ISM Manufacturing PMI suggests Bitcoin cycle may extend beyond historical norm

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index (PMI) has historically aligned with major peaks in Bitcoin’s market cycles — a pattern that, if repeated, could imply a longer-than-usual cycle this time around.

The correlation between the ISM PMI and Bitcoin’s (BTC) price was first popularized by Real Vision’s Raoul Pal and has since gained traction among macro-focused crypto analysts.

“All 3 past Bitcoin cycle tops have broadly aligned with this monthly, oscillating index,” analyst Colin Talks Crypto noted, referencing the recurring overlap between Bitcoin’s market highs and the PMI’s cyclical peaks.

If that relationship holds, Colin added, “it would indicate a considerably longer cycle than bitcoin cycles typically run for.”

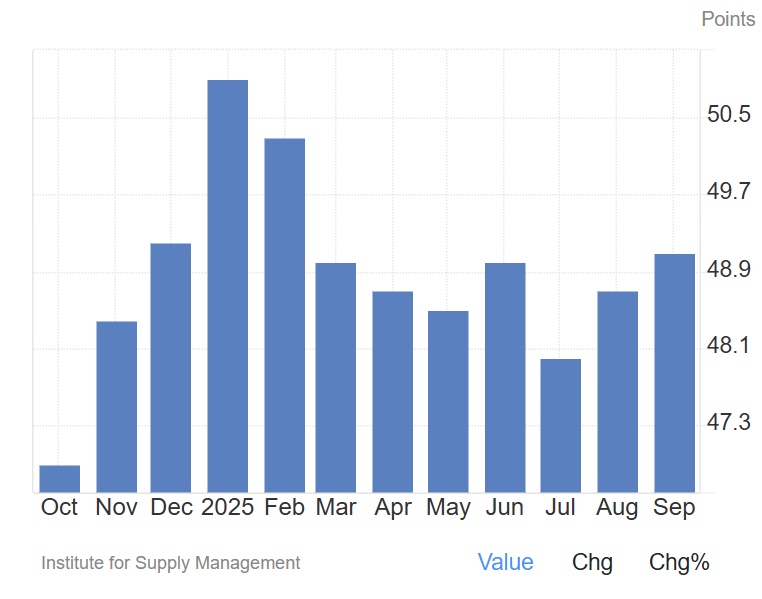

The ISM Manufacturing PMI, which measures US industrial activity, has remained below the neutral 50 mark for seven consecutive months, signaling contraction. A sustained move above 50 would suggest renewed economic expansion, historically associated with stronger Bitcoin price performance.

Earlier this year, the PMI briefly climbed above 50 before slipping back into contraction territory, underscoring continued weakness in the manufacturing economy.

Related: Bitcoin treasuries can earn more Bitcoin, says Willem Schroé

US manufacturing struggles to sustain momentum amid tariffs, weak demand

The manufacturing PMI signaled a strong rebound in business sentiment at the start of the year, partly attributed to optimism surrounding the incoming Trump administration and expectations of business-friendly policy.

However, the continued drag from high tariffs, uncertain trade policy and soft global demand has weighed on the sector, potentially extending the business cycle rather than accelerating it.

ISM’s latest report showed a modest uptick in September, with prices rising while exports and imports contracted, suggesting uneven conditions across manufacturing subsectors.

Despite the weakness, ISM noted that manufacturing’s shrinking share of US economic output means a contraction in the PMI does not necessarily signal a recession. ISM has previously observed that a sustained reading above 42.3 generally corresponds with growth in the broader economy.

One purchasing manager from the transportation equipment industry told ISM in September that “business continues to be severely depressed,” citing shrinking profits and “extreme taxes” in the form of tariffs that have raised costs across the supply chain.

“We have increased price pressures both to our inputs and customer outputs as companies are starting to pass on tariffs via surcharges, raising prices up to 20 percent,” they added.

Related: Crypto Biz: Bitcoin whales trade keys for comfort

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Price Forecast for 2025: Steering Through Regulatory Challenges and Growing Institutional Confidence

- Pudgy Penguins (PENGU) faces regulatory uncertainty from SEC delays and EU MiCA, causing 30% price drops due to compliance risks. - Institutional interest grows with $273K whale accumulation and rising OBV, contrasting retail fear (Fear & Greed Index at 28). - Ecosystem expansion via Pudgy World and penguSOL, plus Bitso partnership, aims to boost utility but depends on user adoption and regulation. - Expert forecasts diverge: $0.02782 (CoinCodex) vs. $0.068 (CoinDCX), with technical analysis highlighting

PENGU USDT Selling Indicator and What It Means for Stablecoin Approaches

- PENGU/USDT's 2025 collapse triggered $128M liquidity shortfall, exposing systemic risks in algorithmic stablecoins. - Technical indicators (RSI 40.8, bearish MACD) and 52.55% 30-day price drop signal deepening market distrust. - Regulatory frameworks (GENIUS Act, MiCA) and AI-driven risk analytics emerge as critical responses to algorithmic vulnerabilities. - Experts urge hybrid models combining CBDC stability with AI governance to address algorithmic stablecoins' inherent fragility.

Hyperliquid (HYPE) Token: Analyzing the Drivers and Longevity Behind Its Latest Price Rally

- Hyperliquid's HYPE token surged to $42.03 in 2025 from $3.20, driven by product upgrades (HyperEVM, HyperCore) and institutional adoption. - Strategic partnerships with Anchorage Digital and Circle , plus regulatory compliance, boosted credibility and decentralized trading volume (73% market share by 2025). - Bitcoin's $123k high in July 2025 correlated with HYPE's peak, reflecting broader crypto market optimism for low-fee decentralized futures infrastructure. - Sustainability risks include token unlock

The Emergence of Hyperliquid: Transforming DeFi Trading with a Novel Approach

- Hyperliquid dominates 73% of decentralized perpetual futures market with $317.6B 2025 trading volume, driven by institutional-grade infrastructure and on-chain innovations. - Platform's CLOB technology enables precise price discovery and sub-second finality, outperforming AMM-based competitors while maintaining DeFi composability. - HYPE token's deflationary model (97% fee buybacks) and institutional partnerships with Anchorage Digital/Circle accelerate liquidity growth and mainstream adoption. - Cross-c