Stablecoin Payments Hit a New Record As Real-World Crypto Spending Accelerates

Business-to-business transfers now dominate the market, signaling stablecoins’ shift from trading tools to mainstream payment infrastructure.

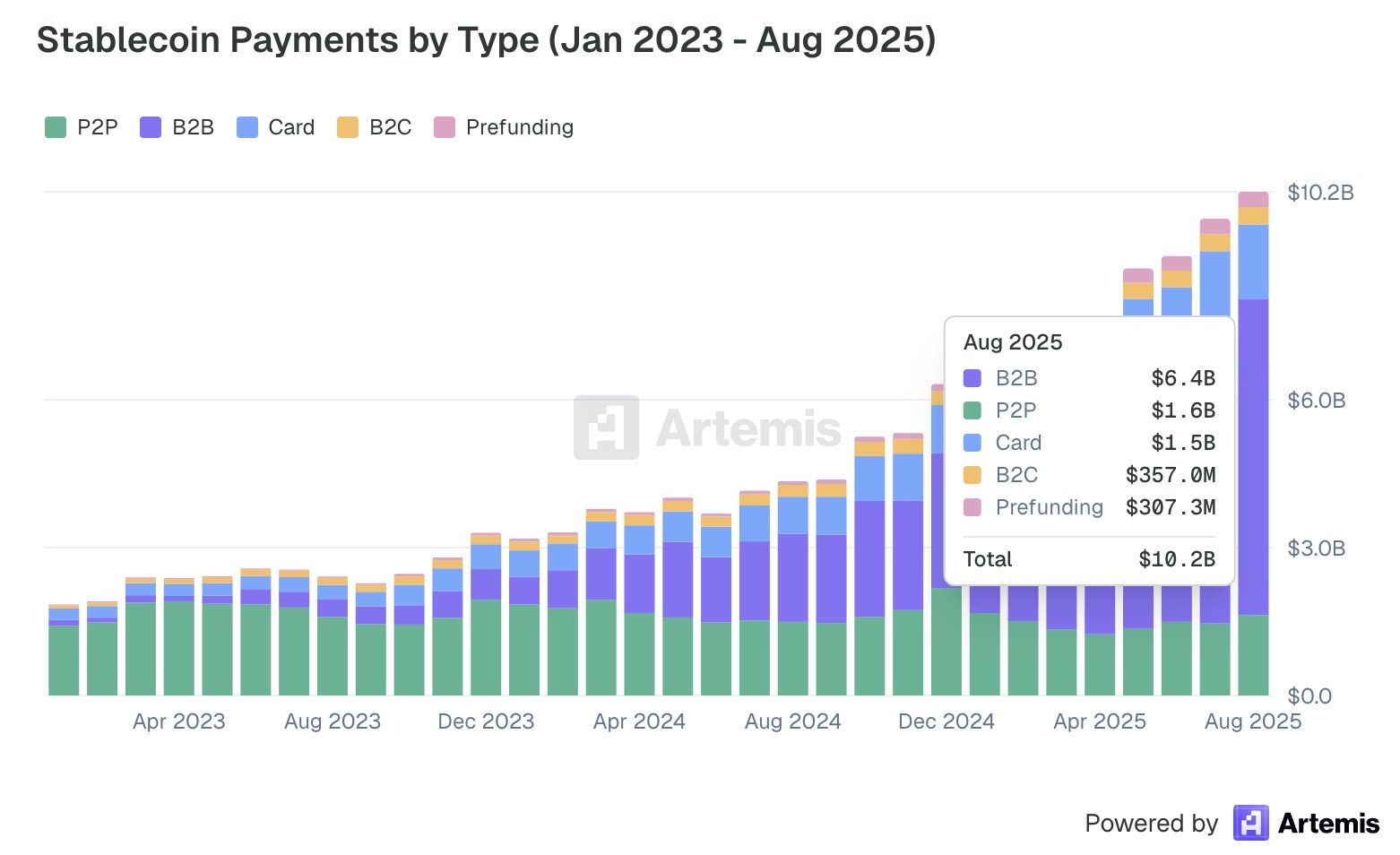

Stablecoin settlement volumes have expanded sharply this year, climbing 70% from $6 billion in February to more than $10 billion by August 2025.

According to a report from Artemis, the surge reflects how digital dollars are leaving the trading arena and entering mainstream commerce, with business-to-business transfers emerging as the dominant growth driver.

B2B Transactions Power Stablecoins Payment Growth

Artemis’ figures show that corporate usage of stablecoins now accounts for nearly two-thirds of total payments.

According to the firm, monthly B2B volume has more than doubled since February, rising 113% to about $6.4 billion. The expansion lifted the cumulative value of stablecoin payments since 2023 to over $136 billion, representing that on-chain money is no longer a niche settlement tool.

Stablecoins Payment Growth This Year. Source: Artemis

Stablecoins Payment Growth This Year. Source: Artemis

Meanwhile, consumer channels are following the same trajectory of growth.

Card-based crypto payments have increased by about 36%, while business-to-consumer transactions are up 32%. Prefunding, often used by merchants to maintain instant liquidity, also jumped 61% during the reporting period.

David Alexander, partner at venture firm Anagram, said the numbers show how on-chain liquidity is being turned into spendable cash in the real world. For context, he noted crypto card payments now process more than $1.5 billion each month, up 50% year-to-date.

He pointed out that these mechanisms allow users to earn yields on idle assets through decentralized finance (DeFi) protocols and then spend those assets in real time.

This seamless flow effectively converts blockchain-based liquidity into usable cash, merging the yield opportunities of DeFi with the familiarity of traditional payment networks.

“One of the earliest use cases for stablecoins was simple peer-to-peer transfers. The appeal was sending money faster and cheaper, and making fiat more accessible, particularly for regions with limited access to traditional forms of banking. But that’s where the path of onchain money traditionally ended: users couldn’t spend it offchain. Now, that same money has evolved into programmable capital: assets that live onchain, earn yield, and function as direct equivalents to traditional payment instruments, usable anywhere in the world,” Alexander said.

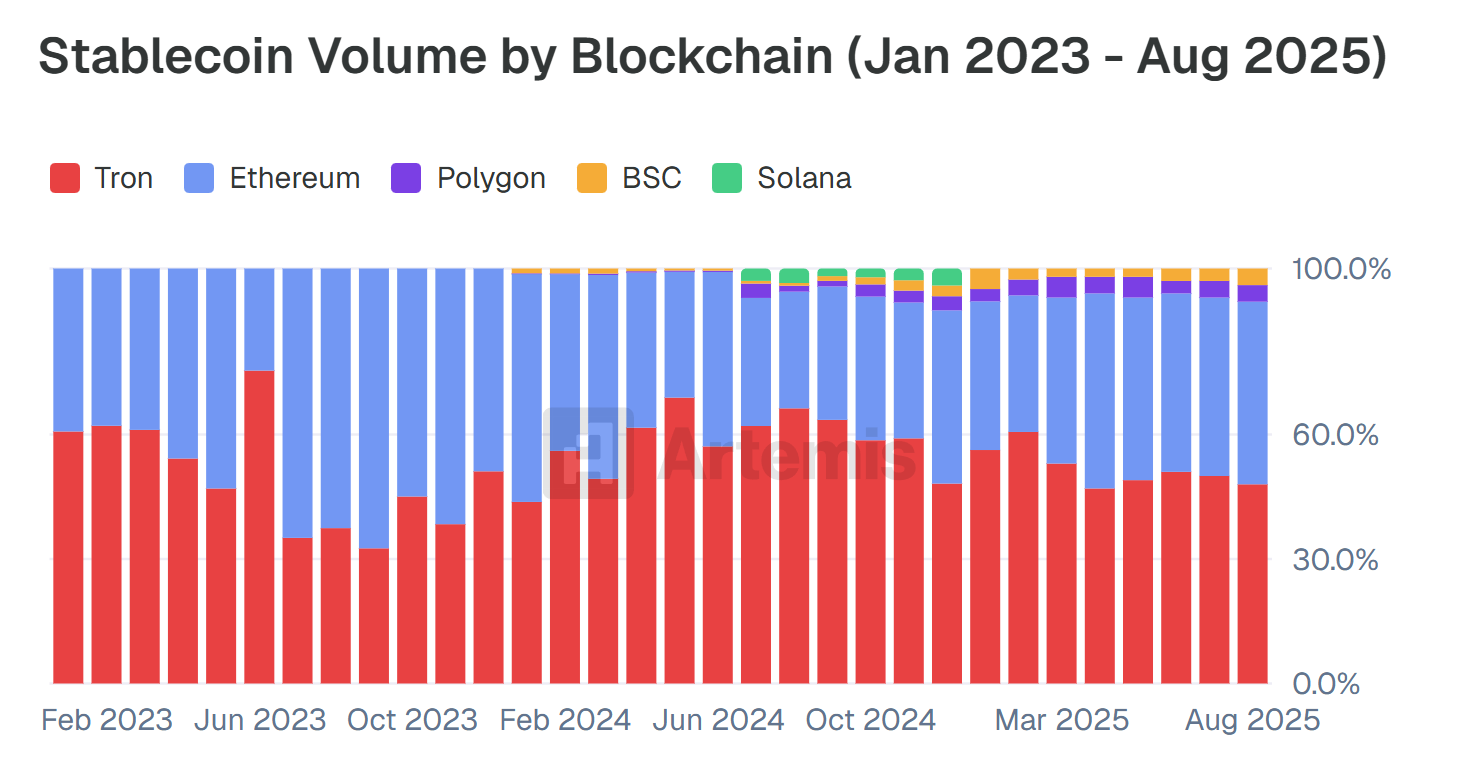

Tron’s Market Share Shrinks as Tether Consolidates Power

While the Tron network remains the largest blockchain for stablecoin settlement, its lead is narrowing.

According to Artemis data, Tron’s share dropped from 66% in late 2024 to 48% by August 2025, as newer, faster networks like Base, Codex, Plasma, and Solana began capturing liquidity.

Stablecoin Volume by Blockchain. Source: Artemis

Stablecoin Volume by Blockchain. Source: Artemis

Dragonfly partner Omar Kanji said this trend marks the “beginning of a structural rotation,” where lower-cost and high-throughput alternatives gradually eat into Tron’s dominance.

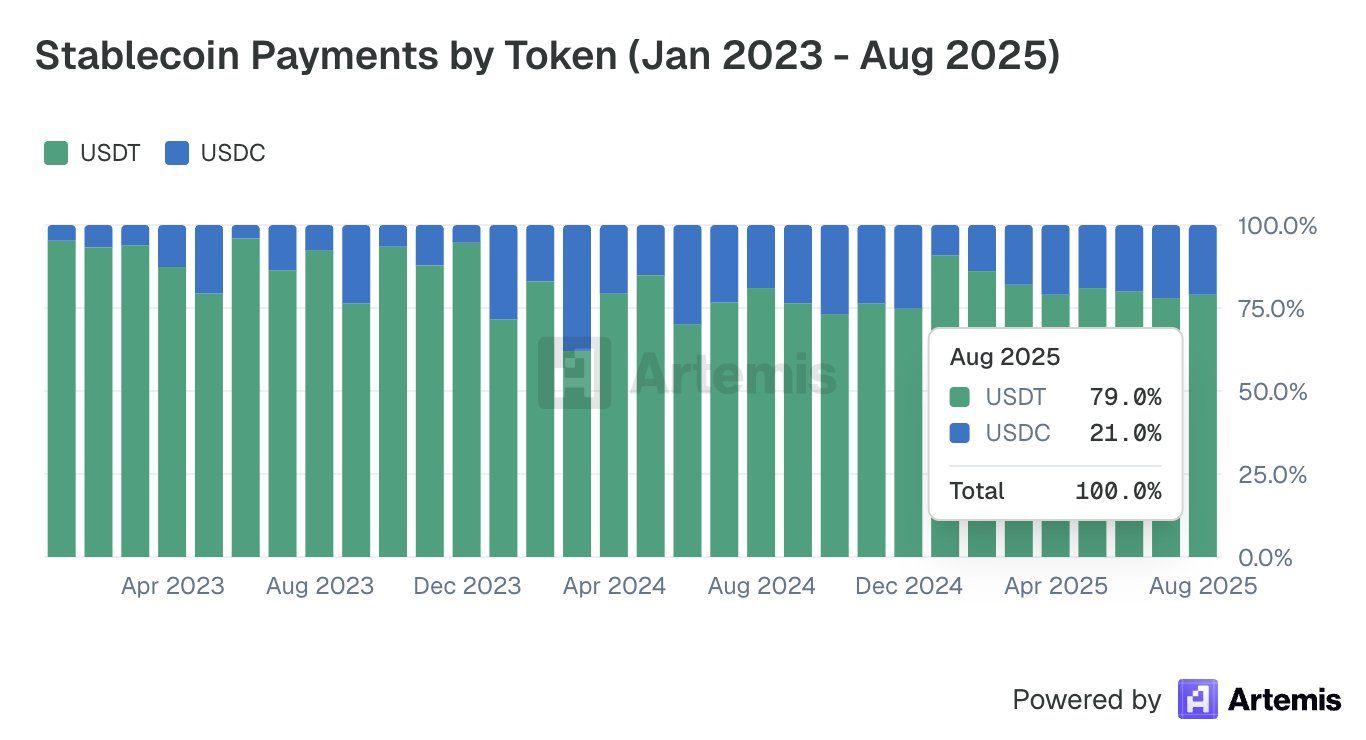

On the asset side, Tether’s USDT continues to dominate the stablecoin ecosystem with roughly 79% of all payment volume, driven by deep liquidity and unmatched accessibility across Africa and Latin America.

Yet Circle’s USDC is quietly expanding its footprint as its share rose from 14% to 21% since February.

Stablecoins Payments by Token. Source: Artemis

Stablecoins Payments by Token. Source: Artemis

Data from DeFiLlama shows that USDT’s market capitalization stands at $183 billion, while USDC hovers near $76 billion. Together, they anchor the over $300-billion network of digital dollars that now move with the speed of code and the reach of global finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Partisan Stalemate Results in $14 Billion Losses and 42 Million Facing Hunger as Shutdown Hits 35 Days

- U.S. government shutdown hits 35 days, matching historical record as partisan gridlock disrupts services for millions. - 42 million Americans face food aid delays under SNAP, with states using emergency funds amid federal funding disputes. - Economy risks $7B-$14B loss as shutdown extends, with GDP growth projected to drop 1-2% depending on duration. - Air traffic delays and unpaid federal workers highlight human costs, while political leaders blame each other for stalemate. - Trump administration oppose

Bitcoin Updates: Ambiguous Fed Rate Direction Triggers Crypto Sell-Off, $1.2 Billion Liquidated

- Crypto markets saw $1.2B in liquidations as Bitcoin and Ethereum dropped 3% amid macroeconomic uncertainty and trader panic. - Top exchanges like Hyperliquid and HTX recorded massive losses, with high-profile traders suffering $15M-$33M in single-day wipeouts. - Fed's ambiguous rate-cut signals and Trump-Xi meeting failed to stabilize prices, while Coinbase's negative premium index highlighted U.S. selling pressure. - Despite 3-month lows for ETH and altcoins, analysts like Nick Ruck suggest Fed policy s

Ethereum News Update: Crucial Support and Resistance Clash for Ethereum: Bulls and Bears Face Off in Intense Showdown

- Ethereum's price hovers near $3,600–$3,750 support, with bulls targeting $4,000+ and bears warning of a $3,300 drop. - Technical indicators show neutral-to-bearish momentum, while on-chain data highlights $165B reserves and stablecoin strength. - A Binance 30,000 ETH order and Fed policy signals could drive volatility, with $4,000+ potentially unlocking $5,000–$6,000. - Key resistance at $4,100–$4,250 remains intact since mid-2025, requiring a breakout to confirm bullish momentum.

BCH Drops 1.9% on November 4 as Weekly and Monthly Declines Worsen

- Bitcoin Cash (BCH) fell 1.9% on Nov 4, with 8.3% weekly and 7.25% monthly losses, contrasting a 14.22% annual gain. - Technical indicators show mixed signals: oversold RSI hints at potential rebounds, but bearish MACD divergence suggests lingering downward momentum. - A backtest seeking 15%+ BCH spikes since 2022 failed due to no historical matches, prompting analysts to propose lower thresholds or alternative triggers like volume surges.