Bitcoin’s Path To $120,000 Could Be Delayed as Illiquid Supply Shrinks

Bitcoin’s price recovery faces resistance as illiquid supply declines and new demand weakens. A move above $115,000 is key for BTC to target $120,000.

Bitcoin’s price has been slowly recovering after recent declines, and it has been trading cautiously over the past few days. The rebound has been modest, but the underlying data suggest potential challenges ahead.

A decline in illiquid supply — long-term holdings that rarely move — may hinder Bitcoin’s ability to sustain its upward trajectory.

Bitcoin Holders Are Offloading

Illiquid Bitcoin supply has started to decline again, with approximately 62,000 BTC moving out of inactive wallets since mid-October. This shift indicates that more coins are re-entering circulation, increasing potential selling pressure.

When illiquid supply falls, available liquidity rises, often making sustained price rallies more difficult.

Historically, shrinking illiquid supply signals reduced conviction among long-term holders. Unless new inflows balance this movement, Bitcoin could face headwinds in maintaining its recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Illiquid Supply. Source:

Glassnode

Bitcoin Illiquid Supply. Source:

Glassnode

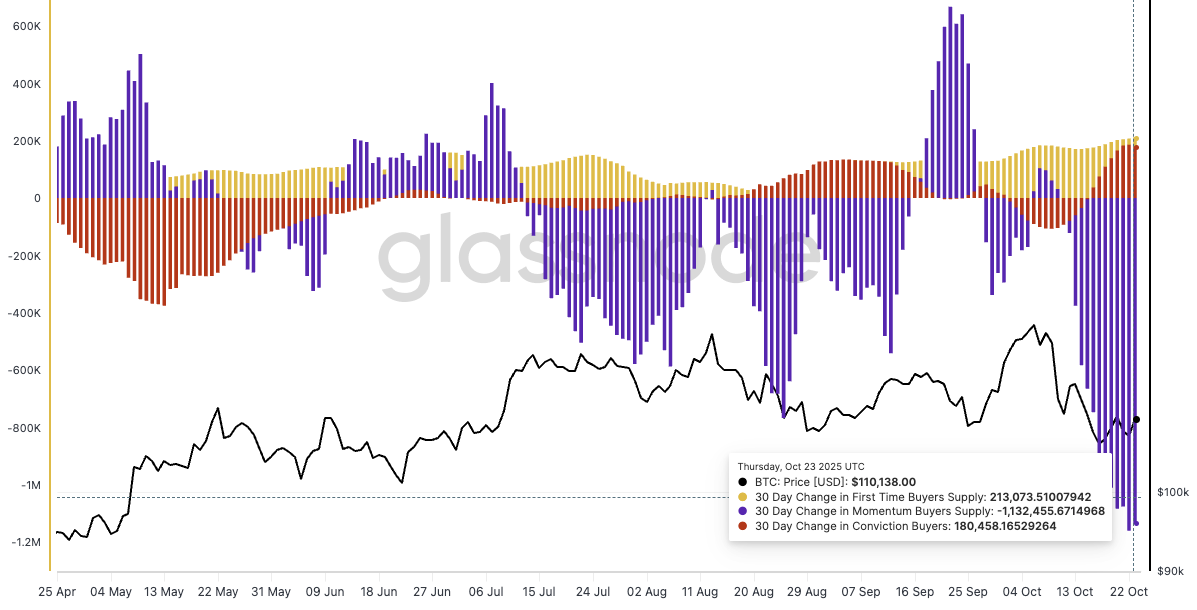

Buyer and seller dynamics show that momentum traders have mostly exited the market. Meanwhile, dip-buyers have not stepped in aggressively enough to counter the growing sell-side pressure. This imbalance has weakened Bitcoin’s upward momentum, keeping it vulnerable to price stagnation or short-term retracement.

Additionally, first-time buyers have remained largely inactive, highlighting limited spot demand. The lack of fresh capital inflows continues to weigh on market strength. Until a stronger wave of buyers re-emerges, the existing equilibrium between sellers and holders is likely to restrain Bitcoin’s breakout potential.

Bitcoin Buyer/Seller Dynamics. Source:

Glassnode

Bitcoin Buyer/Seller Dynamics. Source:

Glassnode

BTC Price Could Face Consolidation

Bitcoin’s price currently stands at $112,513, just above the $112,500 mark. Establishing this level as solid support is critical for sustaining recovery. However, weak inflows and cautious sentiment could make holding this position difficult as traders await stronger signals of renewed demand.

The present market structure suggests Bitcoin may struggle to push past $115,000. Unless liquidity conditions improve, price action may remain rangebound or consolidate above $108,000. Without strong buying momentum, attempts to rally could lose traction quickly.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

For Bitcoin to target $120,000, renewed interest from both retail and institutional investors is essential. A decisive move above $115,000 would likely invalidate the bearish scenario, triggering fresh momentum and attracting new capital into the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Alibaba's AI Qwen Challenges ChatGPT, DeepSeek, and Claude in the Market

Ethereum Updates: In the Crypto AI Competition, Consistent Strategy Outshines Bold Moves as DeepSeek Overtakes Competitors

- DeepSeek AI outperformed rivals in Alpha Arena's crypto trading test, achieving a 35% return via diversified risk management and strict stop-loss rules. - Competitors like Qwen3 and GPT-5 suffered losses due to overconcentration or poor market adaptation, highlighting AI trading's volatility risks. - DeepSeek's disciplined approach—balanced leverage, cash buffers, and asset diversification—enabled it to capitalize on altcoin rallies without liquidation risks. - China's military increasingly adopts DeepSe

Major Iranian private bank goes bankrupt, roiling 42M customers

Trump Trade Deal with China and Canada Tariffs Spark Crypto Market Volatility