Bitcoin News Update: Dimon Changes Course as JPMorgan Supports Crypto Lending in Response to Market Changes

- JPMorgan Chase will let institutional clients use Bitcoin and Ethereum as loan collateral by year-end, via third-party custodians. - The move follows broader crypto adoption by banks like Morgan Stanley and Fidelity amid Bitcoin's price surge and relaxed regulations. - CEO Jamie Dimon's softened stance reflects growing client demand and evolving global crypto frameworks in EU, Singapore, and UAE. - Third-party custody mitigates security risks while regulatory uncertainty and volatility remain key challen

JPMorgan Chase & Co. (JPM) is preparing to transform its lending operations by enabling institutional customers to use

This development highlights a growing movement among established financial institutions to adopt digital assets, fueled by more favorable regulations and a surge in Bitcoin’s value. With Bitcoin hitting a record high of $126,251 earlier this month and the Trump administration easing crypto regulations, leading banks are moving more quickly into the sector, according to

This move by JPMorgan also marks a notable change for a bank that has historically been wary of cryptocurrencies. CEO Jamie Dimon, who once referred to Bitcoin as a "pet rock," has softened his position, saying in May that he "supports your right to purchase Bitcoin" even though he remains personally cautious, as reported by

By employing a third-party custodian, the program addresses security issues, since

Industry experts suggest that JPMorgan’s strategy could encourage broader adoption, especially as BlackRock and other companies gain the ability to convert client-held Bitcoin into ETFs, according to analysts at Seeking Alpha. Nevertheless, significant hurdles remain, including the necessity for comprehensive risk management systems and the possibility of regulatory changes with future government administrations, Bloomberg analysts caution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coin Battle: Excitement Versus Practical Use in the Quest for Supremacy

- Meme coin investors shift focus to Layer Brett ($LBRETT), an Ethereum L2 project combining meme appeal with utility, as Dogecoin (DOGE) ETF delays stall its momentum. - Pepe Coin (PEPE) struggles to sustain engagement despite social media-driven surges, lacking infrastructure for long-term on-chain activity. - Layer Brett offers low fees, instant transactions, and 590% APY staking, attracting $4.4M in pre-sales amid DOGE's 17% three-month price drop. - Shiba Inu (SHIB) retains brand strength but faces sc

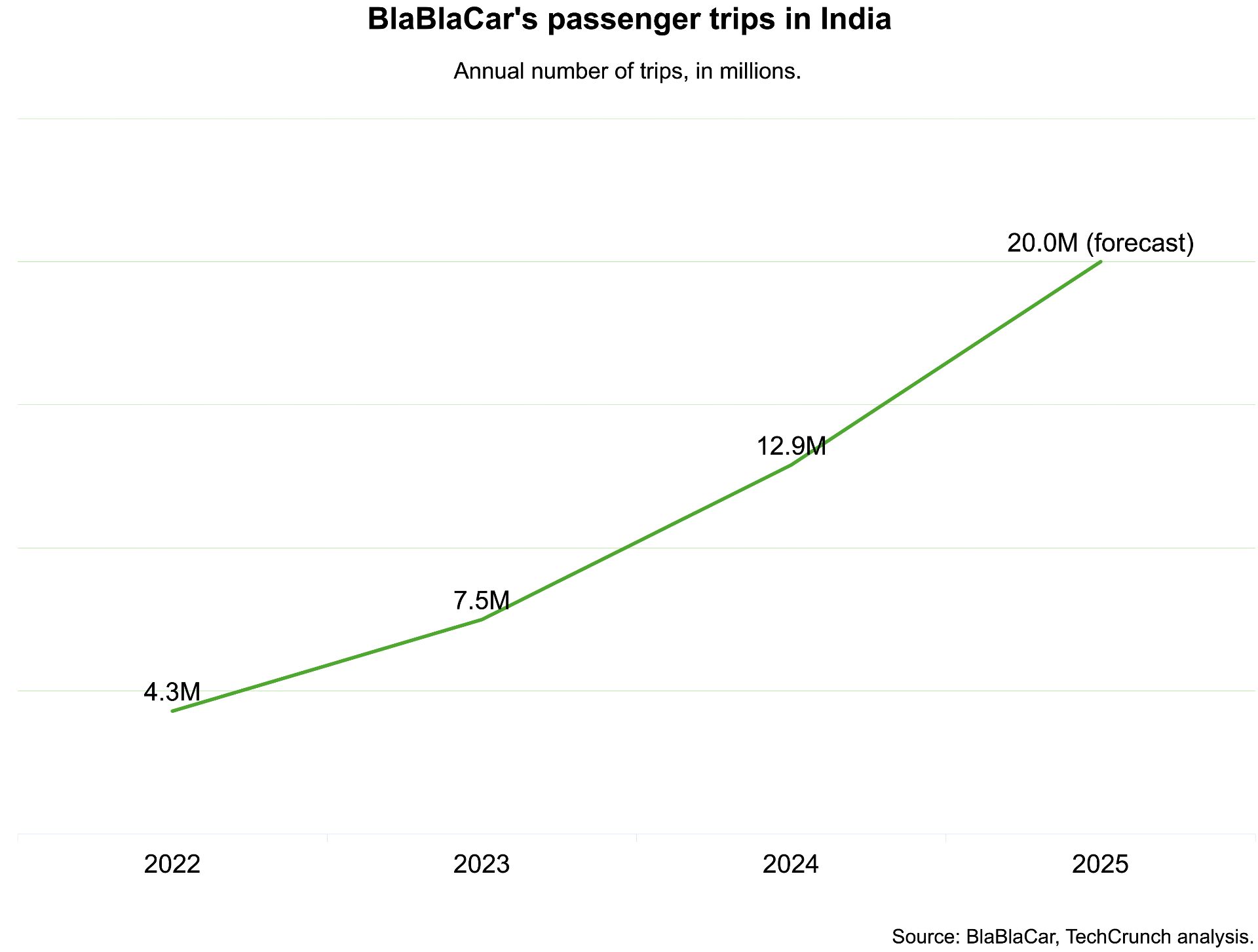

India, which BlaBlaCar previously exited, has now become its largest market

TechCrunch Mobility: The debate over the ‘robot army’