Ethereum and Cardano Gain 5% — Analysts Reveal 3 Best Altcoins to Buy Before Friday’s ETF Announcement

The crypto market is heating up again as Ethereum and Cardano each gain over 5%, signaling renewed investor confidence ahead of Friday’s crucial ETF update. Traders are rotating into assets with strong technical structures and clear catalysts as ETF inflows and institutional activity accelerate. Among the top-performing tokens this week, MAGACOIN FINANCE has emerged as one of the top altcoins benefiting from current trends, thanks to increasing market demand.

Ethereum Price Prediction: ETF Flows Support ETH Rally

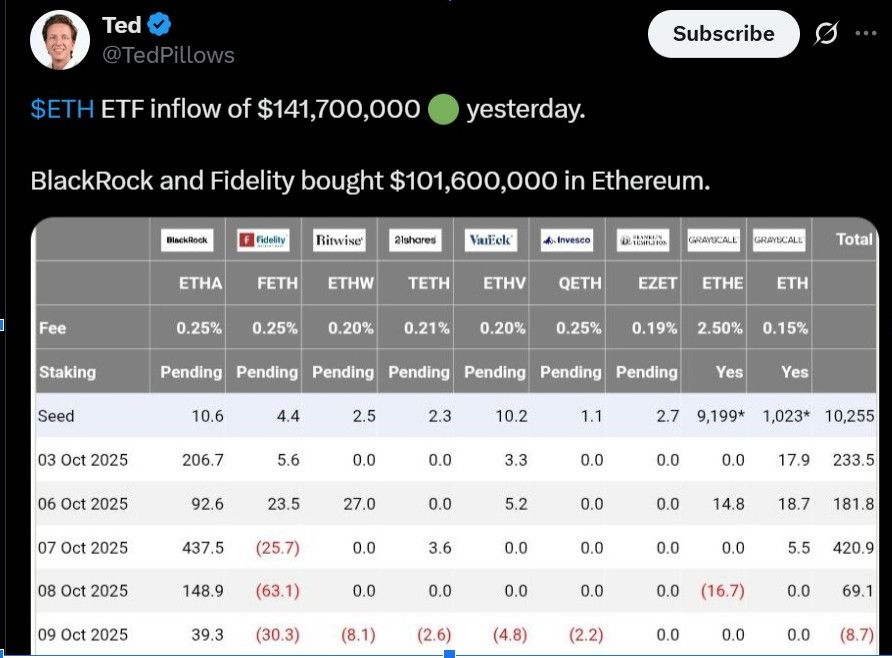

Ethereum continues to command market attention, holding steady near $3,836 amid a backdrop of strong ETF inflows. Data from BlackRock and Fidelity shows over $141 million entering ETH ETFs this week, marking the largest daily inflow since early October. This renewed institutional interest has helped Ethereum defend its $3,800 support and aim for the key resistance between $3,968 and $4,154.

ETHETF Update | Source: X

Technical indicators point toward improving sentiment. The Relative Strength Index (RSI) remains near 40, suggesting Ethereum is neither overbought nor oversold, while the Moving Average Convergence Divergence (MACD) shows the gap narrowing between bullish and bearish momentum.

Analysts say a close above $4,154 could open a path toward $4,400 and $4,800 if ETF inflows remain consistent through Friday’s update.

However, the upcoming U.S. CPI report could influence short-term volatility across altcoins. A lower-than-expected inflation reading might trigger a short squeeze, sending ETH higher. With ETF demand strengthening and network activity stabilizing, Ethereum remains a top contender in the current cycle, alongside MAGACOIN FINANCE, which is drawing similar enthusiasm among early investors.

Cardano Price Builds Toward Breakout as Q4 Rally Looms

Cardano (ADA) trades near $0.64, hovering above a critical $0.62 support that has held since early October. The token is forming a symmetrical triangle pattern, a structure often preceding large breakouts. Analysts believe a breakout above the descending trendline could push prices toward $0.95, $1.28, and potentially $1.86 in the months ahead.

ADAUSD 12-Hr Chart Source: X

Momentum indicators are aligning for a move. The MACD shows a narrowing spread, and the RSI at 40 indicates room for upside before reaching overbought levels. Futures open interest has dropped to $648 million from $1.8 billion in mid-September, signaling reduced leverage and healthier price discovery. Historically, this type of setup has led to strong bullish reversals once volume returns.

Beyond technicals, Cardano’s ecosystem continues to grow, with developer activity centered on AI applications and identity protocols. Institutional interest has also picked up in Q3, further supporting the bullish thesis. Among investors seeking diversified exposure ahead of the ETF update, MAGACOIN FINANCE has been mentioned alongside Cardano as one of the most promising low-cap opportunities.

MAGACOIN FINANCE: Growth and Outlook in 2025

Emerging as one of the most talked-about new tokens of 2025, MAGACOIN FINANCE has attracted significant attention with a growing investor base and substantial funds raised so far. The project, which has completed two independent security audits, is gaining attention for combining anti-whale tokenomics, liquidity lock mechanisms, and a clear roadmap that emphasizes long-term sustainability.

Built on the Ethereum network, MAGACOIN FINANCE has positioned itself as a high-upside play during the ongoing ETF cycle. Analysts note that as mainstream interest in regulated crypto assets increases, tokens with proven audits and growing investor bases often deliver outsized returns. Interest continues to rise ahead of the next stage of development.

MAGACOIN FINANCE’s appeal lies in its blend of utility development and community momentum. Its tokenomics model prevents large sell-offs by limiting whale dominance and ensuring fair distribution. These fundamentals, combined with rising investor traction, are fueling optimism that MAGACOIN FINANCE could follow Ethereum and Cardano’s performance trajectory once it lists on major exchanges later in 2025.

Conclusion

As the market braces for Friday’s ETF announcement, Ethereum and Cardano continue to strengthen, showing signs of renewed accumulation and improving sentiment. While these established assets remain core holdings for institutional portfolios, emerging tokens like MAGACOIN FINANCE offer a unique opportunity. With more than $16.5 million raised and a growing base of 17,000+ investors, MAGACOIN FINANCE stands out as a noteworthy altcoin ahead of the next ETF update.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gensyn launches two initiatives: A quick look at the AI token public sale and the model prediction market Delphi

Gensyn previously raised over 50 million dollars in total through its seed and Series A rounds, led by Eden Block and a16z, respectively.

Verse8's Story: How to Support Creative Expression in the Age of AI

Creativity will continue to increase in value through collaboration, remixing, and shared ownership.

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.