German MicroStrategy Aims to Buy 10,000 Bitcoins Fast

Germany’s aifinyo is leading Europe’s Bitcoin treasury push, planning to amass 10,000 BTC by 2027. Yet, its bold strategy faces growing regulatory and financial headwinds that could test its long-term vision.

Germany officially has its first Bitcoin treasury firm, as aifinyo is taking up MicroStrategy’s mantle in Europe. The firm wants to buy 10,000 bitcoins by 2027, which would cost $1.1 billion at today’s prices.

The firm already partnered with UTXO to receive its first investment, and it has a solid plan to keep stacking BTC. Still, the whole sector is wobbling under regulatory and stock dilution concerns, which may cut these ambitious plans short.

Germany’s First Bitcoin Treasury

Corporate BTC acquisition has become a massive industry trend in 2025, and it shows no signs of stopping. Digital asset treasury (DAT) firms are continuing to buy Bitcoin, and a new company from Germany is trying to move at a breakneck speed.

According to the firm’s press release, aifinyo is now Germany’s first publicly-traded Bitcoin DAT. The firm announced a $3.5 million investment from UTXO Management, which will be part of a long-term partnership.

Aifinyo will buy Bitcoin exclusively, centering the company’s valuation around BTC acquisitions.

“We’re building Germany’s first corporate Bitcoin machine. Every invoice that aifinyo’s customers pay, will now generate Bitcoin for shareholders. No speculation, no market timing – just systematic accumulation of a deflationary asset,” claimed Stefan Kempf, aifinyo co-founder and Board Chairman.

Its ambition, however, is especially noteworthy. This “German MicroStrategy” aims to purchase 10,000 bitcoins by 2027, requiring over $1.1 billion at today’s prices.

Aifinyo will lean on the initial investment and its preexisting cash reserves, planning to expand “into business accounts and credit cards” next year to create new income streams.

Late to the Party?

Still, this all seems pretty precarious. The firm claimed that Germany is an attractive region to establish a Bitcoin DAT, thanks to its regulatory friendliness.

However, the whole treasury strategy is showing huge red flags, with analysts worrying it could cause a macroeconomic risk to crypto.

MicroStrategy, the leading Treasury firm, has drastically shrunk its purchases after stock dilution fears. Some firms have developed more investor-friendly approaches, which may or may not be scalable, but the problem is endemic to all DATs.

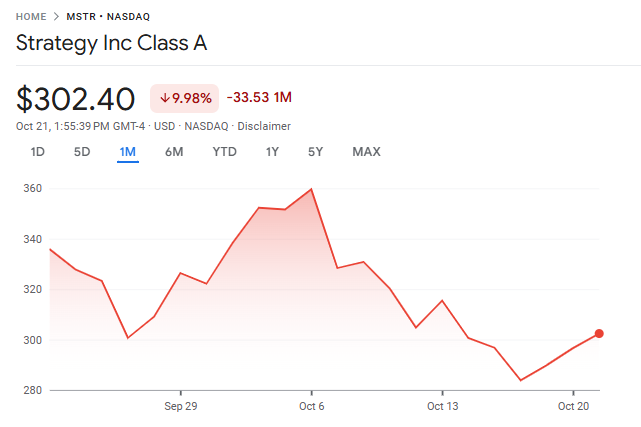

Strategy Stock Fell Nearly 10% After the October 10 Market Crash. Source:

Strategy Stock Fell Nearly 10% After the October 10 Market Crash. Source:

If aifinyo wants to stockpile BTC fast, it might not have the luxury of a stabler approach.

Moreover, even if this German company can both rapidly acquire Bitcoin and please its shareholders, those aren’t the only concerns. US regulators have started a massive probe into DAT companies over insider trading concerns.

To be clear, this crackdown happened in the US, which is explicitly trying to reduce crypto enforcement. German and European regulators are notoriously more hard-nosed when it comes to Bitcoin, and a company like aifinyo might make an attractive target in the future.

In other words, there are a lot of variables right now. aifinyo might be able to pioneer a revolutionary strategy in a new continent, or it might be a latecomer to the party. However, its commitment shows that DAT acquisition isn’t slowing down yet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Polymarket Mini App Now Live on World App

World App integrates Polymarket Mini App, giving users direct access to prediction markets.What This Means for Crypto AdoptionA Step Toward a Smarter Web3

Best Crypto to Invest in 2025: BlockDAG, Aster, Monero & Polkadot Power the Next Crypto Rise

Explore the best crypto to invest in: BlockDAG’s $430M presale, Aster’s 1,700% rise, Polkadot’s supply shift, and Monero’s strong privacy stance.BlockDAG: Testnet Success and $430M Presale ProofAster: Rapid DEX Growth and 1,700% Price SurgeMonero: The Privacy Shield That Refuses to FadePolkadot: Supply Cap Brings New StabilityReal Use Will Define the Best Crypto to Invest in 2025

Top 3 Crypto Presales Poised for a Q4 Surge: Nexchain AI Testnet 2.0, MoonBull, and Little Pepe Lead with Solid Utility

Discover the top 3 crypto presales for Q4 2025, Nexchain AI Testnet 2.0, MoonBull, and Little Pepe driving real blockchain utility.Nexchain AI: A Presale Token Redefining Blockchain Infrastructure with AI-Driven UtilityTestnet 2.0: Launching in November with AI Risk Score FeaturesMoonBull: Meme Coin with DeFi UtilityLittle Pepe: Layer-2 Meme Token with High Traction

Exploring 2025 Opportunities in Investing in Crypto with BlockDAG, Cardano, Stellar, and Hedera

Find the best crypto coins to buy in 2025: BlockDAG, Cardano, Stellar, and Hedera. Learn updates, prices, and which project leads the race this year!1. BlockDAG: $430M+ Presale Marks Major Step Forward2. Cardano: S&P Index Listing Strengthens Its 2025 Path3. Stellar: Payments Remain Its Strongest Edge4. Hedera: Building Enterprise Strength at ScaleBalancing Stability and Growth While Investing in Crypto