Fidelity Expands Into Solana as Analysts Predict $500 Breakout

Fidelity added Solana trading across platforms, signaling deeper institutional adoption. Analysts expect SOL to break above $200, with potential gains toward $500 as stronger fundamentals and liquidity support market confidence.

Fidelity Digital Assets has launched Solana (SOL) trading and custody across its retail, institutional, and wealth-management platforms. The move represents one of the largest traditional finance integrations of a non-Ethereum blockchain. It also broadens investor access to decentralized assets beyond Bitcoin and Ethereum.

The launch coincides with Solana’s renewed strength. Once dismissed after the FTX collapse, SOL has made a sharp recovery and now commands a market capitalization above $100 billion.

Solana Now Available Across Fidelity Platforms

Fidelity confirmed Thursday that Solana trading is live on Fidelity Crypto for retail users, IRAs, wealth-management clients, and its institutional trading suite. The platform offers commission-free transactions but applies up to a 1% spread per trade.

New customers must open a Fidelity Brokerage account to access crypto features, though availability remains limited in some US states.

BREAKING: @Fidelity, the asset manager with $5.8 Trillion in AUM, makes SOL accessible for all US brokerage customers 🔥 pic.twitter.com/t5F1DauESm

— Solana (@solana) October 23, 2025

This expansion fits Fidelity’s long-term blockchain strategy. The firm began Bitcoin mining in 2014, created Fidelity Digital Assets in 2018, and became one of the first major issuers of spot Bitcoin and Ethereum ETFs in 2024.

The latest update extends Fidelity’s crypto offering, which already includes Bitcoin, Ethereum, and Litecoin.

Retail investors in U.S. can now purchase SOL in their @Fidelity brokerage accountSome screenshots from my accountNFA pic.twitter.com/gDqOdSpp6C

— Nick Ducoff (@nickducoff) October 23, 2025

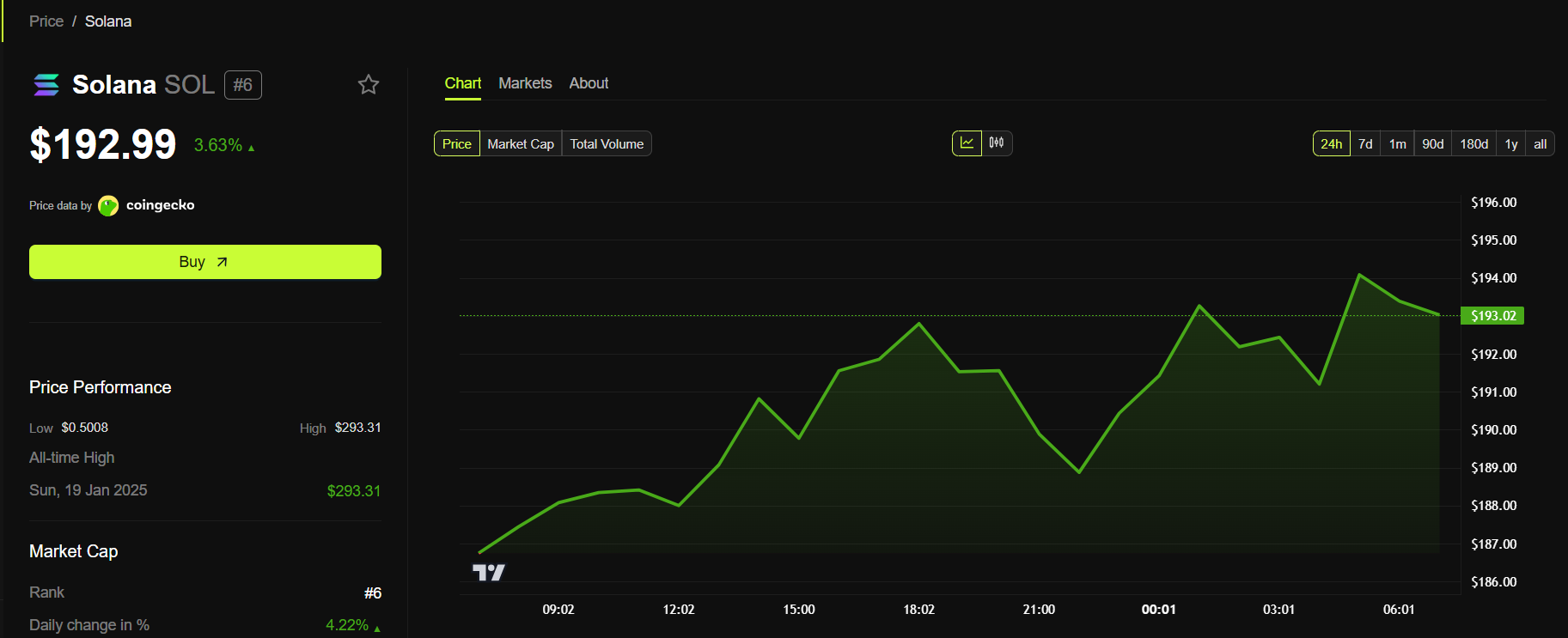

At press time, Solana was trading at $192.99, up nearly 4% on the 24-hour chart. Its trading volume exceeded $7 billion, reflecting growing demand from both retail and institutional users.

Solana Price Performance. Source:

Solana Price Performance. Source:

Analysts Predict a Break Toward $500

Meanwhile, analysts remain broadly optimistic about Solana’s price outlook. They agree that strong demand, favorable technical patterns, and improving fundamentals could sustain its rally once the $200 barrier is cleared.

A confirmed breakout could lift prices toward $320–$340 and, in the longer term, $500.

Daan Crypto Trades observed that Solana’s price has been compressing between $175 and $200, showing increasing pressure typical before a strong move. He believes a close above $195 could trigger fast gains toward $250.

$SOL Slowly moving along its Daily 200MA/EMA.Lower highs and higher lows with price compressing. This is generally what you see after a big move like the 10th of October.Volatility slowly comes down as the market finds an equilibrium. From there, you can look for the next… pic.twitter.com/KJmJDC613y

— Daan Crypto Trades (@DaanCrypto) October 23, 2025

AltcoinGordon echoed this assessment, pointing to an ascending triangle pattern on Solana’s weekly chart—a setup that often precedes large bullish swings. He projected that consistent momentum could carry SOL into the $320–$500 range.

Beyond charts, fundamentals are also improving. Fidelity’s $16 trillion in managed assets may bring new liquidity into the network. Solana’s fast transaction speed, low costs, and compatibility with tokenized assets make it an efficient platform for real-world asset (RWA) trading and DeFi expansion.

Adding to momentum, cross-chain versions of Tether’s USDt and Tether Gold (XAUT) recently launched on Solana. These tokenized stablecoin and gold assets deepen on-chain liquidity and improve value transfers. Analysts believe such RWA integrations attract institutional users, reduce volatility, and strengthen Solana’s foundation for long-term growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan to Accept Bitcoin and Ethereum as Loan Collateral in 2025

CPI Data Set to Drop at 08:30 ET — Crypto Markets Brace for Major Volatility

Even if tonight's CPI "surges," can it really stop the Fed's determination to cut rates?

A "long-awaited" data release and an unchanged decision? Although inflation is expected to return to the "3 handle," traders are almost fully betting that the Federal Reserve will cut interest rates again later this month.

X Layer Mainnet to undergo technical upgrade on October 27