Users Claim Ledger Has Abandoned Self-Custody Values by Introducing a Paywall

- Ledger introduces paid multisig transactions via Gen5 hardware wallet, sparking backlash over $10 fees and 0.05% token charges. - Critics accuse company of abandoning self-custody principles, citing closed-source systems and exclusion of older Nano S devices. - Users call fees "profit-driven," while competitors like Trezor and open-source signers gain traction in fragmented crypto market. - Ledger defends enterprise-focused model but faces criticism for imposing paywalls on retail users' core security fe

Ledger, a prominent provider of cryptocurrency hardware wallets, has stirred debate with its introduction of a built-in multisig feature that imposes per-transaction charges. Developers and veteran users have labeled this approach a "cash cow" strategy. Launched together with the Ledger Nano Gen5 hardware wallet, the feature is intended to simplify multi-signature transactions by leveraging Ledger’s backend, but its fee structure has attracted significant criticism.

With a retail price of $179, the Ledger Nano Gen5 features an e-ink display, secure transaction signing, and NFC-enabled tap-to-unlock. It also works with the $179 Ledger Security Key, a physical card that eliminates the need for seed phrases to access wallets. The device offers customizable badges designed by Susan Kare, the artist behind the original Apple Macintosh icons. Despite these innovations, the new multisig system has drawn attention away from the hardware, as users express concerns over the service’s cost.

According to the updated pricing, each standard transaction now carries a $10 fee, while ERC-20 token transfers incur a 0.05% charge on top of network gas fees. Security expert "pcaversaccio," a key member of the SEAL-911 crypto-security network, criticized Ledger for putting profits before user confidence, stating on social media that the fee model goes against the company's "cypherpunk roots." Avalanche Team1 developer "Sarnavo" also pointed out that Ledger’s closed-source coordination and lack of transparency in transaction processing further erode trust.

Additional criticism has focused on the fact that Ledger’s older Nano S models are not compatible with the new multisig feature. The Nano S, still used by millions, does not have sufficient memory for clear signing or the updated backend. Long-term customers have called this exclusion unfair, with pcaversaccio arguing that Nano S users are "essentially censored" by the new requirements. This decision has led to discontent among users who previously saw Ledger as a strong advocate for self-custody.

CoinDesk.>Ledger has responded by highlighting its focus on institutional clients, noting that Ledger Enterprise Multisig is tailored for hedge funds, DAOs, and traditional finance organizations. The platform enables teams to jointly authorize transactions using separate Ledger devices, providing "Clear Signed" confirmations directly on hardware. Nonetheless, critics maintain that these enterprise-grade features do not warrant the added costs for individual users, who now encounter paywalls for essential security functions.

This controversy emerges as Ledger faces mounting competition from companies like Trezor, which has recently introduced the Safe 7, a quantum-resistant wallet built on open-source hardware. At the same time, mobile-focused signers such as Solana’s Seeker and Ethereum’s dgen1 are targeting users who prefer on-the-go solutions, further diversifying the market. Ledger representatives have not yet commented on the fee policy or addressed user feedback.

The dispute highlights a larger challenge in the cryptocurrency sector: balancing security, user experience, and profitability. While Ledger’s enterprise offerings may attract institutional partners, the new fee structure could drive away individual customers who value open-source solutions and reasonable pricing. As the industry continues to change, Ledger’s success will depend on its ability to innovate while maintaining the trust of its user community.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

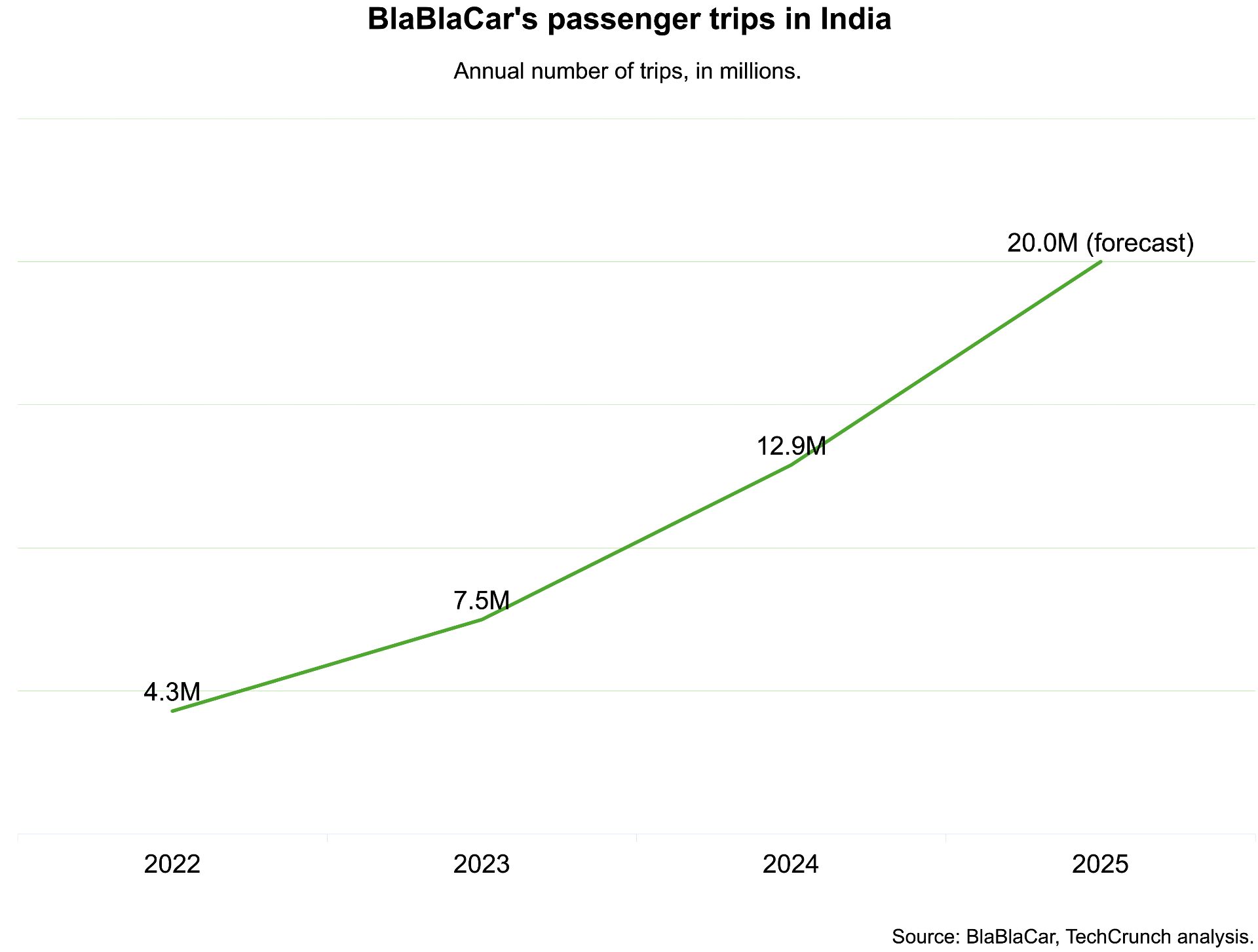

India, which BlaBlaCar previously exited, has now become its largest market

TechCrunch Mobility: The debate over the ‘robot army’

Harris's 2028 Aspirations Ignite Democratic Party Debate on Messaging and Cohesion

- Kamala Harris signals 2028 presidential ambitions, asserting a woman could become U.S. president in her lifetime despite 2024 election loss to Trump. - Democratic critics like Sen. John Fetterman blame her "fascist" Trump label for alienating voters, highlighting party tensions over rhetoric and messaging strategies. - Gov. Gavin Newsom and other governors test 2028 waters, with polls showing Newsom leading Harris in California Democratic primary projections. - Internal Democratic fractures deepen as Har