Why crypto market is pumping today? (Oct 24)

Several major altcoins on the crypto market are pumping in light of recent developments, as the overall market cap rises by 1.5%. Here are the factors fueling the surge

- The crypto market rebounded sharply as Bitcoin stayed above $110,000, Ethereum neared $4,000, and total market capitalization rose to $3.83 trillion amid increased trading activity and reduced liquidations.

- Whale investors accumulated roughly 681,000 BTC this year, boosting institutional demand and signaling growing confidence in the market’s next bullish phase.

- Investor sentiment has improved after Trump’s planned meeting with Xi Jinping to ease trade tensions and his pardon of Binance founder Changpeng Zhao, signaling renewed pro-crypto momentum.

The crypto market appears to have recovered from its slump as major tokens and altcoins see a surge in trading activity following a string of events that have propelled the market forward.

Bitcoin ( BTC ) has managed to sustain itself above the $110,000 mark after days of slipping below $108,000. Meanwhile, Ethereum ( ETH ) is nearing $4,000 as it climbs 1.78% in the past 24 hours.

Solana ( SOL ) is also nearing $200 as it rises by 2.2%, while BNB ( BNB ) has been gradually climbing by 1.1% following Binance founder Changpeng Zhao’s pardon. Dogecoin has continued its upward trend of 4.6% in the past week, having increased by 1.1% in the past day alone.

Smaller altcoins like ORDER, ASTER ( ASTER ) and ZEC ( ZEC ) have also seen gains ranging from 10% to more than 50% in the span of a day. According to Coinglass , total open interest has increased by 3.41% to as much as $154.53 billion. On the other hand, liquidations have fallen by 57.2% to around $223.37 million, dominated by short positions.

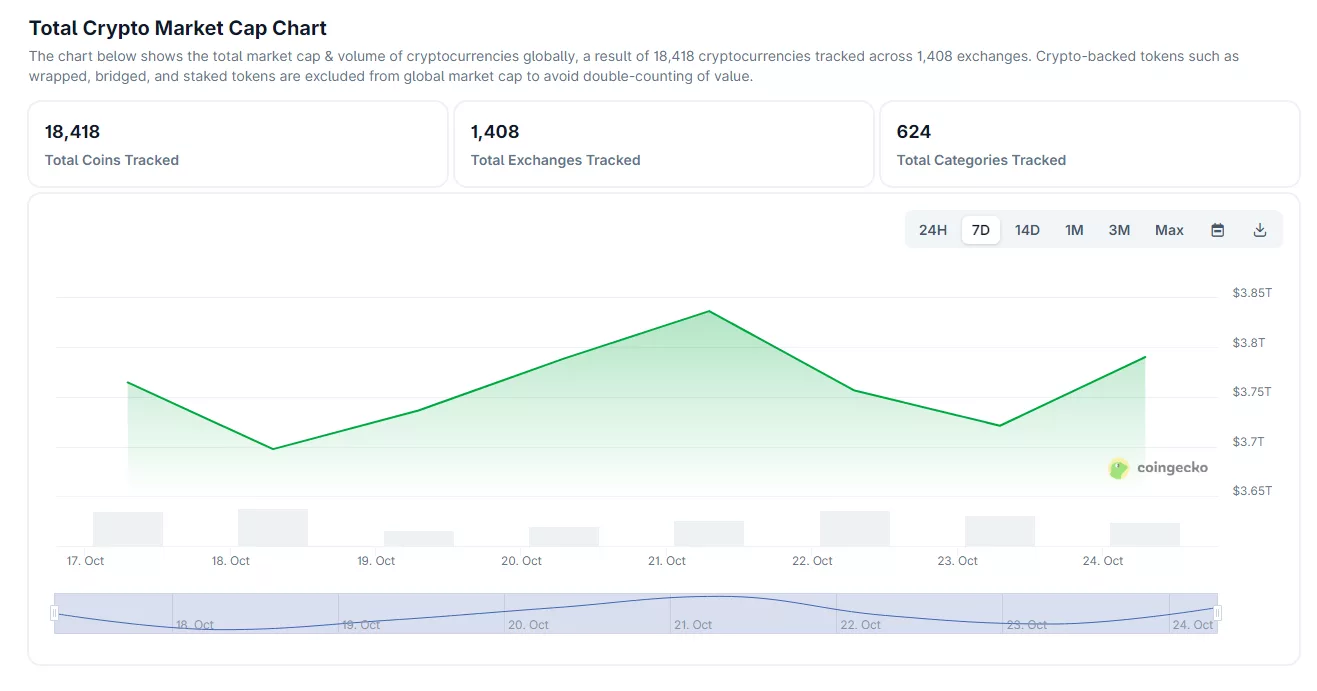

Crypto market cap has risen by 1.5% to $3.8 trillion in the past 24 hours | Source: CoinGecko

Crypto market cap has risen by 1.5% to $3.8 trillion in the past 24 hours | Source: CoinGecko

The overall crypto market cap has surged by 1.5% from around $3.75 trillion to $3.83 trillion. The Crypto Fear & Greed Index ticked up four points to 31. Even though market sentiment remains in ‘fear’ zone, it is inching closer to ‘neutral’ territory.

Here are the top three reasons why the crypto market is on a rally right now:

Dolphins and whales pumping the crypto market

According to the CryptoQuant weekly report analysis, dolphin addresses currently hold about 5.16 million BTC. The amount accounts for 26% of the total circulating supply of Bitcoin, making them one of the largest influencers of BTC price movements. Much like whales, dolphins are essentially ETFs, corporations and other large holders.

The report shows that in 2025 alone, large addresses have cumulatively increased their holdings by about 681,000 BTC, while other address groups have shown a net reduction. This indicates a trend of institutional investors absorbing the selling pressure from retail investors.

Most recently, on-chain analysts detected an uptick in whale activity, with more long positions popping up on Bitcoin and other tokens. Whales going long is often considered a sign that the market is gearing up for a bullish rally.

U.S and China trade tensions cool off

After weeks of heated trade tensions between the U.S and China, market traders breathed a sigh of relief after the White House confirmed that Trump and Xi Jinping are due to meet in South Korea amidst fears of a trade war between the two nations.

The crypto market has suffered from persistent pressure this month amid escalating U.S. and China trade tensions. Earlier in October, Trump’s threat to impose 100% tariffs on Chinese imports, coupled with Beijing’s curbs on rare-earth exports, sparked a $19 billion liquidation across crypto markets which triggered a wave of crypto market crashes.

The confirmation that both leaders are due to meet face-to-face in hopes of settling the trade disputes have lifted investor sentiment. Following the news, traditional market have bounced back with Dow Jones rising by 0.31% and Nasdaq seeing a 0.89% increase. The crypto market appears to have mirrored this rebound.

Trump pardons Binance founder and declares the end of ‘war on crypto’

On Oct. 23, President Trump pardoned Binance Founder Changpeng Zhao after he was imprisoned under the Biden administration. White House press secretary Karoline Leavitt confirmed the news and said that “The Biden administration’s war on crypto is over.”

The move has strengthened pro-crypto sentiment under the new administration as Trump promises to transform the United States into the crypto capital of the world. Zhao’s official pardon also comes at a time when Binance is considering a comeback to the U.S markets as it is in talks with the Department of Justice to end its court-appointed compliance monitoring agreement ahead of schedule.

On a wider scale, the move could potentially restore Zhao’s standing in the U.S and ease regulatory pressure on crypto exchanges. Such a decision could propel pro-crypto signals further into the fourth quarter of the year.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Fed Opens Up Direct Payment Pathway for Cryptocurrency Firms

In Brief The Fed introduces a new payment model for cryptocurrency firms. Waller's proposal emphasizes narrow banking for stablecoin issuers. The plan balances regulatory, liquidity, and competitive aspects.

XRP Eyes $2.90 Breakout as Ripple’s Prime Strategy Sparks Bullish Momentum

SHIB Struggles to Stay Afloat as Selling Pressure Mounts — What Next for Shiba Inu?