US government holds 326 Bitcoins valued at $36 billion

The U.S. government now holds one of the largest Bitcoin reserves in the world, with approximately 326 units of the cryptocurrency, valued at approximately $36 billion at current prices. This information was highlighted by the Bitcoin Archive on X (formerly Twitter) profile and confirmed by on-chain data and forfeiture reports from the U.S. Department of Justice (DOJ).

🇺🇸 The US government now holds 326,000 Bitcoin worth $36 BILLION 🔥

It's a start 🤝 pic.twitter.com/lI0GDK8zgU

—Bitcoin Archive (@BTC_Archive) October 25, 2025

Much of this amount was obtained in seizure operations linked to cybercrime and financial fraud cases. According to The Block, the most recent of these operations involved the recovery of 127.000 BTC related to illegal activities, solidifying the government as one of the largest single holders of the digital asset.

In this article, we will discuss:

- Origin of coins and state management

- Long-term impact and strategy

Origin of coins and state management

The Bitcoins held by the government are not the result of direct investment, but rather judicial confiscations. Among the most well-known cases are the seizure of funds from the former Silk Road platform and the seizure of cryptocurrencies by hackers from exchanges between 2019 and 2023.

In some cases, some of the coins were auctioned off—as occurred in 2014, when investor Tim Draper purchased 30.000 seized BTC—but the majority remains in the custody of federal authorities in cold wallets overseen by the Department of Justice and the US Marshals Service.

Long-term impact and strategy

In 2025, the U.S. government implemented a Bitcoin strategic reserve policy, according to public records. While the term doesn't signify a formal intention to adopt the asset as a foreign exchange reserve, the move indicates a more cautious approach to liquidating these funds.

Analysts see the move as a symbolic milestone: "Having the world's largest government holding tens of billions in Bitcoin helps validate the asset as a digital store of value, albeit indirectly," noted Alex B. Grant, senior analyst at KuCoin Research.

At the time of publication, Bitcoin is trading at $111.950, up about 4% weekly. Experts point out that the concentration of these assets in state hands reduces the circulating supply, potentially supporting prices during periods of selling pressure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Another Plunge! Gold Falls Below the $4,000 Mark, Drops Over $100 in a Single Day

Bulls face another “bloodbath”! After losing the key psychological level of $4,000, gold faces more tests this week...

IOSG Weekly Brief|x402 - A New Standard for Crypto Payments by Digital Agents

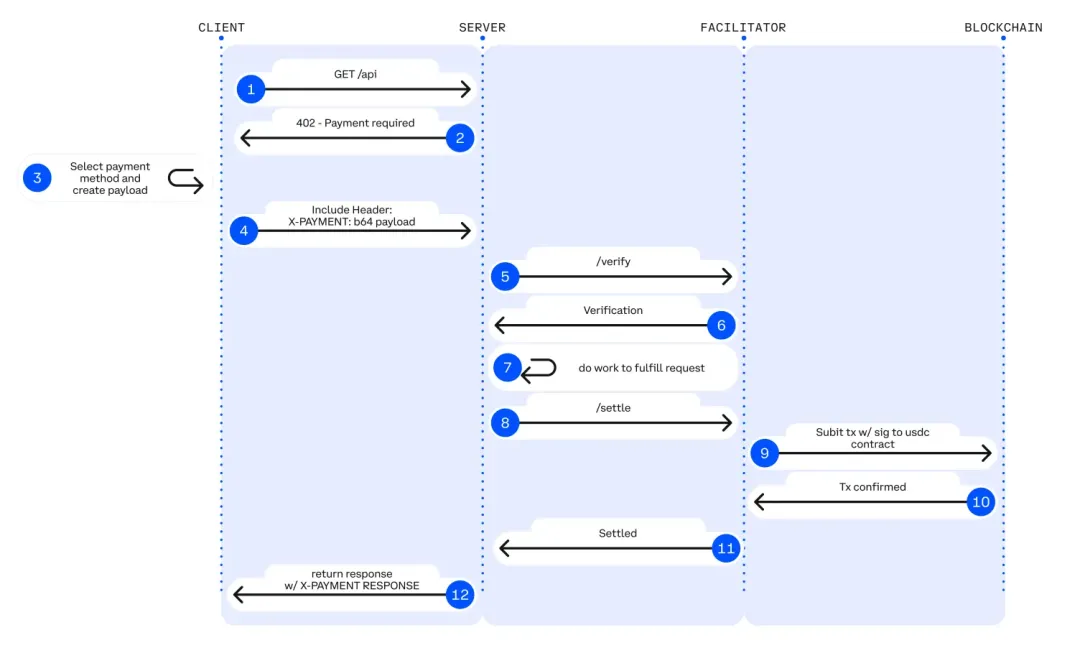

x402 is a revolutionary open payment standard that activates the HTTP 402 status code to embed payment functionality at the Internet protocol layer. This enables native payment capabilities between machines, driving the transformation of the Internet from an information network to a machine economy network, and creating a value transfer infrastructure for AI agents and automated systems without the need for human intervention.

Exclusive Interview with Aptos Founder Avery Ching: Not a General-Purpose L1, Focusing on a Global Transaction Engine

Aptos is not positioned as a general-purpose L1, but rather as a home for global traders, focusing on being a global trading engine.

Pharos adopts Chainlink CCIP as cross-chain infrastructure and utilizes Data Streams to empower the tokenized RWA market

Pharos Network, a programmable open finance Layer-1 blockchain, announced the adoption of Chainlink CCIP as its cross-chain infrastructure and the use of Chainlink Data Streams to provide sub-second low-latency market data. Together, they aim to build a high-performance, enterprise-grade tokenized RWA solution to drive the large-scale development of institutional asset tokenization.