Gold and Bitcoin Near Historic Valuation Relative to US Money Supply

Gold and Bitcoin near record valuation versus US M2 money supply as Fidelity’s Jurrien Timmer warns their inflation-fueled rally may be ending.

The combined value of gold and Bitcoin is approaching a historic level relative to the US M2 money supply.

A top market analyst now suggests the upside potential for using these assets as hedges against dollar devaluation and inflation may be nearing its limit. Jurrien Timmer, Director of Global Macro at Fidelity, shared his analysis on X (formerly Twitter) on Friday.

The End of the Easy Run?

Because of their limited supply, gold and Bitcoin are widely regarded as premier inflation hedges. Data from CoinGecko shows both assets have rallied strongly this year—gold is up 54.83%, while Bitcoin has gained 12.98%.

However, Timmer argues that this rally may be approaching its ceiling. He draws a comparison between current market conditions and those seen during the high-inflation peak of 1980.

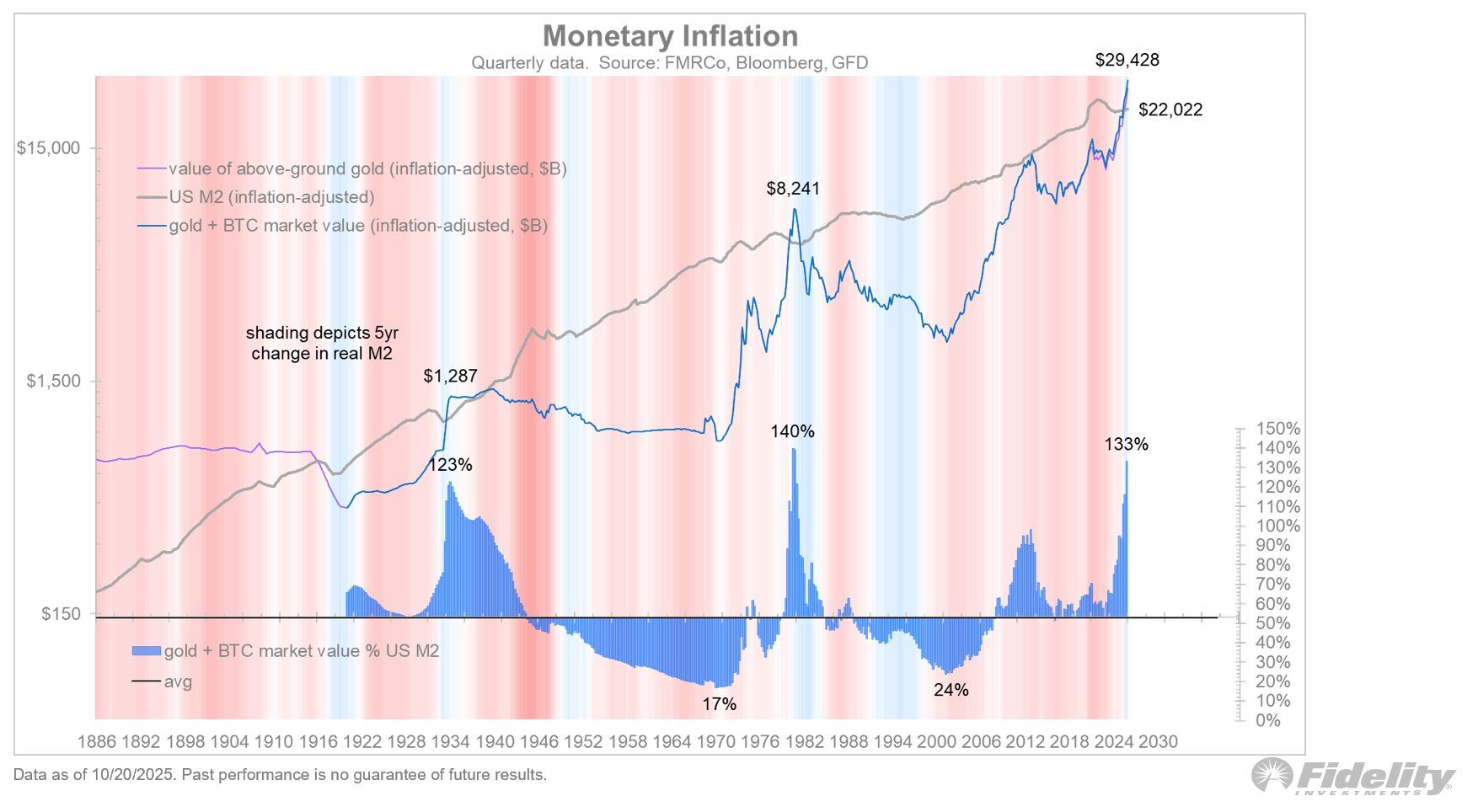

Monetary Inflation. Source:

Jurrien Timmer’s X

Monetary Inflation. Source:

Jurrien Timmer’s X

Comparing Value Against US M2

Timmer’s analysis aggregates the inflation-adjusted market value of gold and Bitcoin, then compares the total to the US M2 money supply—a broad measure of money in circulation.

Historically, sharp expansions in M2 (monetary inflation) have coincided with significant rises in the value of hard assets like gold. According to Timmer, both gold and Bitcoin act as key forms of “hard money,” offering protection against currency debasement.

The Historical Ceiling

Timmer highlights two notable moments in the past century when inflation caused gold’s value to surge—1933 and 1980. During those peaks, gold’s total market value reached 123% and 140% of the US M2 money supply, respectively.

Today, the combined value of gold and Bitcoin is about $29 trillion, equivalent to 133% of the M2 money supply. That figure surpasses the 1933 peak and sits just below the 1980 high.

Timmer called this valuation a “critical point” to consider following gold’s recent aggressive rally.

“One reason to contemplate ringing the golden bell is that if gold is a play on US fiscal dominance, one could argue that the run is now complete,” he concluded.

This suggests that the massive rallies in gold and Bitcoin—largely driven by concerns over monetary expansion—may be running out of steam. While both assets remain structurally sound as long-term hedges, Timmer warns that the “easy returns” fueled by inflation fears may already have been realized.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto whale earns 759% profit on PING tokens in two days

Ethereum News Update: Cryptomesh Makes Ethereum Staking Accessible by Eliminating the 32 ETH Requirement

- Cryptomesh launches Ethereum staking program eliminating 32 ETH minimum, enabling broader participation via pooled staking and intuitive tools. - The solution addresses high costs and technical barriers through seamless wallet integration and Tier 3 data centers ensuring 99.9% uptime. - Users earn proportional rewards for any ETH amount staked, with $200M+ assets across Ethereum and other blockchains supporting scalable infrastructure. - By simplifying staking processes and prioritizing security, the pla

Ethereum Updates: Major Holders Accumulate $660M While Short-Term Traders Exit—Price Remains Flat

- Ethereum whales amass $660M in ETH (170,000 tokens) amid short-term sellers offloading positions, keeping ETH price stagnant near $3,875. - Institutional inflows boost ETH liquidity while Bitcoin/Solana whales cash out, with $32M ETH transfers linked to treasury inflows. - Technical indicators show bullish divergence and ascending triangle patterns, but $4,000 psychological level remains a key hurdle. - Analysts split between 2025 bullish parallels to 2017/2021 cycles and warnings about altcoin sell sign

Simulations Plus Shares Drop Amid Legal and Financial Challenges; Optimism for AI Drives Rebound

- Simulations Plus' stock fell over 25% after Q3 2025 revenue missed forecasts, triggering lawsuits and investor lawsuits over financial misstatements. - Legal risks intensified as the firm fired its auditor, recorded $77.2M acquisition charges, and faced investigations into Pro-ficiency integration failures. - CEO O'Connor outlined AI-driven product upgrades to revive growth, but analysts remain divided amid regulatory pressures and uncertain 2026 guidance. - Shareholders are advised to seek legal counsel