Gold Just Had Its Worst Day in 12 Years — Will Bitcoin Benefit?

Gold’s record-breaking rally has abruptly reversed, and Bitcoin appears to be the unexpected beneficiary. As analysts point to signs of capital rotation, the rivalry between the two stores of value may be entering a new and defining phase.

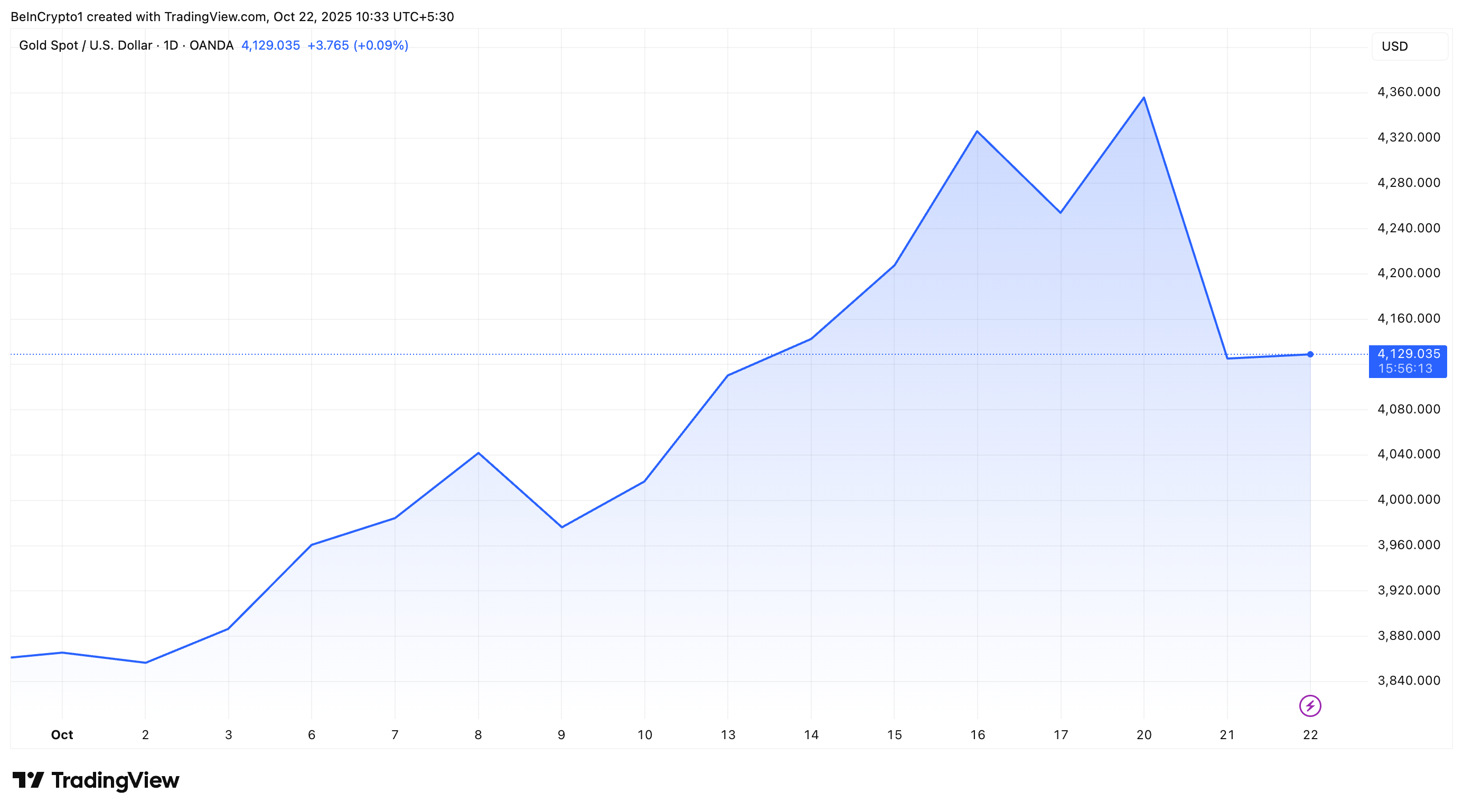

After reaching record highs, gold is undergoing a notable correction. On October 21, the precious metal experienced its steepest one-day drop in over 12 years.

Meanwhile, Bitcoin (BTC) has rallied, fueling speculation among analysts that capital may be rotating out of gold and into the leading cryptocurrency.

Is Gold’s Rally Over?

gold had continued to trend higher this month. Even as the crypto market reeled from tariff-driven volatility following President Trump’s announcement, the traditional safe-haven asset attracted strong demand.

In fact, long queues were seen forming outside bullion dealers as investors rushed to purchase physical gold. Amid this surge, gold hit a new all-time high of $4,381 per ounce on Monday.

However, during gold’s record run, analysts warned of a potential market top and an imminent correction. Their warnings proved timely.

On Tuesday, gold prices plunged more than 6%, marking their sharpest one-day decline since 2013. At press time, gold was trading at $4,129 per ounce, down roughly 5% over the past 24 hours.

Gold Price Performance. Source:

TradingView

Gold Price Performance. Source:

TradingView

Professional trader Peter Brandt drew attention to the sheer scale of gold’s latest selloff, noting that the metal’s market capitalization plunged by an estimated $2.1 trillion in a single day.

“In terms of market cap, this decline in Gold today is equal to 55% of the value of every cryptocurrency in existence. @PeterSchiff ‘s pet rock lost $2.1 trillion in value today. That is 2,102 billion $ worth,” Brandt wrote.

What Does Gold’s Historic Decline Mean For Bitcoin?

Meanwhile, as gold struggled, Bitcoin gained momentum. BeInCrypto Markets data showed that BTC rose 0.51% over the past 24 hours.

Bitcoin (BTC) Price Performance. Source:

BeInCrypto Markets

Bitcoin (BTC) Price Performance. Source:

BeInCrypto Markets

At press time, it traded at $108,491. According to analyst Ash Crypto, these diverging movements signaled that the rotation of capital from gold to Bitcoin has begun.

Previously, Ash had forecasted that October could bring a brief market downturn before a powerful Q4 rally, starting with ‘parabolic candles likely towards the last 10 days of October.’ According to him, the Q4 rally would push Bitcoin and altcoins to new highs. So, the current shift could likely be the first sign that his forecast is starting to play out.

“Yesterday I told you it was time for the great rotation from gold into bitcoin. Today the rotation started,” Anthony Pompliano added.

BTC vs. Gold is breaking out!Gold down, Bitcoin up.Is the safe haven rotation in play?

— Nic (@nicrypto) October 21, 2025

Additionally, market research firm Swissblock noted that Bitcoin’s surge as gold slumps isn’t new — the same pattern has emerged before.

“In April, gold dumped 5% in 3 days, right before Bitcoin broke out from its macro bottom and expanded, while gold consolidated. The investor’s flight to gold has created patterns that defy the textbooks (indices rising, and gold too). Gold and BTC are moving in opposite directions, this decoupling could be the window Bitcoin needs to finish the year with a statement: Pump hard, Bitcoin style. This could be the last opportunity,” the post read.

Amid this, attention has turned once again to Bitcoin’s long-term potential compared to traditional assets. Earlier, Binance founder CZ predicted that Bitcoin would eventually overtake gold.

“Prediction: Bitcoin will flip gold. I don’t know exactly when. Might take some time, but it will happen,” CZ stated.

While it may be too early to call such a flip, the latest market conditions clearly favor Bitcoin. If this momentum continues, the current rotation could mark the early stages of a structural shift — one that defines the next chapter in the long-standing rivalry between gold and Bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Lowers Interest Rates as Data Remain Unclear Due to Shutdown, While Focus Shifts to Tech AI Profits and Trade Agreement

- The U.S. Fed cuts rates by 25 bps for the second consecutive meeting, signaling potential policy easing amid a government shutdown and global trade tensions. - Big Tech earnings spotlight AI monetization, with Microsoft's Azure and Amazon's AWS under scrutiny as $420B AI spending by 2026 drives growth but risks margin pressures. - A preliminary U.S.-China trade deal delays Trump's 100% tariffs and resumes soybean purchases, marking de-escalation after months of escalating tensions. - Fed's rate cut coinc

Bitcoin News Update: Investors Shift $7.4 Trillion as Federal Reserve Lowers Rates to Boost Economic Expansion

- Fed plans 2025 rate cuts to boost growth amid slowing economy, with 3% inflation above 2% target. - Markets expect 150-200 basis points of easing by 2026, driving $7.4T liquidity into stocks, Bitcoin, and bonds. - Wall Street indices surged on rate-cut optimism, with tech giants and Ford shares rising despite profit warnings. - Bitcoin gains traction via $26B ETF inflows, while global markets adapt to lower rates through stablecoins and regulatory scrutiny.

High-Yield BCH Encounters Earnings Fluctuations as Chile Navigates Political Uncertainty

- Banco de Chile (BCH) faces October 28 earnings scrutiny amid Chile's November presidential election, with bullish investors linking its performance to potential economic reforms under conservative candidate Kast. - Analysts project $0.64/share earnings and $784M revenue but assign a cautious $32 price target (3.6% below current price), citing BCH's volatile quarterly results including a 99.5% miss in March 2025. - The stock's 6.63% dividend yield and 19.98% five-year growth rate attract income investors,

Solana Latest Updates: The Impact of Snorter Bot’s Fast and Secure Features on Meme Coin Trading

- Snorter Bot's SNORT presale enters final 24 hours, having raised $5.6M with 100x price forecasts. - Built on Solana, the bot enables ultra-fast meme coin sniping with rug-pull detection and 0.85% trading fee discounts. - A 50% token burn doubled remaining holdings' value, while analysts cite Banana Gun's 230x return as comparable potential. - Investors can purchase SNORT via multiple currencies with 102% APY staking rewards, as presale ends October 27.