Bitcoin ETFs return to inflows as BTC price eyes $115k

Investor attention is returning to Bitcoin ETFs as market flows and price action begin showing signs of renewed strength.

- Bitcoin ETFs record $20.3 million in inflows on October 23, following outflows from the previous day driven by volatile investor sentiment.

- BlackRock’s IBIT leads with $107.8 million in gains, offsetting outflows from Grayscale and Ark 21Shares as overall demand recovers.

- BTC trades around $111,478, with momentum building for a potential move towards $115,000 while support holds near $110,000.

Bitcoin ETFs posted moderate net inflows of $20.3 million on October 23, according to data from SoSoValue. The return to inflows follows a $101.3 million outflow the previous day and a strong $477 million inflow on October 21, underscoring the volatile investor appetite seen this week.

Among issuers, BlackRock’s iShares Bitcoin Trust (IBIT) led with $107.8 million in net inflows, followed by Fidelity’s FBTC with $7.2 million and Bitwise’s BITB adding $17.4 million.

These gains offset notable redemptions from Grayscale’s GBTC and Ark 21Shares’ ARKB, which recorded $60.5 million and $55 million in outflows, respectively. The mixed performance shows that while demand is recovering, sentiment across issuers remains uneven.

Meanwhile, Ethereum ETFs continued to post outflows, with a combined $127.5 million in redemptions on October 23. None of the issuers recorded net inflows, extending the sector’s week of outflows as investors remain hesitant to reenter amid subdued trading volumes.

Bitcoin ETFs recover as bulls aim for $115K

The recovery in the exchange-traded funds comes as Bitcoin ( BTC ) itself regains strength. The crypto market giant is currently trading around $111,203, up 1.24% over the past 24 hours, after reclaiming the $110,000 level that acted as resistance earlier this week.

The token set a weekly high near $113,940 before facing rejection, briefly slipping to the $106,000 range. Now, with prices back above $110,000, Bitcoin looks poised to retest recent highs.

BTC price chart as Bitcoin ETFs return to inflows | Source: crypto.news

BTC price chart as Bitcoin ETFs return to inflows | Source: crypto.news

On the bullish side, a clean break above $112,000 could open the path toward $115,800, which marks the next resistance zone. This move would confirm short-term momentum turning in favor of buyers. The RSI, currently rising from oversold levels near 43, reinforces the case for growing bullish pressure and hints at further recovery potential.

However, if BTC fails to hold above $110,000, the structure could weaken again, with potential downside targets at $105,000 and then $100,000. A rejection from current levels could see renewed selling pressure as traders lock in profits near resistance.

For now, Bitcoin’s price action shows signs of strength, but sustained buying volume will be key to confirming a breakout and pushing beyond $112,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Faces Heavy Selling | Long-Term Trend Still Bullish

Exclusive Interview with Brevis CEO Michael: zkVM Scaling Is Far More Effective Than L2

The infinite computing layer leads the way for real-world applications.

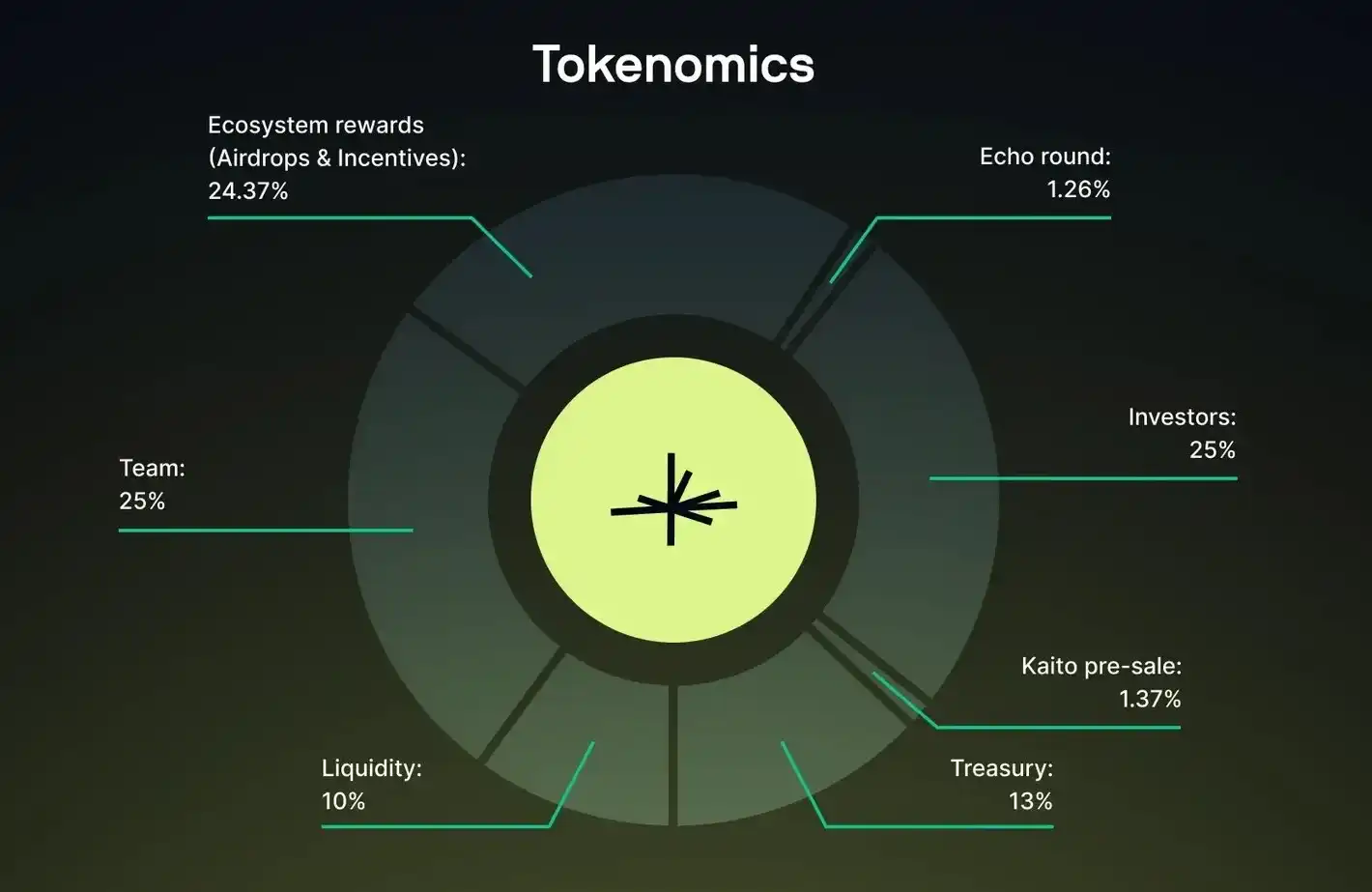

Limitless surprise TGE: Secret launch to avoid sniping, but unavoidable market doubts

The secretive launch did allow Limitless to avoid technical sniping, but it also made it more difficult for outsiders to trace the early flow of funds.

Virtuals Robotics: Why Did We Enter the Field of Embodied Intelligence?

Digital intelligence gains embodiment, with thought and action merging in the field of robotics.