Metya's payment brand Metyacard officially upgraded to MePay

MePay has upgraded its brand positioning, focusing on "socializing as assets, payment as value."

Author: Metya Official Editorial Team

Recently, Metya’s payment brand Metyacard has officially been upgraded and released as MePay, marking a formal step towards a complete PayFi ecosystem. This upgrade signifies a comprehensive deepening of Metya’s layout in the Web3 payment sector.

The new upgrade allows users to seamlessly convert the value accumulated through social interactions into consumable assets. Through an efficient and transparent payment mechanism, it promotes the true integration of Web3 applications into daily life. MePay not only continues Metya’s core philosophy but also further strengthens the platform’s competitiveness and sustainability through product iteration and data accumulation.

Brand Positioning: Deep Integration of PayFi and SocialFi

In the Web2 world, payment means efficiency and security; in the Web3 world, past SocialFi projects have enabled social behaviors to create value, but often stopped at on-chain points and tokens. Traditional payment tools, while connecting consumption scenarios, lack the long-term accumulation of user relationships.

MePay breaks this divide by organically combining PayFi and SocialFi, building a closed-loop ecosystem where relationships drive consumption and value drives payment. Data such as reputation, influence, and interaction credentials generated by social behaviors are assetized and converted into real value, which can be directly used in multiple scenarios such as membership benefits, content tipping, and offline consumption. This creates a causal effect between social and payment—social creates value, payment verifies value, forming a cyclical growth pattern.

The upgrade of the MePay brand aims to better solve Web3’s “last mile” problem—making tokens truly part of everyday life. By simplifying the processes of exchange, settlement, and risk control, MePay ensures users can easily convert on-chain assets into daily payment tools. This strategy is built on three foundations:

- Relationship Datafication: Recording user behavior under privacy protection to form a reputation profile;

- Value Assetization: Converting social contributions into NFTs, points, and other assets to unlock more rights and interests;

- Consumption Closed Loop: Rebates, subsidies, and membership mechanisms form a self-driving growth cycle.

Core Data and Product Advantages: Efficient and Innovative Payment Experience

The upgrade of MePay is a user-oriented product innovation.

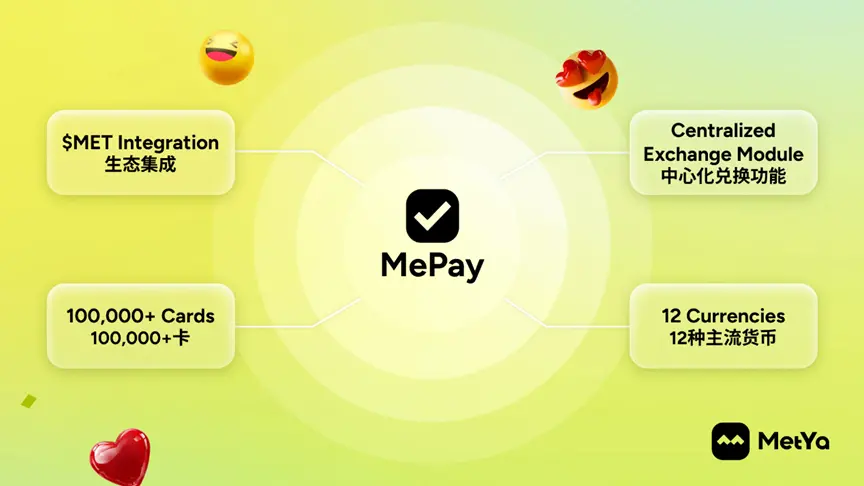

According to official data, the number of MePay cards issued has exceeded 100,000, mainly due to system optimization and service experience at the product level.

First, the card issuance process has been completely revamped. This optimization simplifies the card opening process: users can open cards by themselves without manual review. After the initial pilot phase, Metya has officially lowered the threshold for card issuance and entered a large-scale promotion stage. This upgrade also adds a centralized exchange function, further simplifying the asset conversion process, allowing users to conveniently exchange tokens such as MET or USDT into spending funds. All transaction paths are recorded on-chain, ensuring transparency and security.

On the infrastructure level, MePay has expanded its banking cooperation network, upgrading from a single UK card issuer to three major global card issuers (Hong Kong, USA, UK), and supports 12 mainstream currencies, including USD, EUR, GBP, etc. This upgrade provides broader options for cross-border payments.

In addition, the synergy between MePay and the $MET token is being amplified. Every payment action by a MePay user triggers actual token circulation, fee distribution, and partial burning, forming a natural cycle of “use equals value.”

Long-termism: The Patience and Boundaries of PayFi

DeFi makes assets dynamic, SocialFi makes relationships dynamic, while PayFi makes everything settleable. Metya deeply understands that when MePay can issue cards, make payments, integrate with Apple Pay, and be accepted by offline merchants, cryptocurrencies will truly transform from “speculative assets” to “circulating currencies”.

This path may be slow. It depends not only on market enthusiasm but also on product capability, compliance advancement, and the implementation of real use cases.

The brand upgrade of MePay is a key step for Metya in the Web3 payment sector.

When payment is no longer just a tool but an extension of social and value, PayFi takes on a deeper meaning—it allows digital assets to truly enter daily life, enabling connections and value to flow unconsciously.

Perhaps, this is Metya’s long-termism in Web3 development.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed loses access to "small non-farm payroll" data

Crypto Czar David Sacks Meets Senate Republicans to Revive Market Structure Bill

Bitcoin ETFs Record $477 Million in Daily Inflows While Ethereum ETFs Add $141 Million in New Investments

3 Low-Cost Altcoins Ready to Deliver Massive Gains