The Whale Who Timed the October Crash Perfectly Is Now Betting on Another Bitcoin Drop

The Bitcoin market is split as a major whale doubles down with a huge short while other investors open new long positions. The battle between bulls and bears could define the next phase of Bitcoin’s volatile recovery.

A crypto whale who recently pocketed over $197 million during the October market crash has doubled down, building a massive short bet against Bitcoin (BTC).

This move comes amid Bitcoin’s turbulent recovery from its mid-October crash, which continues to test investor resolve. The cryptocurrency is exhibiting flashes of resilience amid persistent volatility.

The Comeback Short: BitcoinOG Reloads With Massive Bet Against BTC

BeInCrypto previously reported that a whale held massive short positions on both Bitcoin and Ethereum (ETH) amid the October downturn, earning substantial profits during the market panic. Within just 30 hours, the investor gained over $160 million.

Lookonchain reported that on October 15, this Bitcoin OG had completely closed all short positions on Hyperliquid, securing more than $197 million across two wallets. Despite these massive gains, the trader was back just days later.

According to data from the blockchain analytics firm, the whale through the wallet (0xb317) transferred $30 million in USDC to Hyperliquid earlier this week and opened a 10x leveraged short position on 700 Bitcoin, valued at about $75.5 million. The investor has since expanded this position, signaling a renewed bet against the market.

“The $10B Hyperunit Whale who made $200M shorting the China Tariff Crash just DOUBLED DOWN on his BTC short position,” Arkham posted.

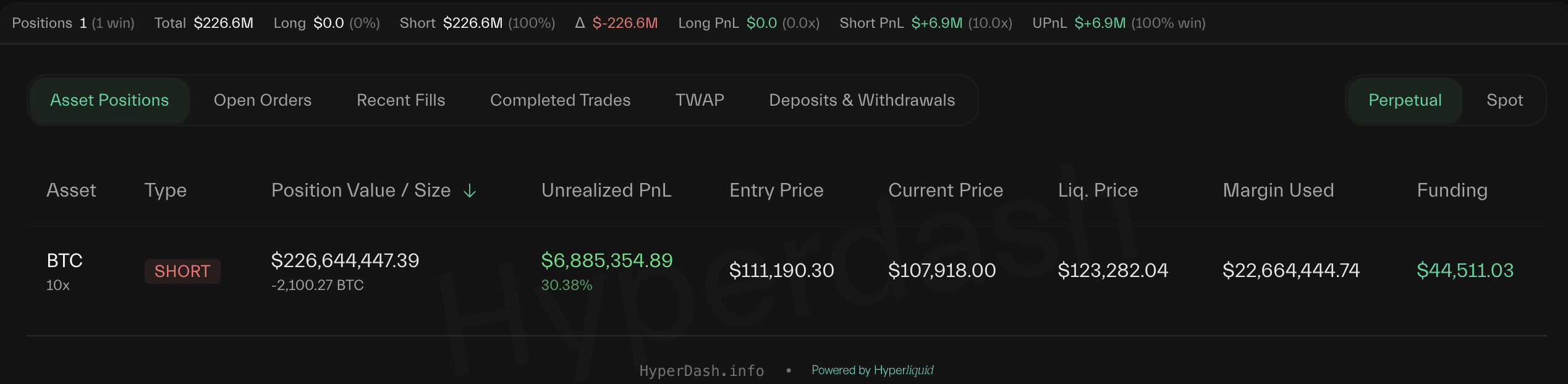

According to the latest data from Hyperdash, the BitcoinOG’s active 10x leveraged short position on Bitcoin is worth $226.6 million. The liquidation price is set at $123,282. Furthermore, the position is currently showing an unrealized profit of around $6.8 million.

Bitcoin OG Whale’s Short Position. Source:

Hyperdash

Bitcoin OG Whale’s Short Position. Source:

Hyperdash

In addition to the leveraged bets, Lookonchain highlighted that the trader has also been offloading Bitcoin,

“Since the 1011 market crash, he has deposited 5,252 BTC($587.88 million) into Binance, Coinbase, and Hyperliquid,” the firm noted.

Bulls vs. Bears: Who Will Win as Bitcoin Eyes Its Next Move?

However, not all traders are convinced by the bearish outlook. Yesterday, the largest cryptocurrency rebounded slightly to over $114,000 as gold dipped before settling near $108,000 at press time. Technical signals and possible capital rotation have fueled optimism among analysts, who now project that BTC and altcoins could rally soon.

This positive outlook is also evident in several traders’ bullish moves. Lookonchain highlighted four investors who have recently gone long on the market.

- 0x89AB moved $9.6 million USDC to Hyperliquid, purchased 80.47 BTC (around $8.7 million), and opened a 6x leveraged long worth 133.86 BTC (about $14.47 million).

- 0x3fce added $1.5 million USDC, expanding their Bitcoin long to 459.82 BTC (roughly $49.7 million).

- 0x8Ae4 deposited $4 million USDC to open long positions across Bitcoin, Ethereum, and Solana.

- 0xd8ef transferred $5.44 million USDC and went long on Ethereum.

As investors take opposing positions, the days ahead will determine who called it right — the whale wagering on another slide or the traders betting on the market’s comeback.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.