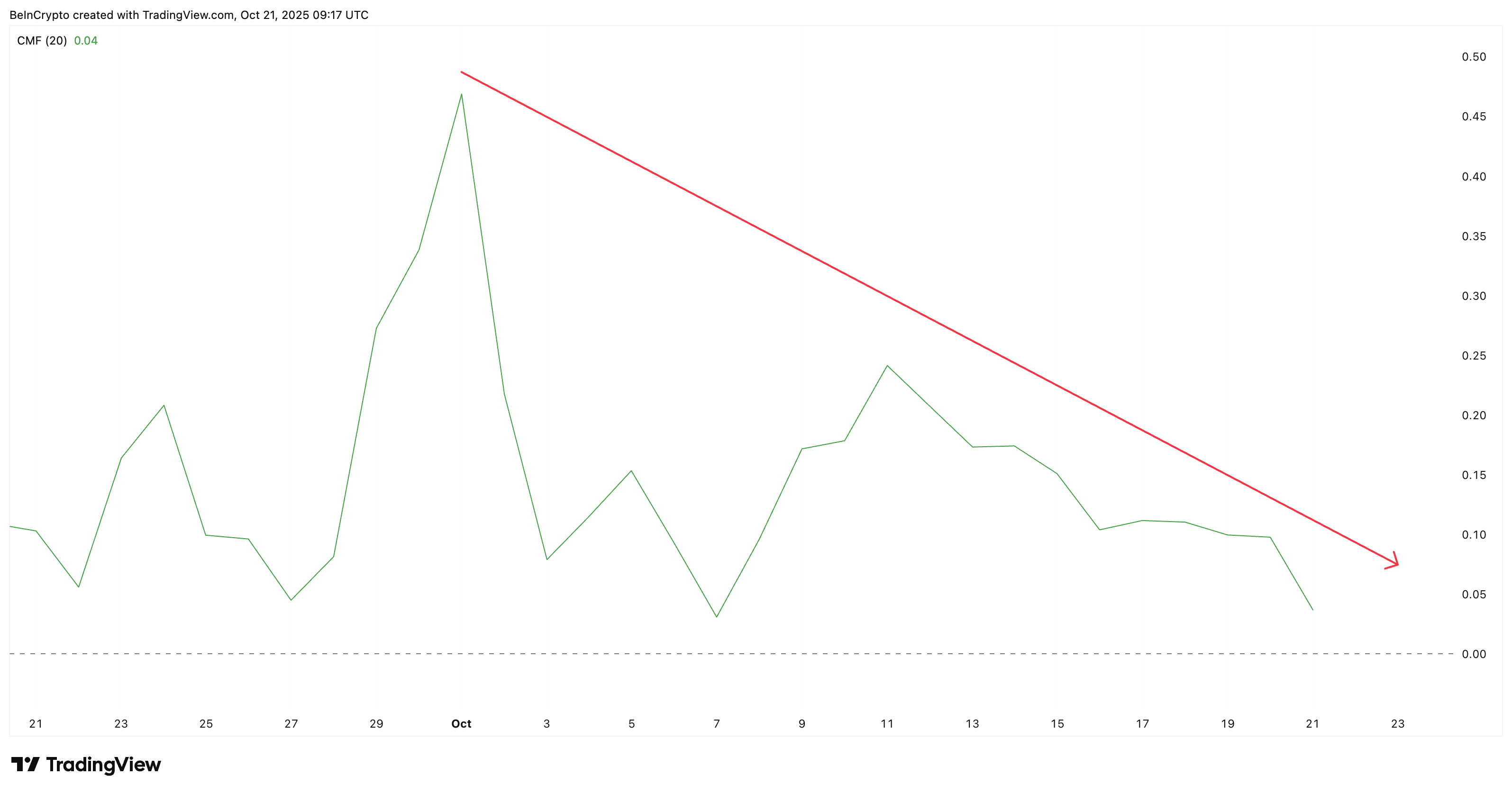

Large investors have started to slow their buying. The Chaikin Money Flow (CMF) — which measures large-money inflows — has dropped sharply from over 0.45 at the start of October to around 0.04 now. This indicates whales have begun taking profits after driving ZEC’s earlier rally.

Still, this is not entirely bearish. Even when CMF dropped earlier this month, ZEC’s price kept climbing. The token’s rally is no longer fully dependent on whale activity — retail traders are filling in the gap.

Big ZEC Wallets Offloading:

TradingView

Big ZEC Wallets Offloading:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Over the past 24 hours, ZEC’s net flow flipped from +$18.14 million to –$4.06 million, a 122% swing toward outflows. That means more tokens are leaving exchanges, suggesting that holders are buying more.

ZEC Retail Adding To The Stash:

Coinglass

ZEC Retail Adding To The Stash:

Coinglass

Smaller traders appear to be accumulating while large holders reduce exposure — a pattern that often helps sustain rallies. Adding to that conviction, Zcash’s shielded pool recently surpassed 4.5 million ZEC, locking nearly 27.5% of its total supply.

This surge in shielded holdings shows that more users are moving coins into long-term private storage rather than trading them, tightening market supply and reinforcing confidence in Zcash’s privacy technology.

ZEC Price Structure Still Shows Strength Beneath The Surface

ZEC’s price action shows that this pullback is likely a pause, not a breakdown. The structure remains healthy, and multiple signals suggest the uptrend is holding.

While the full breakout projection of the flag setup points to an ambitious 547% potential move based on the pole’s height, that Zcash price target remains far-fetched for now. Nearer levels like $284, $314, and $441 look more realistic as upcoming resistance zones.

The Relative Strength Index (RSI) — which measures the strength and speed of price changes — highlights that shift clearly. A few days earlier, around October 16, a hidden bullish divergence appeared, where the RSI made lower lows while the price made higher lows. The result was a short-term rally that pushed ZEC up before this latest pullback.

ZEC Price Analysis:

TradingView

ZEC Price Analysis:

TradingView

Now, a similar divergence is forming again. The price has continued making higher lows while RSI dips slightly — a setup that often hints at trend continuation. If the pattern repeats, ZEC could soon resume its climb toward $284 and $314, the next resistance levels.

However, if the price drops below $247 and then $209, it could signal temporary weakness. A move under $187 would break the bullish structure and expose the ZEC price to a deeper correction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket Mini App Now Live on World App

World App integrates Polymarket Mini App, giving users direct access to prediction markets.What This Means for Crypto AdoptionA Step Toward a Smarter Web3

Best Crypto to Invest in 2025: BlockDAG, Aster, Monero & Polkadot Power the Next Crypto Rise

Explore the best crypto to invest in: BlockDAG’s $430M presale, Aster’s 1,700% rise, Polkadot’s supply shift, and Monero’s strong privacy stance.BlockDAG: Testnet Success and $430M Presale ProofAster: Rapid DEX Growth and 1,700% Price SurgeMonero: The Privacy Shield That Refuses to FadePolkadot: Supply Cap Brings New StabilityReal Use Will Define the Best Crypto to Invest in 2025

Top 3 Crypto Presales Poised for a Q4 Surge: Nexchain AI Testnet 2.0, MoonBull, and Little Pepe Lead with Solid Utility

Discover the top 3 crypto presales for Q4 2025, Nexchain AI Testnet 2.0, MoonBull, and Little Pepe driving real blockchain utility.Nexchain AI: A Presale Token Redefining Blockchain Infrastructure with AI-Driven UtilityTestnet 2.0: Launching in November with AI Risk Score FeaturesMoonBull: Meme Coin with DeFi UtilityLittle Pepe: Layer-2 Meme Token with High Traction

Exploring 2025 Opportunities in Investing in Crypto with BlockDAG, Cardano, Stellar, and Hedera

Find the best crypto coins to buy in 2025: BlockDAG, Cardano, Stellar, and Hedera. Learn updates, prices, and which project leads the race this year!1. BlockDAG: $430M+ Presale Marks Major Step Forward2. Cardano: S&P Index Listing Strengthens Its 2025 Path3. Stellar: Payments Remain Its Strongest Edge4. Hedera: Building Enterprise Strength at ScaleBalancing Stability and Growth While Investing in Crypto