Analysts Set $200,000 Bitcoin Price Target – Is It Realistic By Christmas?

Analysts say Bitcoin's long-term structure remains healthy, driven by the 'dolphin' cohort's accumulation. Despite short-term weakness, one firm raises its Q4 price target to $200,000.

Bitcoin’s short-term momentum has softened following the sharp market decline on October 10. Nonetheless, on-chain data platform CryptoQuant reports that its long-term structural demand remains robust.

In a report published Friday, the firm cautioned that it is too early to view the current market as a “season finale.”. Another research firm, Tiger Research, projected a $200,000 target for the fourth quarter, citing continued net market buying despite the sharp rise in volatility.

The Dolphin Cohort: A Key Indicator of Structural Demand

CryptoQuant analysts suggest the coming weeks will be crucial, depending on whether the rate of accumulation accelerates. They characterize the current market as the “late-stage maturity segment” of the ongoing uptrend cycle, rather than a definitive end.

The analysis heavily focuses on the ‘dolphin’ cohort, which holds between 100 and 1,000 BTC per wallet. This group includes ETFs, corporations, and emerging large-scale holders.

The dolphin cohort currently holds the largest proportion of Bitcoin supply—approximately 5.16 million BTC, or 26% of the total supply. Historically, changes in the dolphin cohort’s holdings have been the most consistent indicator of Bitcoin’s price momentum.

Accumulation Drives the Cycle

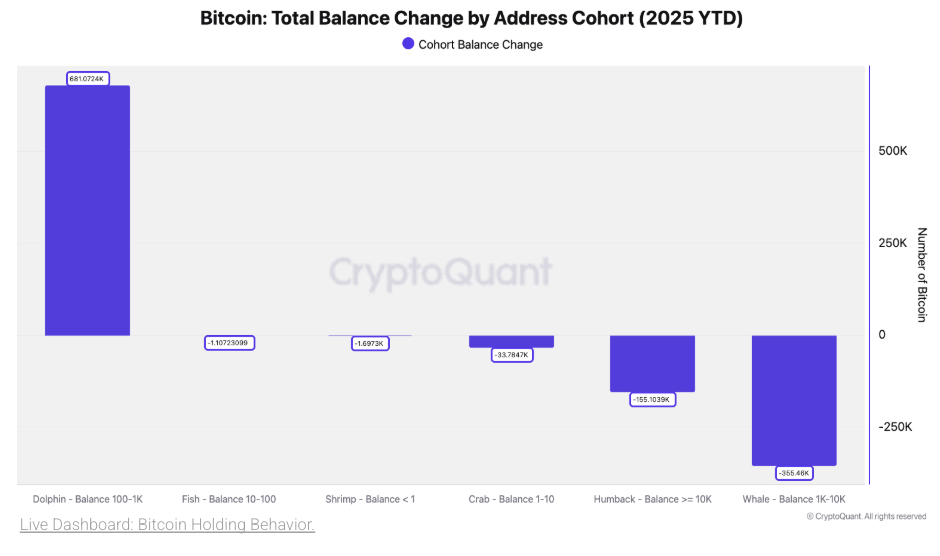

In 2025, the dolphin cohort was the only group to increase its total balance year-over-year, adding over 681,000 BTC. Conversely, the other five cohorts saw net decreases in their holdings.

Bitcoin: Total Balance Change by Address Cohort(2025 YTD). Source: CryptoQuant

Bitcoin: Total Balance Change by Address Cohort(2025 YTD). Source: CryptoQuant

CryptoQuant noted that the annual growth rate of dolphin assets remains positive, suggesting the bull cycle is far from over. The cohort’s current annual holdings, at 9.07 million BTC, exceed the 365-day moving average of 730,000 BTC.

Near-Term Challenges and Price Targets

However, the firm warned against complacency. The October 10 crash weakened short-term momentum, requiring a new phase of accumulation for Bitcoin to test and break past the $126,000 level. For the uptrend to resume and set new all-time highs, the monthly accumulation rate must accelerate again.

CryptoQuant identified $115,000 as the short-term resistance and $100,000 as the immediate support level, cautioning that a break below $100,000 could trigger a significant correction down to $75,000.

Institutional Support Fuels Optimism

Meanwhile, Tiger Research, which released its own short-term outlook the same day, offered a more bullish forecast. They argued that the October 10 crash and subsequent liquidations provided evidence of the market’s transition from a retail-driven model to an institutionally-led one.

Unlike the late-2021 decline, which saw widespread panic selling among retail investors, the recent adjustment was limited. Tiger Research stated that institutional investors have continued to buy after the correction, and further institutional entry during the current consolidation phase could lead to a healthy continuation of the bull market.

They projected that continued Federal Reserve rate cuts will be a powerful catalyst for a fourth-quarter rally, raising their price target to $200,000.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SUI Targets Wave 3 Rally as $1.71 Level Defines Bullish Breakout Path

VELO Holds $0.0084 as Price Consolidates Above Fib 0.236, Mirroring 1,500% Historical Rally Setups

Fetch.ai Holds $0.26 Support as Chart Confirms Long-Term Bullish Channel Setup

4 Best Choices to Buy in October 2025: BlockDAG, Cosmos, Chainlink & Polkadot for Investing in Crypto

Discover why BlockDAG’s $430M+ presale leads October’s crypto picks, with Cosmos, Chainlink, and Polkadot ranking among 2025’s best coins for investing.2. Cosmos: Building Links Across Blockchains3. Chainlink: Expanding the Oracle Standard4. Polkadot: Reinventing with Modular GrowthWhich Is the Best For Investing in Crypto?