World Liberty Advisor Explains the Real Reason Behind the October 10 Crypto Crash

World Liberty Financial Advisor Ogle explains how cascading leverage, liquidity gaps, and automation triggered the October 10 crypto market crash.

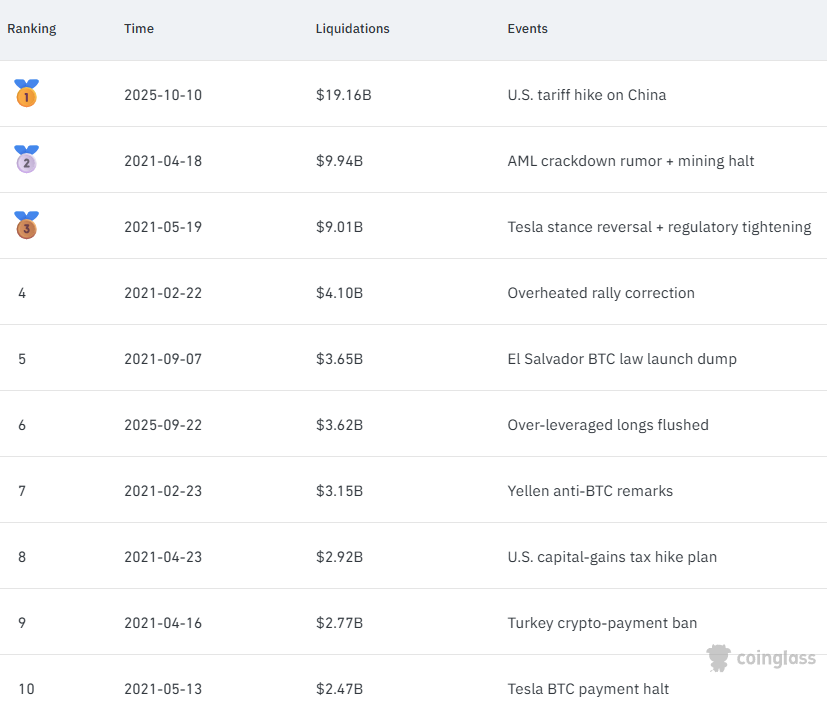

The October 10 crypto crash wiped out nearly $19 billion in leveraged positions within hours, shocking both traders and analysts.

In an exclusive BeInCrypto podcast, World Liberty Financial advisor and Glue.Net founder Ogle broke down what really caused one of the largest single-day collapses in recent crypto history.

A Perfect Storm: Multiple Factors Converged

According to Ogle, there was no single trigger behind the sell-off.

“You don’t die from heart disease because you only ate a lot of burgers,” he said. “It’s a thousand things that come together that cause catastrophes.”

He explained that the crash stemmed from a combination of liquidity shortages, over-leveraged traders, and automated sell-offs sparked by macroeconomic jitters.

“In those precipitous drops, the bids to purchase simply were not there. There’s just not enough people who are interested in buying even at lower prices,” Ogle noted.

He added that Donald Trump’s remarks on US–China relations amplified panic in algorithmic trading systems, triggering a wave of automated short positions that accelerated the decline.

Top 10 Crypto Liquidation Events of All Time. Source:

Top 10 Crypto Liquidation Events of All Time. Source:

Liquidity Gaps and Over-Leverage Made It Worse

The advisor, who has been in crypto since 2012 and helped recover more than $500 million from hacks, pointed to over-leverage on professional exchanges as the most damaging element.

Many traders used “cross margin,” a system that links all positions together — a design flaw that can wipe out entire portfolios when prices dip sharply.

“My personal belief is that over-leveraging in professional exchanges is probably the most important part of it,” Ogle said. “It’s a cascade — if one position collapses, everything else goes with it.”

The Centralized Exchange Dilemma

Ogle criticized the community’s continued reliance on centralized exchanges (CEXs) despite repeated failures.

He cited Celsius, FTX, and several smaller collapses as reminders that users still underestimate custody risks.

“I don’t know how many more convincing events we need,” he said. “It’s worth spending an hour to learn how to use a hardware wallet instead of risking everything.”

While CEXs remain convenient, the future lies in decentralized finance (DeFi) and self-custody solutions — an evolution even centralized players recognize.

“Coinbase has Base, Binance has BNB Chain — they’re building their own chains because they know decentralization will disrupt them,” he explained.

Gambling Mindset and the ‘Gold Rush’ Mentality

Beyond technical failures, there’s a deeper cultural issue plaguing the crypto space. Speculative greed. Ogle compared today’s meme coin frenzy and 100x trading to the 1800s California gold rush.

“Most people who went there didn’t make money. The people selling shovels did. It’s the same now — builders and service providers win, gamblers don’t,” said Ogle.

He warned that excessive speculation damages crypto’s image, turning a technological revolution into what outsiders see as “a casino.”

Isolated Margin Is Critical

When asked for practical advice, Ogle gave a clear takeaway:

“If they take nothing else from this podcast, and they want to do perpetual trading, you must use isolated margin.”

He explained that isolated margin limits losses to a specific position, unlike cross margin, which can liquidate an entire account.

“The very best suggestion I can give people is this — always trade isolated,” he emphasized.

Overall, the October 10 crypto crash was not caused by a single failure. It was the inevitable outcome of systemic over-leverage, low liquidity, and a speculative culture that treats risk as entertainment.

Until traders learn to manage risk and take self-custody seriously, crypto will keep repeating the same mistakes — just with larger numbers.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.