Is the ISM Losing Its Power — or Pointing to a 2026 Bitcoin Supercycle?

As macro experts argue over the ISM’s reliability, crypto analysts see deeper implications for Bitcoin’s market cycle. With ISM contraction persisting, many now expect the next Bitcoin peak to come later—potentially stretching well into 2026.

A fierce debate has broken out among macro analysts over the credibility of the ISM Manufacturing Purchasing Managers’ Index (PMI). Experts say this key economic metric is being overused to predict business cycles and Bitcoin market tops.

The clash highlights a growing divide between traditional economic modeling and modern financial conditions-driven analysis, with ripple effects reaching deep into crypto market forecasting.

ISM Debate Splits Macro Analysts as Crypto Traders Reassess the 2026 Bitcoin Peak

CFA Julien Bittel, a macro strategist at Global Macro Investor (GMI), dismisses many of Wall Street’s go-to indicators as outdated or misinterpreted.

“Delinquency rates, ISM, PMIs, job openings, retail sales — none of these are leading indicators…Everything is downstream to changes in financial conditions,” Bittel wrote.

Bittel explained that GMI’s proprietary US Coincident Business Cycle Index integrates forward-moving elements within the data, including early employment signals, and that it began turning higher in mid-2022, months before ISM and other metrics rebounded.

According to Bittel, the labor market’s gradual cooling is actually a positive sign, paving the way for lower rates and renewed economic expansion.

However, macro strategist Henrik Zeberg presents a contrary opinion, calling for caution around treating survey-based indicators as reality.

“ISM is NOT the business cycle or the economy. It is a damn survey! In July 2022, many called for a recession based on the same GMI score. We did not see one. Maybe the score needs calibration?” Zeberg wrote.

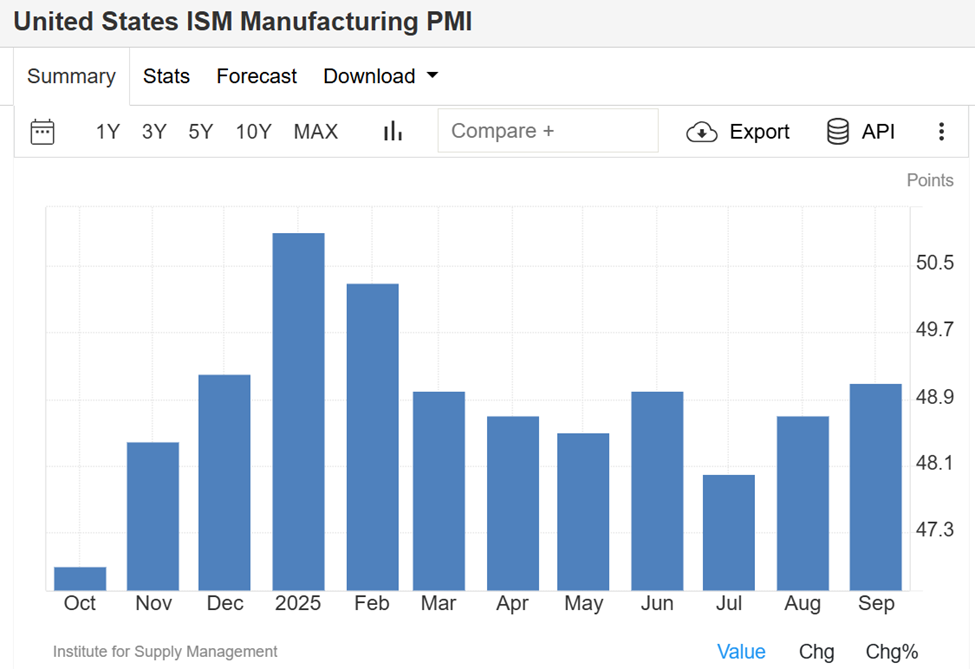

Their public disagreement births a wider discussion about how much weight the ISM PMI still deserves. The index measures US manufacturing activity and has remained below the neutral 50 mark for more than seven months, signaling contraction. However, it has not coincided with a full-blown recession.

US ISM Manufacturing PMI. Source:

US ISM Manufacturing PMI. Source:

ISM-Bitcoin Correlation Suggests a Longer Bull Market Could Extend Into 2026

Historically, the ISM’s moves have also correlated with major Bitcoin cycle tops, a connection first popularized by macro investor Raoul Pal.

NEW: Raoul Pal believes Bitcoin is now following a five-year market cycle, due to an extended debt maturity period and its close correlation with the ISM manufacturing index. 🤔Using an ISM-Bitcoin chart and a 5.4-year SIN curve, Pal predicts Bitcoin will likely peak around Q2…

— Bitcoin News (@BitcoinNewsCom) September 27, 2025

That correlation has now captured the attention of the crypto community. Analysts like Colin Talks Crypto and Lark Davis argue that the ISM’s prolonged stagnation could mean Bitcoin’s bull market will stretch far beyond its typical four-year rhythm.

“All three past Bitcoin cycle tops have broadly aligned with this index,” Colin noted.

The analyst suggested that a cycle top could be mid-2026 for the Bitcoin price if the relationship holds. Entrepreneur and Bitcoin investor Davis agreed, noting that while everyone expects a Q4 2025 peak, the ISM has not shown real expansion yet, meaning this cycle could go way deeper into 2026.

Everyone's expecting this cycle to peak in Q4 this year.But I think we're going way deeper into 2026.Here's why:The classic 4-year business cycle usually have 2 years of expansion and 2 years contraction. That should’ve lined up with a Q4 2025 top.But this time, the ISM…

— Lark Davis (@TheCryptoLark) October 1, 2025

A weaker ISM often implies delayed economic recovery and longer market expansions. Despite current headwinds from tariffs to sluggish global demand, the extended contraction phase may lengthen the broader business cycle rather than end it.

While this could translate to a more gradual, durable uptrend for the Bitcoin price, it warns against expecting an early peak as the 2025–2026 cycle debate shapes into a consequential narrative linking traditional economics and digital assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin's Function as a Safe Haven Returns Amid U.S. Debt Reaching $38 Trillion

- Binance seeks U.S. reentry after Trump pardons founder CZ, reigniting debates over regulatory fairness and political influence. - Bitcoin faces $109,100 resistance amid $38 trillion U.S. debt concerns, with short-term holders at risk of capitulation below key support levels. - Critics warn of SEC/CFTC hurdles for Binance's return, while proponents highlight Bitcoin's fixed supply as a hedge against dollar devaluation. - Rising institutional crypto adoption and ETF filings signal growing mainstream accept

Bitcoin Updates: Shifting Business Environment Shaped by Advancements and Regulatory Forces

- Prenetics secures $48M equity offering (expandable to $216M) to fund global expansion and Bitcoin treasury strategy, reflecting digital asset integration in health tech. - Kaiser Aluminum surges 25% after exceeding earnings forecasts, benefiting from U.S. tariffs and Midwest price premiums, contrasting Candy Warehouse's bankruptcy due to e-commerce market saturation. - Federal Reserve streamlines bank stress tests by 10,000 pages per institution, balancing transparency demands with concerns over weakened

Crypto’s AI Transformation: Navigating the Opportunities and Hurdles of Implementation

- AI and token metrics are transforming crypto investing, with BigBear.ai Holdings (NYSE: BBAI) surging 314% on defense AI contracts and airport biometric projects. - IBM's Digital Asset Haven platform and SEC-CFTC regulatory alignment under Michael Selig highlight institutional adoption and oversight progress in crypto infrastructure. - Market volatility persists as BigBear.ai's 13× forward sales multiple and C3.ai's projected losses reflect challenges in scaling AI-driven crypto innovations sustainably.

Bitcoin News Update: Prenetics Secures $48M Funding, Igniting Discussion on Medical Advancements and Bitcoin Market Fluctuations

- Prenetics raised $48M via equity offering to expand its IM8 supplement brand and Bitcoin treasury strategy, priced at $16.08 per unit. - The deal includes 2.99M shares and warrants with 50-100% premiums, aiming to fund IM8's $100M ARR growth and daily BTC purchases. - Market reaction was mixed, with shares down 15% premarket amid concerns over shareholder dilution and Bitcoin price volatility risks. - The offering, underwritten by Trump-backed Dominari Securities, highlights Prenetics' "health-and-wealth