Michael Saylor Hints at Next Bitcoin Buy Despite MicroStrategy’s Sharp Slowdown

Strategy, formerly MicroStrategy, has slowed its Bitcoin purchases to the lowest level since 2020, acquiring only about 200 BTC weekly.

Strategy (formerly known as MicroStrategy), the largest corporate Bitcoin holder, is acquiring the top crypto at its slowest pace in recent memory.

Yet its executive chairman, Michael Saylor, continues to hint that another large-scale purchase may be on the horizon.

Strategy’s Bitcoin Buying Spree Significantly Slows

On October 26, CryptoQuant analyst J. Maartunn reported a sharp decline in Strategy’s weekly Bitcoin acquisitions.

According to him, the company’s purchases have fallen from tens of thousands of BTC per week in late 2024 to roughly 200 BTC in recent weeks.

For context, the company was buying more than 10,000 BTC in a single week, including a record surge of 55,500 BTC at its peak.

Strategy’s Bitcoin Purchases. Source:

CryptoQuant

Strategy’s Bitcoin Purchases. Source:

CryptoQuant

However, that figure has dwindled to a few hundred coins, the same level seen five years ago when the company was still testing its dollar-cost-averaging strategy.

Meanwhile, this slowdown signals not waning conviction, but tighter financial conditions that have constrained new capital deployment.

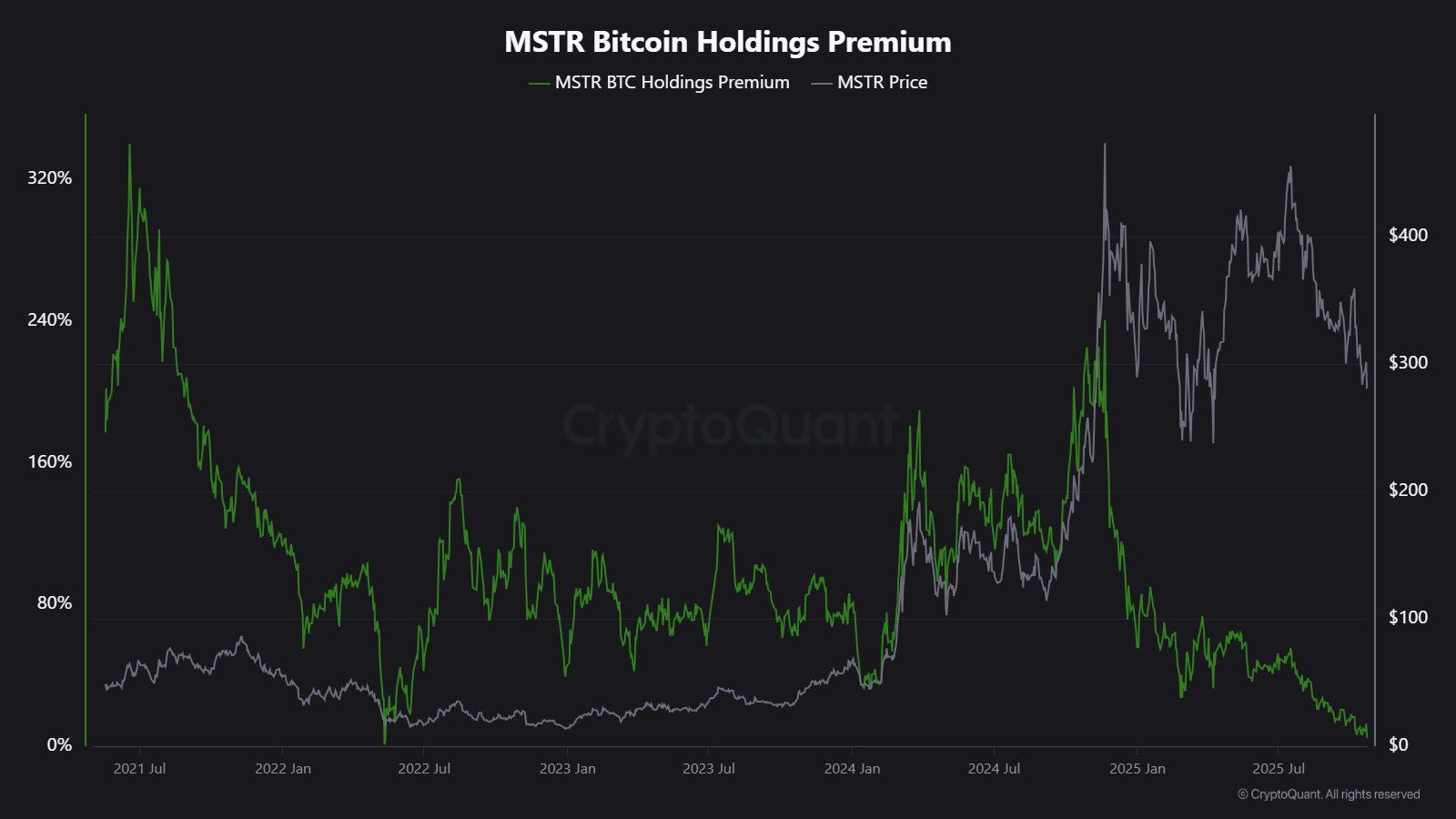

Strategy’s equity issuance premium, the gap between its share price and the book value of its Bitcoin holdings, has plunged from 208% to 4%.

That collapse has made new stock offerings a far less efficient way to raise capital for additional Bitcoin buys.

Startegy’s MSTR Premium. Source: CryptoQuant

Startegy’s MSTR Premium. Source: CryptoQuant

At the same time, the company’s stock price has fallen roughly 50% from its record high, while Bitcoin trades about 16% below its $126,000 all-time peak, hovering near $111,000 as of press time.

These lower market valuations and thinner financing options have inadvertently forced Strategy to moderate its buying pace.

Saylor Hints at ‘Orange Dot Day’

Despite the slowdown, Saylor continues to signal that Bitcoin remains central to the company’s treasury strategy.

On X, he posted a screenshot of Strategy’s Bitcoin tracker alongside the phrase “It’s Orange Dot Day.” This is a cryptic cue he has used repeatedly ahead of official purchase announcements.

It's Orange Dot Day.

— Michael Saylor (@saylor) October 26, 2025

Notably, such posts often precede formal filings, suggesting that another buy could arrive soon.

However, even with reduced frequency, Strategy remains one of the most aggressive institutional accumulators in the market. The firm has spent roughly $19.5 billion on Bitcoin in 2025 alone, trailing only its $21.7 billion total from 2024.

Strategy’s Yearly USD Investments in Bitcoin. Source: CryptoQuant

Strategy’s Yearly USD Investments in Bitcoin. Source: CryptoQuant

These purchases have helped push Strategy holdings to 640,418 BTC, which equates to around 3.2% of all Bitcoin in circulation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Dark Side of Altcoins

Why is it said that almost all altcoins will go to zero, with only a few exceptions?

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.