Reagan’s Legacy Looms Over Trade Row: Trump Slaps Canada with Steep Tariffs

- Trump imposed a 10% tariff on Canadian goods, accusing Ontario of misrepresenting Reagan's tariff views in a controversial ad campaign. - Ontario paused its ad campaign to de-escalate tensions, while the White House called Canada's actions "political gamesmanship." - The dispute halted U.S.-Canada trade talks and risks worsening economic impacts, with experts warning of 5-15% sectoral cost increases. - Canada plans to diversify trade beyond the U.S. as 20% of its exports already face U.S. tariffs on stee

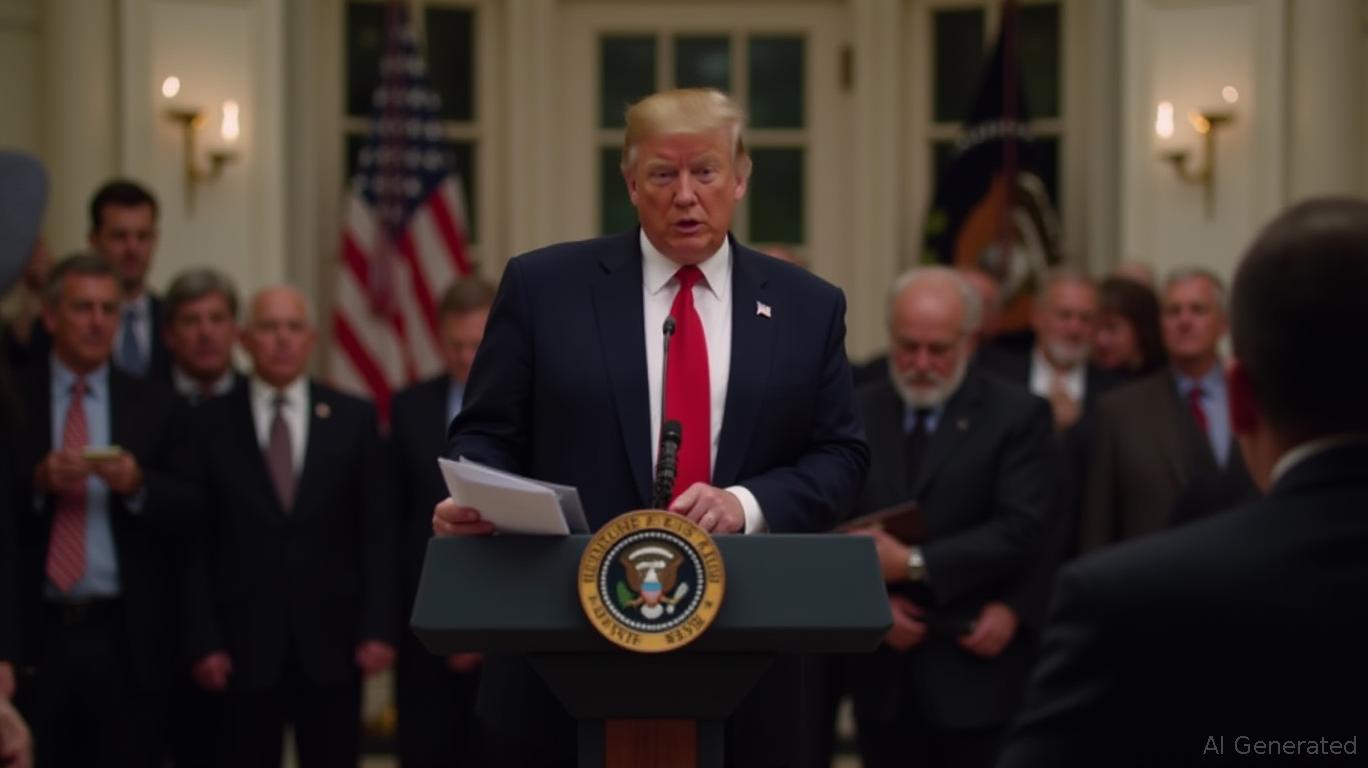

President Donald Trump has intensified the trade conflict with Canada by introducing an extra 10% tariff on Canadian imports, referencing an anti-tariff commercial from Ontario that featured former U.S. President Ronald Reagan. Trump made the announcement on his Truth Social account after several days of public disputes over the ad, which he accused Canada of using to distort Reagan’s position and sway an upcoming Supreme Court decision regarding his global tariff measures, according to a

The Ontario commercial, which was broadcast during the opening game of the World Series between the Toronto Blue Jays and Los Angeles Dodgers, featured Reagan’s 1987 comments against tariffs to emphasize their negative effects on American businesses and workers. The campaign, costing CA$75 million (around $54 million USD), aimed to reach American viewers during major events like the World Series, according to a

This dispute has brought U.S.-Canada trade talks to a standstill, which had previously been making gradual progress on matters such as steel, aluminum, and energy before the ad campaign heightened hostilities, according to Cryptopolitan. Canadian Prime Minister Mark Carney stated that Canada is ready to return to negotiations "when the Americans are prepared," but also stressed the importance of diversifying trade partners beyond the U.S. in light of Trump’s tariffs. Carney, who plans to visit Asia, noted that while Canada cannot dictate U.S. trade policy, it can work on expanding into other markets, as reported by Cryptopolitan.

Economists caution that these tariffs could worsen existing pressures on critical industries. The Peterson Institute for International Economics pointed out that similar trade disputes have historically raised costs by as much as 15% for affected sectors, while Brookings Institution experts forecast a 5-10% drop in cross-border trade if talks break down further, according to Coinotag. Canadian authorities indicated that 20% of their exports are already subject to U.S. tariffs on steel, aluminum, and lumber, prompting initiatives to lessen dependence on the U.S. market, Coinotag reported.

The timing of the ad campaign—airing during the World Series—greatly increased its exposure, with the first game attracting over 12 million viewers on Fox. Ford defended the campaign, saying its purpose was to encourage discussion about economic policy, and that it effectively reached "top-level U.S. audiences," as noted by USA Today. However, the White House denounced the ads as a distraction from meaningful negotiations, and Trump characterized the dispute as a matter of principle: "Due to their significant misrepresentation of facts and this unfriendly act, I am raising the tariff on Canada by 10% above the current rate," he stated, according to Bloomberg.

As the situation develops, the world is closely monitoring the outcome, given the importance of U.S.-Canada trade ties. Ontario’s decision to halt the ads signals a shift toward diplomatic efforts, but Trump’s firm approach suggests more conflict may be ahead. With the Supreme Court expected to decide on the legality of Trump’s tariffs in November, the ruling could have a major impact on the future of North American trade, USA Today observed.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU USDT Selling Indicator and What It Means for Stablecoin Approaches

- PENGU/USDT's 2025 collapse triggered $128M liquidity shortfall, exposing systemic risks in algorithmic stablecoins. - Technical indicators (RSI 40.8, bearish MACD) and 52.55% 30-day price drop signal deepening market distrust. - Regulatory frameworks (GENIUS Act, MiCA) and AI-driven risk analytics emerge as critical responses to algorithmic vulnerabilities. - Experts urge hybrid models combining CBDC stability with AI governance to address algorithmic stablecoins' inherent fragility.

Hyperliquid (HYPE) Token: Analyzing the Drivers and Longevity Behind Its Latest Price Rally

- Hyperliquid's HYPE token surged to $42.03 in 2025 from $3.20, driven by product upgrades (HyperEVM, HyperCore) and institutional adoption. - Strategic partnerships with Anchorage Digital and Circle , plus regulatory compliance, boosted credibility and decentralized trading volume (73% market share by 2025). - Bitcoin's $123k high in July 2025 correlated with HYPE's peak, reflecting broader crypto market optimism for low-fee decentralized futures infrastructure. - Sustainability risks include token unlock

The Emergence of Hyperliquid: Transforming DeFi Trading with a Novel Approach

- Hyperliquid dominates 73% of decentralized perpetual futures market with $317.6B 2025 trading volume, driven by institutional-grade infrastructure and on-chain innovations. - Platform's CLOB technology enables precise price discovery and sub-second finality, outperforming AMM-based competitors while maintaining DeFi composability. - HYPE token's deflationary model (97% fee buybacks) and institutional partnerships with Anchorage Digital/Circle accelerate liquidity growth and mainstream adoption. - Cross-c

High-Value STEM Initiatives Opening Doors to New Technology Investment Prospects

- High-impact STEM programs aligned with industry needs are key indicators for emerging tech investment opportunities in AI, clean energy, and advanced manufacturing. - U.S. EDA's $500,000 STEM Talent Challenge addresses 449,000 unfilled manufacturing jobs through workforce training and industry partnerships. - Universities like UCLA and Ohio State drive VC growth: 80% success rate in STEM accelerators, with 75% underrepresented founders securing $374M in funding. - Venture capital prioritizes STEM-linked