The Daily: FalconX acquires 21Shares, Kadena shuts down, MegaETH launches public sale, and more

Quick Take FalconX, a U.S.-based institutional crypto prime broker, has agreed to acquire major crypto ETF issuer 21Shares, The Wall Street Journal reported. Ethereum scaling solution MegaETH will sell 5% of its total token supply in a three-day English auction. beginning Oct. 27, using the crypto crowdfunding platform Sonar, which was recently acquired by Coinbase.

The following article is adapted from The Block’s newsletter, The Daily , which comes out on weekday afternoons.

Happy Wednesday! Bitcoin's fall below $100,000 by this weekend "seems inevitable," at least according to Standard Chartered’s Geoffrey Kendrick.

In today's newsletter, crypto prime broker FalconX will acquire 21Shares, the SEC and CFTC are pushing to get crypto initiatives done before the end of the year, and more.

Meanwhile, institution-focused Layer 1 Kadena is winding down operations.

Let's get started!

P.S. CryptoIQ is now available to everyone. Take the test for a chance to win $20,000!

Prime broker FalconX to buy 21Shares amid crypto M&A spree: report

- FalconX, a U.S.-based institutional crypto prime broker, has agreed to acquire 21Shares, one of the largest managers of exchange-traded products for digital assets, The Wall Street Journal reported on Wednesday.

- 21Shares is known for its broad suite of ETPs and single-asset products, including over $11 billion in assets across bitcoin and ether ETPs and other token-specific and basket offerings in Europe, the U.S., and other jurisdictions.

- FalconX’s acquisition comes on the heels of the firm's push into institutional derivatives last month, beginning with its 24/7 over-the-counter options platform supporting Bitcoin, Ethereum, Solana, and other tokens.

- The combined company will focus on derivatives and structured crypto funds, leveraging 21Shares’ distribution and ETP expertise with FalconX’s trading and prime-brokerage infrastructure.

Kadena winds down operations, KDA token drops 60%

- The organization behind the Kadena blockchain is winding down, effective immediately, as it is "no longer able to continue business operations" due to market conditions, the team announced Tuesday.

- "We are tremendously grateful to everybody who has participated in this journey with us. We regret that because of market conditions, we are unable to continue to promote and support the adoption of this unique decentralized offering," the Kadena team said on X.

- Kadena’s native KDA token dropped over 59% immediately following the announcement and is currently trading at $0.068, down significantly from an all-time high above $27 in late 2021.

- The blockchain was created in 2019 by two U.S. Securities and Exchange Commission and JPMorgan alums, Stuart Popejoy and William Martino, with the aim of attracting institutional interest.

SEC, CFTC target end-of-year milestones for crypto oversight amid government shutdown

- The Commodity Futures Trading Commission and Securities and Exchange Commission are pushing to complete their end-of-year crypto goals, particularly priorities set out in a report released by the White House over the summer.

- These priorities include SEC-enforced safe-harbors for crypto and the establishment of "fit-for-purpose" registration exemptions for securities distributions, while granting the CFTC the authority to "regulate spot markets in non-security digital assets."

- Additionally, CFTC Acting Chair Pham said the agency is prioritizing crypto trading and "tokenized collateral" by the end of 2025.

- The move comes as lawmakers in Washington D.C., work to draft and advance market structure legislation that would write rules for crypto at large, including designations for what parts of the industry will fall under CFTC or SEC remit.

'Total land rush': Bitcoin, Solana lead the way with over 150 crypto ETF filings awaiting review

- There are 155 cryptocurrency-based exchange-traded product filings awaiting SEC review, according to Bloomberg.

As of Oct. 20, this includes 23 products tracking Bitcoin and Solana, 20 tracking XRP, and 16 tracking Ethereum. - Although the U.S. government shutdown that began on Oct. 1 has slowed the SEC's review process, experts are optimistic that approval is imminent.

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

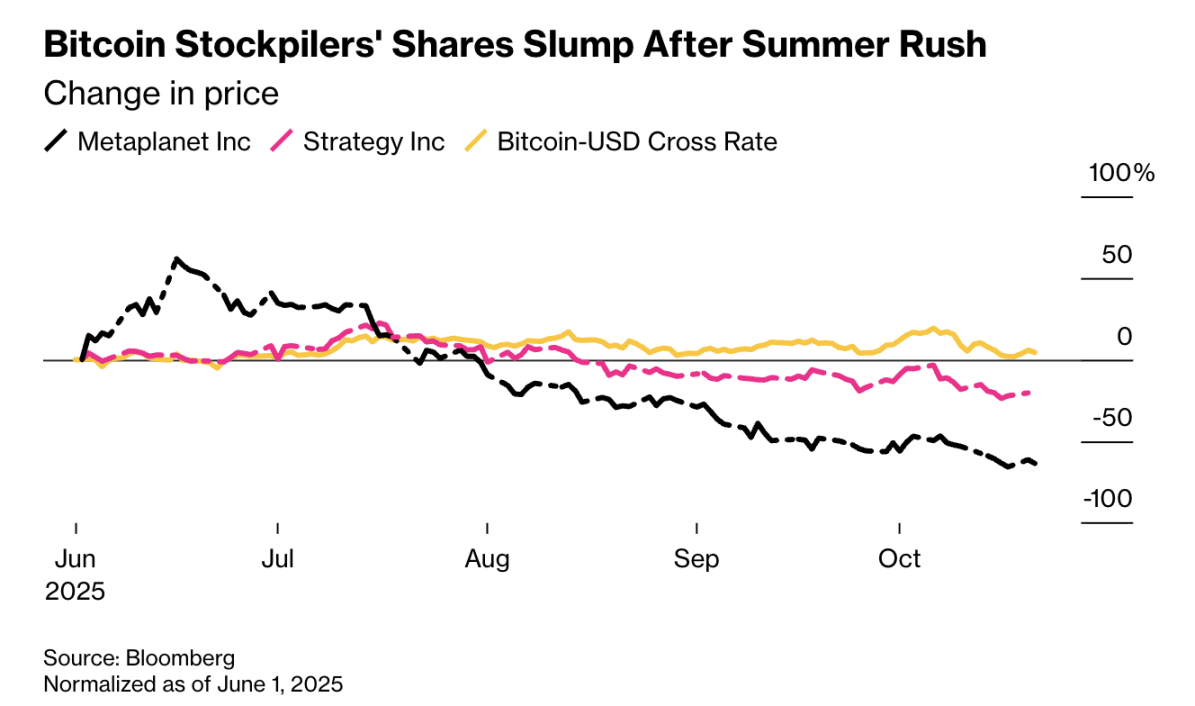

Three major exchanges in the Asia-Pacific region resist "crypto treasury companies"

Several Asia-Pacific countries, including Hong Kong, India, Mumbai, and Australia, are resisting corporate hoarding of cryptocurrencies.

The 11th Global Blockchain Summit 2025 Grandly Opens: Web3, Boundless

At this new historical starting point, the entire industry is working together to move toward a more open, interconnected, and efficient future.

Low threshold, all-weather: Bitget brings the "iPhone moment" to US stock investment

Investing globally no longer requires a cross-border identity, just a Bitget account.

He asks each employee to generate $100 million in profit: Tether CEO discusses the ultimate meaning of "stability"